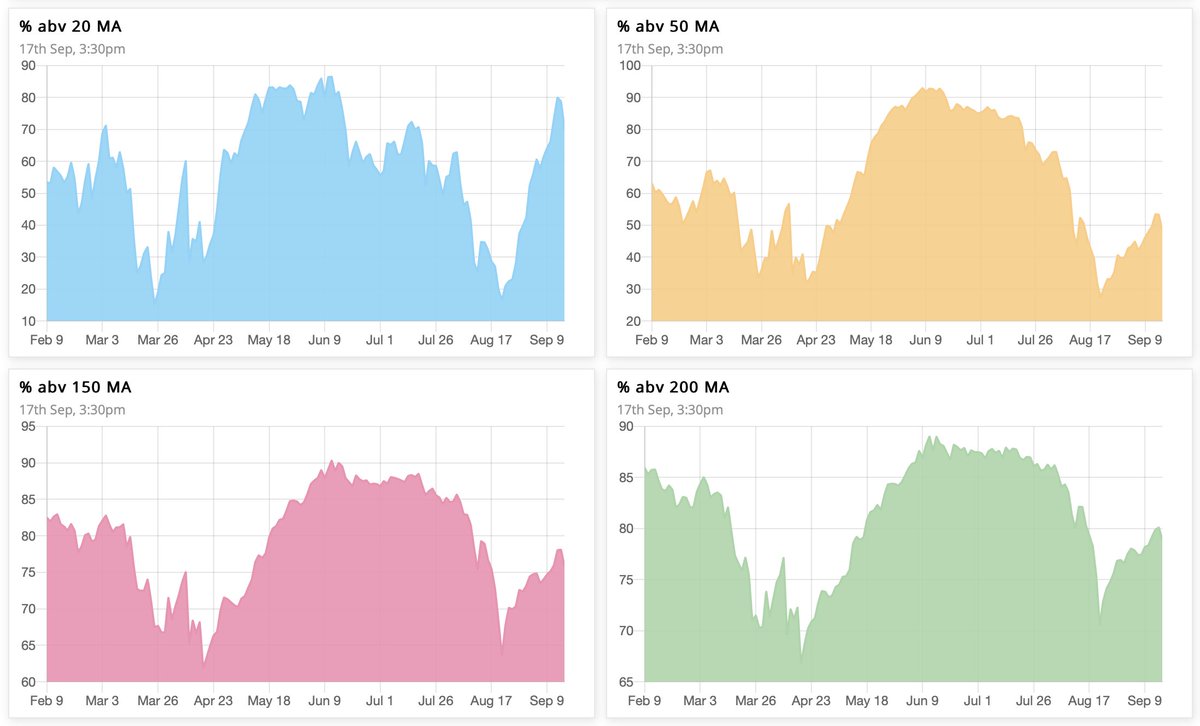

Market breadth measures the degree of participation & the conviction in the overall mood of the underlying index. A positive market breadth is said to happen when more stocks are advancing than are declining.

