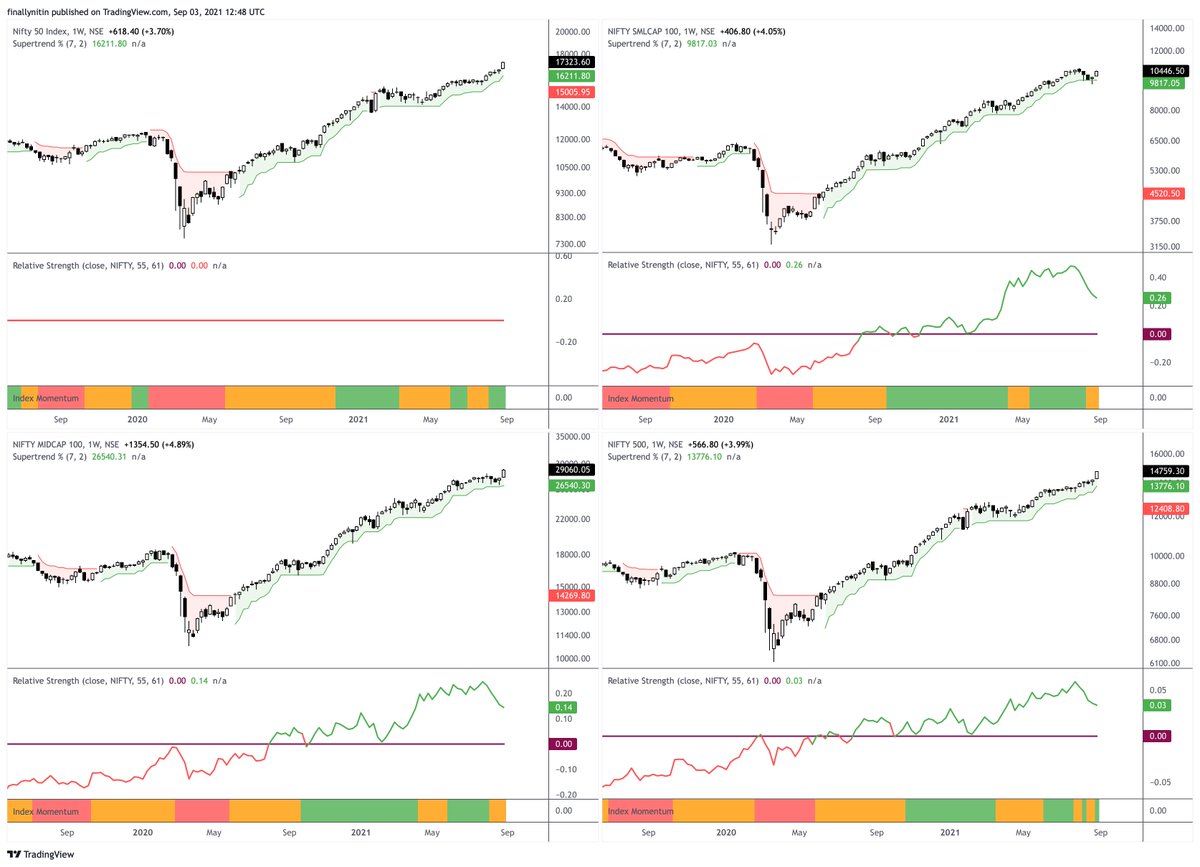

#WeeklyIndexCheck CW35/2021

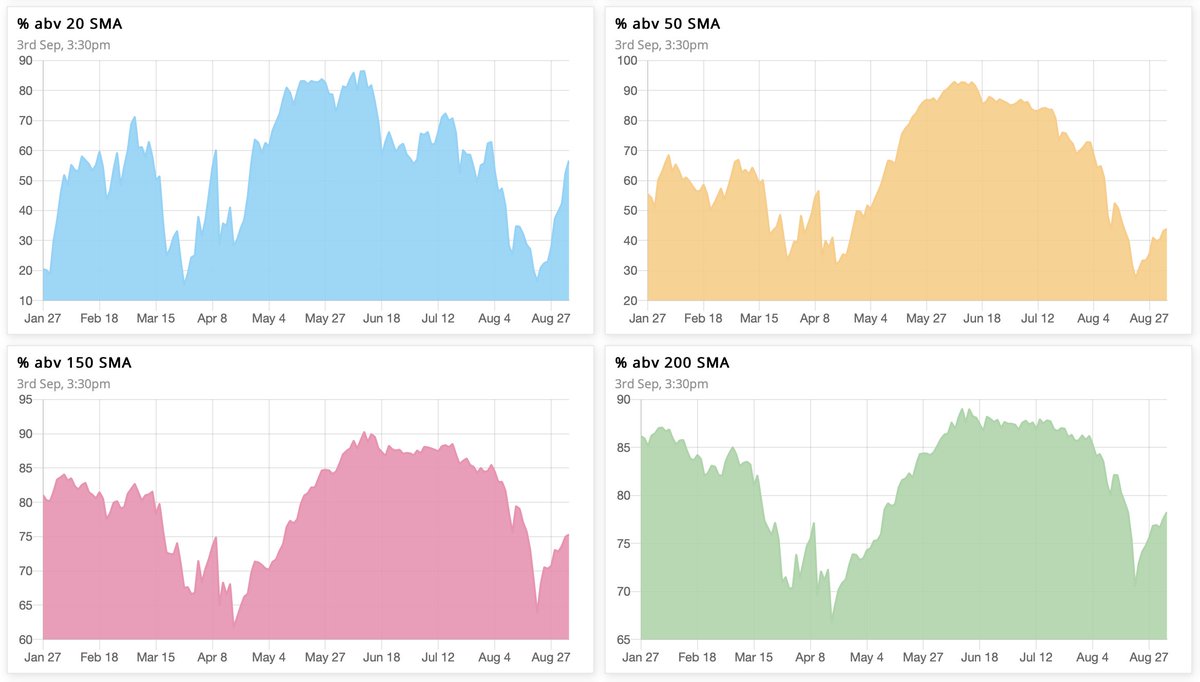

