Every asset by its nature, will generate returns.

For Fixed Deposits = Returns are Interest Payments

For Real Estate = Returns are Rent Payments

For Debt Securities = Returns are coupon payments

For Stocks = Returns are Dividends + Any Appreciation in Stock Price

For Fixed Deposits = Returns are Interest Payments

For Real Estate = Returns are Rent Payments

For Debt Securities = Returns are coupon payments

For Stocks = Returns are Dividends + Any Appreciation in Stock Price

There are entire books and research papers written on determining the present value of something using various models (and new ones are being developed everyday).

All of these models combined are known as Valuation Models.

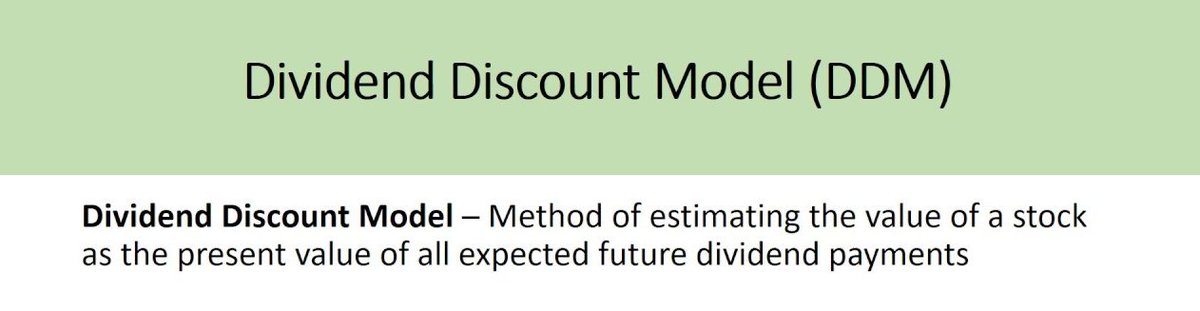

Dividend Discount Model is one amongst them.

All of these models combined are known as Valuation Models.

Dividend Discount Model is one amongst them.

Lets understand what that means.

Let's assume you want to invest in a company for next 10 years.

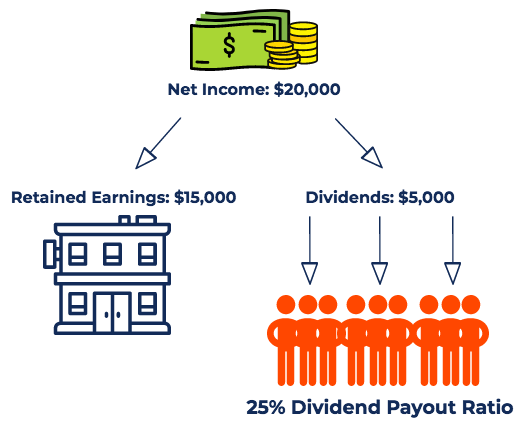

Dividend Discount Model states that you can get a fair sense of the correct value of the stock if you can estimate how much dividend will be paid out by the company to you (the investor) during your holding period.

Dividend Discount Model states that you can get a fair sense of the correct value of the stock if you can estimate how much dividend will be paid out by the company to you (the investor) during your holding period.

All of these models state a single thing - present value of all the future dividend paid out by the company is the fair value of the stock.

I will explain later in this thread, how to discount these dividends to their present value.

So now you have a general idea of what a Dividend Discount Model is, lets explore what are its main components.

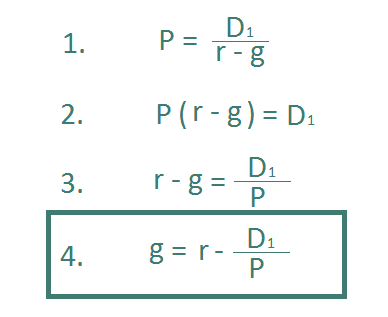

The formula may look complicated but its really easy.

PV = present value of the company (this is what we are estimating)

D1 = Dividend we will receive next year (assuming we are only buying the stock for one year)

r = Cost of Capital

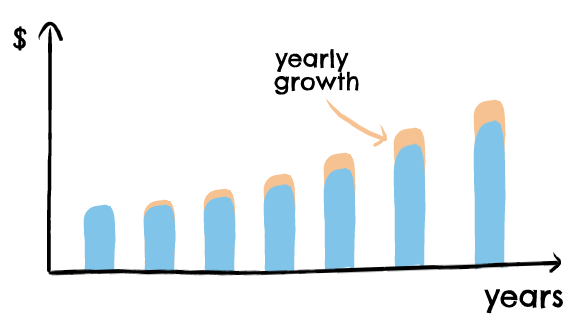

g = Growth Rate

PV = present value of the company (this is what we are estimating)