A thread on how do we interpret market breadth👇

A thread on how do we interpret market breadth👇

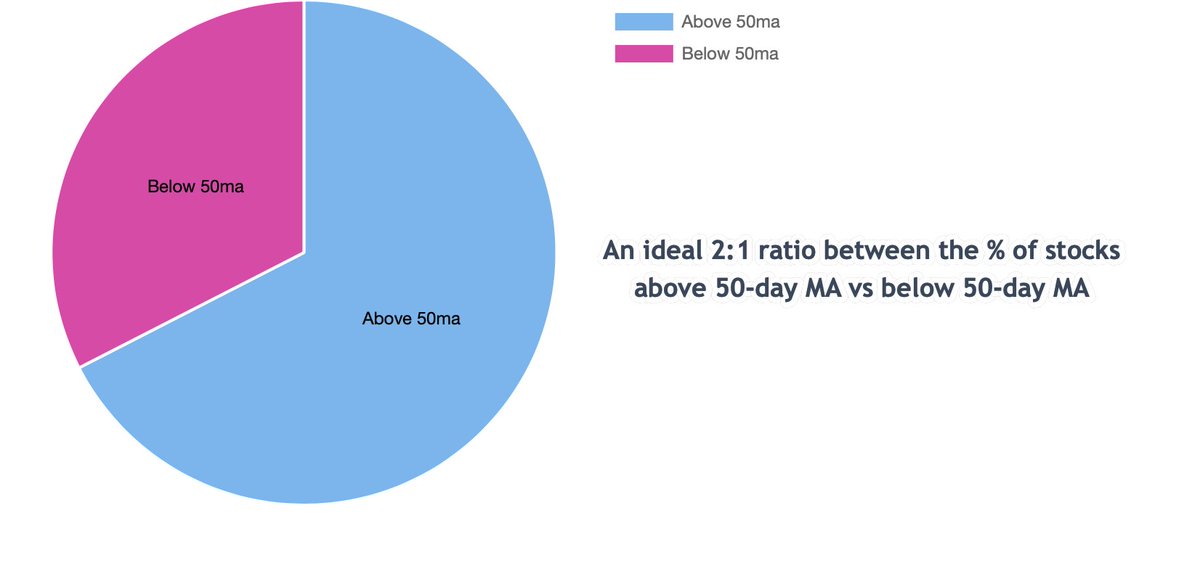

Overbought market breadth doesn’t tell us to rush to exit all our holdings.

We instead need to:

- Ideally: Avoid initiating fresh longs

- Next to ideal: Avoid fresh breakouts

- At the very least: Reduce position size

As @Prashantshah267 says, "Breadth tells us what not to do”.

We instead need to:

- Ideally: Avoid initiating fresh longs

- Next to ideal: Avoid fresh breakouts

- At the very least: Reduce position size

As @Prashantshah267 says, "Breadth tells us what not to do”.

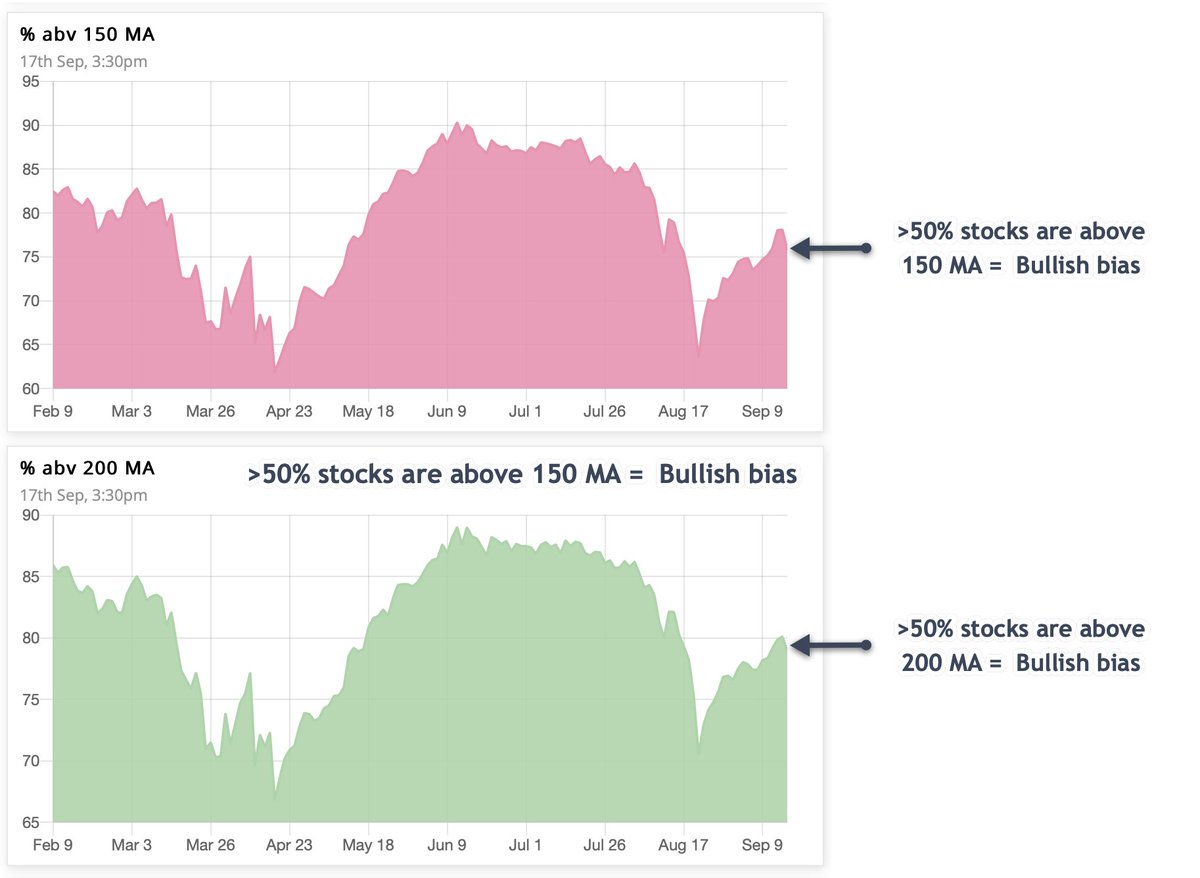

Divergence

Can the index rally, but the market breadth fall?

