They have over 100 years of experience in sulphur chemistry and have also diversified their operations across other downstream products. Their products find usage in a wide range of industries such as pharmaceuticals, detergents, dyes, fertilisers, pigments and cosmetics.

From the year 2000 onwards, the fertiliser business began incurring losses. In 2009, the company decided to discontinue the fertilizer business and focus on manufacturing bulk sulphuric acid and its downstream chemicals.

which is then sold within a limited radius from the manufacturing site. Almost 50% of the bulk chemicals that is manufactured is sold in the market while the remaining 50% is used for captive consumption.

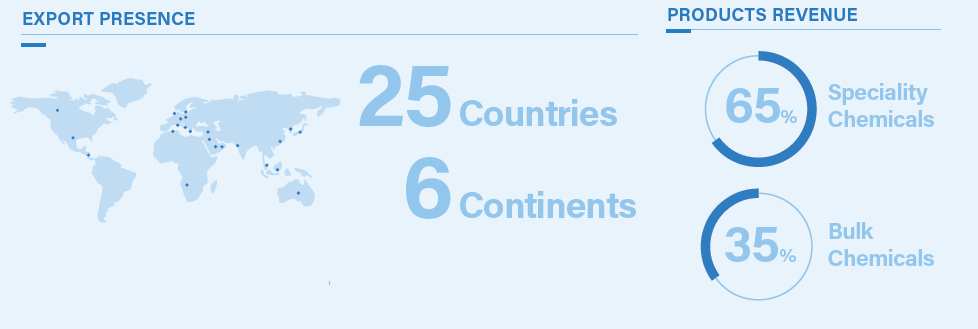

ii) Specialty Chemicals: Under this segment, the company makes various downstream chemicals from sulphur through reactions with phenol, benzene and methanol. They have backward integration for this segment. 65-70% of speciality chemicals are exported

iii)Boron Chemistry: This segment produces various commodity and downstream products of boron. However, in recent years, this business has been crippled due to unfavourable government policy around the import of boron.

Dahej – They acquired this plant through the merger with Borax Morarji in 2016. Boron and sulphur products are manufactured at this site. They have an additional 50% vacant land available at this site for future expansion

7. R&D expenditure: The company spent 2.1 Cr on R&D in 2021 which is about 1% of revenue.

8. Capex: The company is spending ₹100Cr on expanding its capacities. A major chunk of this(about ₹50Cr) is being spent on setting up a new bulk sulphuric acid plant at the Dahej facility

8. Capex: The company is spending ₹100Cr on expanding its capacities. A major chunk of this(about ₹50Cr) is being spent on setting up a new bulk sulphuric acid plant at the Dahej facility

which is expected to be completed by Q2 FY22. The remainder is being spent on setting up MPPs to manufacture various specialty chemicals and intermediates.

9.Financials:

Revenue growth - 6.7%/3.9%/14.7% (1 yr/3yr/5yr CAGR)

Profit Growth – 3.5%/38.3%/22.1% (1 yr/3yr/5yr CAGR)

Operating Profit Margin – 15.1%/14.5%/21.5% (2021/2020/2019)

ROCE – 14.5%/16%/35.6% (2021/2020/2019)

Revenue growth - 6.7%/3.9%/14.7% (1 yr/3yr/5yr CAGR)

Profit Growth – 3.5%/38.3%/22.1% (1 yr/3yr/5yr CAGR)

Operating Profit Margin – 15.1%/14.5%/21.5% (2021/2020/2019)

ROCE – 14.5%/16%/35.6% (2021/2020/2019)

10. Future Outlook: The company is expected to complete all capacity expansion by March 2022.The new bulk chemicals facility is expected to come on stream in Q3,at which point the company will see a contraction in margins due to higher contribution from the bulk chemicals segment

Margins will return back to current levels after the capacity expansion is done on the specialty segments side. Management has indicated that the new bulk chemicals plant will be more than enough to take care of their feedstock needs for the foreseeable future and all further

capex for the coming years will be made on the specialty chemicals side. So there seems to be scope for margin expansion.

11. Risks :

i) A significant part of the revenues come from the bulk commodities segment which is very dependent on the price of crude and sulphur.

11. Risks :

i) A significant part of the revenues come from the bulk commodities segment which is very dependent on the price of crude and sulphur.

ii)The Roha plant was set up in 1978. Since it is an old plant, the chances of unforeseen breakdown is high. Sulphur plants also need to be shut down for 30 days every 18 months for maintenance. Both these risks however are mitigated by setting up the plant in Dahej.

Loading suggestions...