D1 = Dividend we will receive next year (assuming we are only buying the stock for one year)

r = Cost of Capital

g = Growth Rate

Of these, the most important parts of are

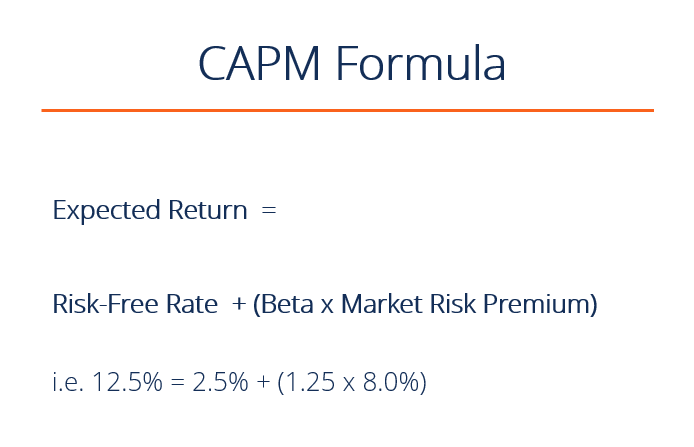

1. Cost of Capital

2. Growth Rate

1. Cost of Capital

2. Growth Rate

Each of these two avenues, require a cost.

For debt it is the interest rate at which the debt is issued.

For equity it is a combination of various risk specific required returns that investors expect from the company.

For debt it is the interest rate at which the debt is issued.

For equity it is a combination of various risk specific required returns that investors expect from the company.

We will explore how to calculate cost of debt and cost of equity along with required returns in another thread.

For now, just remember that 'r' in Dividend Discount Model stands for cost of capital which ultimately means costs of raising funds.

For now, just remember that 'r' in Dividend Discount Model stands for cost of capital which ultimately means costs of raising funds.

Now that you have a general idea of the formula, lets apply it to an example.

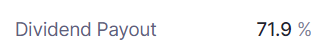

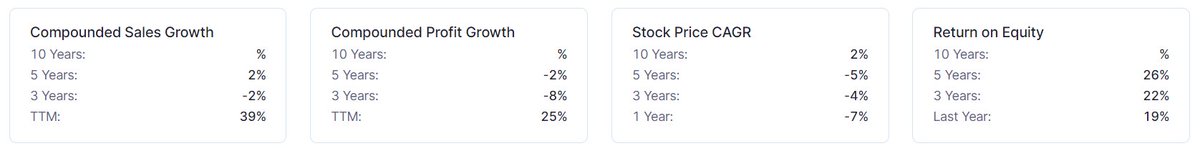

To demonstrate the Dividend Discount Model, I will be valuing #HeroMotoCorp to arrive at its intrinsic value.

Let's find the relevant Hero Moto Corp data for our Dividend Discount Model formula.

Step 2: Find Appropriate Growth Rate

Your Growth Rate needs to take a full cycle, i.e., both periods of normal and abnormal growth.

The Growth Rate should also be in line with your investment horizon, i.e., how long you want to invest for.

Your Growth Rate needs to take a full cycle, i.e., both periods of normal and abnormal growth.

The Growth Rate should also be in line with your investment horizon, i.e., how long you want to invest for.

So, now we have all the components required for our Dividend Discount Model formula.

D = Rs 105 per share

g = 10%

r = 14%

g = 10%

r = 14%

As per the formula the intrinsic value of Hero Moto Corp today is Rs 2887.5 per share.

Now this is just an example, please don't consider this as real life use case.

So that's how you use a Dividend Discount Model to value a company.

Limitation # 1

The model only works for companies that

1. Are paying a Dividend

2. Dividend has a clear linear relationship with profitability

The model only works for companies that

1. Are paying a Dividend

2. Dividend has a clear linear relationship with profitability

Limitation # 3

Any change in assumption of 'r' and 'g' in the formula can sway the model and the intrinsic value can move by orders of magnitude.

So be very careful and conservative in your assumptions of 'r' and 'g'.

Any change in assumption of 'r' and 'g' in the formula can sway the model and the intrinsic value can move by orders of magnitude.

So be very careful and conservative in your assumptions of 'r' and 'g'.

So that's how you use a Dividend Discount Model.

Its one of the easiest models to learn and understand the process of valuations.

Its one of the easiest models to learn and understand the process of valuations.

I hope, this thread helped you learn about Dividend Discount Models.

If you're new here, I write a thread every weekend, explaining an investing concept.

Here is a link to my last weekend's thread.

If you're new here, I write a thread every weekend, explaining an investing concept.

Here is a link to my last weekend's thread.

I also teach a few classes at @skillshare, sign up using any of the below links to get access to them along with 30,000+ classes on the Skillshare platform absolutely FREE for 30 days.

Also, write and publish long form articles on my @SubstackInc

Subscribe for FREE, if you're interested and join 3000+ readers that get insights on companies like Nykaa, PolicyBazaar, Renewables, etc. delivered straight to their inbox every few weeks.

investkaroindia.substack.com

Subscribe for FREE, if you're interested and join 3000+ readers that get insights on companies like Nykaa, PolicyBazaar, Renewables, etc. delivered straight to their inbox every few weeks.

investkaroindia.substack.com

If you find this thread useful then follow me

@itsTarH

I write a new thread every weekend.

All my previous work, can be found here.

@itsTarH

I write a new thread every weekend.

All my previous work, can be found here.

Loading suggestions...