Yes, when a small number of stocks rally so much that they move entire market higher.

Similarly, a bullish divergence is when the underlying index moves lower but the market breadth does not breach its previous low.

Can the index rally, but the market breadth fall?

Yes, when a small number of stocks rally so much that they move entire market higher.

Similarly, a bullish divergence is when the underlying index moves lower but the market breadth does not breach its previous low.

What is the ideal scenario?

A rally with decreasing market breadth is less sustainable. A person with a bullish view would love to see the market rallying with increasing market breadth that is not extended on short-term charts.

A rally with decreasing market breadth is less sustainable. A person with a bullish view would love to see the market rallying with increasing market breadth that is not extended on short-term charts.

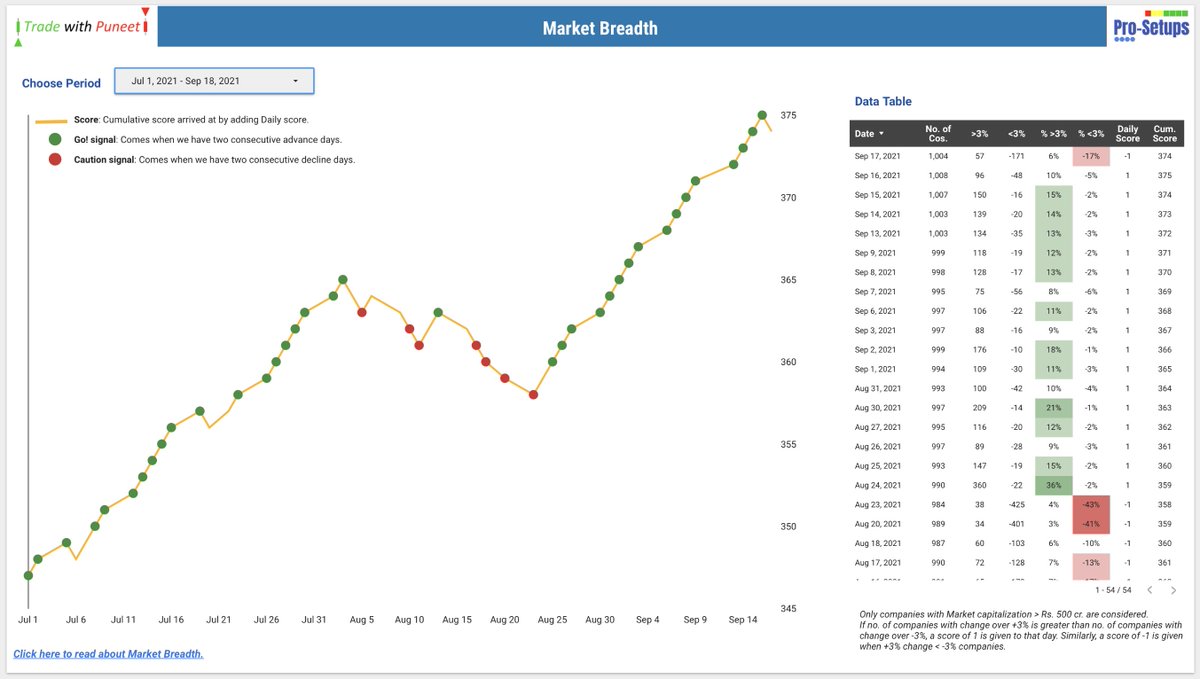

Another fine way for judging the market breadth is by using @tradewithpuneet’s dashboard.

This system uses an adjusted advance-decline ratio, comparing the number of stocks that are closing 3% positive vs the stocks that are closing 3% negative compared to their previous close.

This system uses an adjusted advance-decline ratio, comparing the number of stocks that are closing 3% positive vs the stocks that are closing 3% negative compared to their previous close.

That’s all! Hope all this made some sense. Thanks to @varunmehta for asking me to write this up.

Loading suggestions...