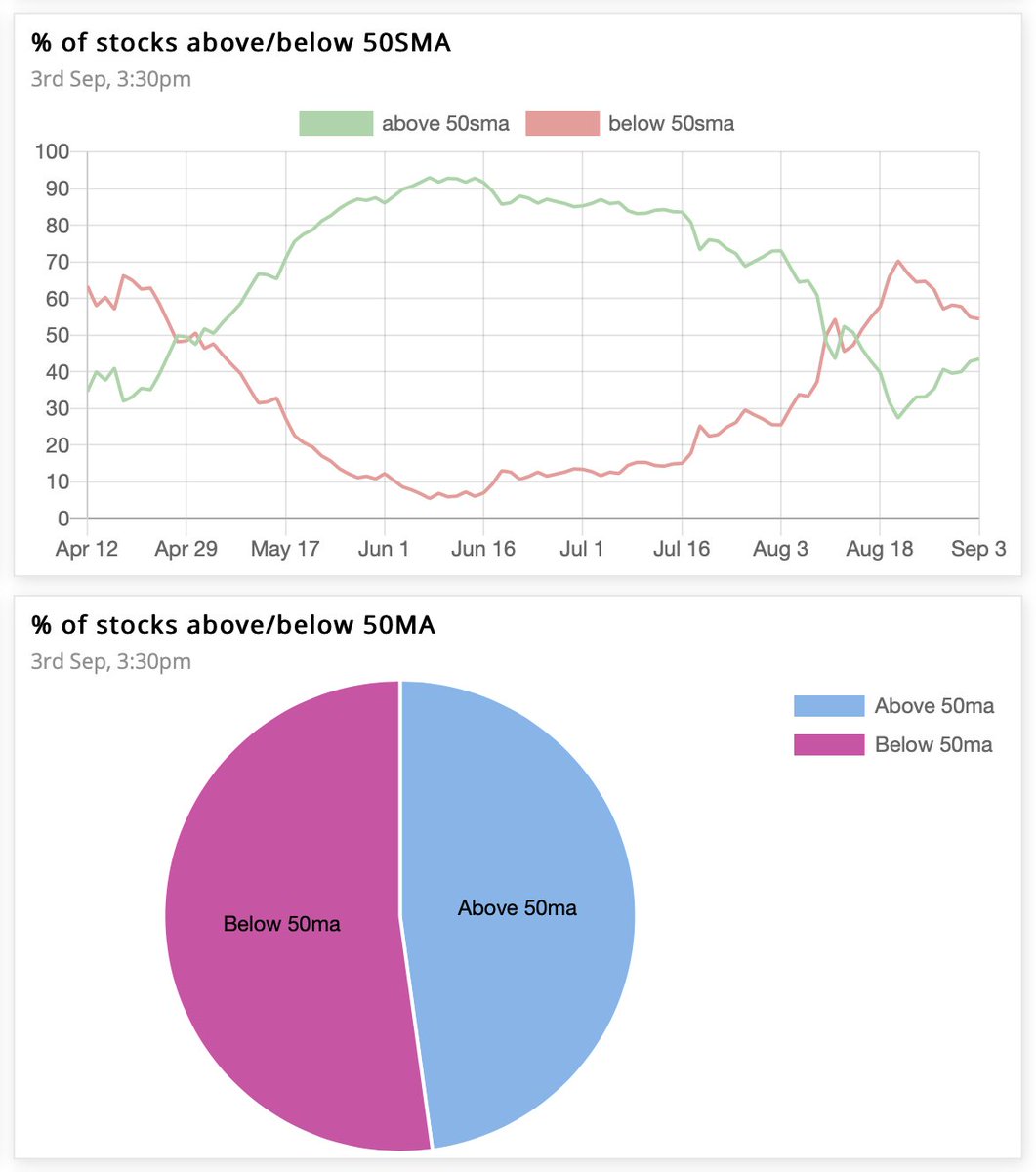

Uptrend intact. Broader markets' momentum & market breadth improving.

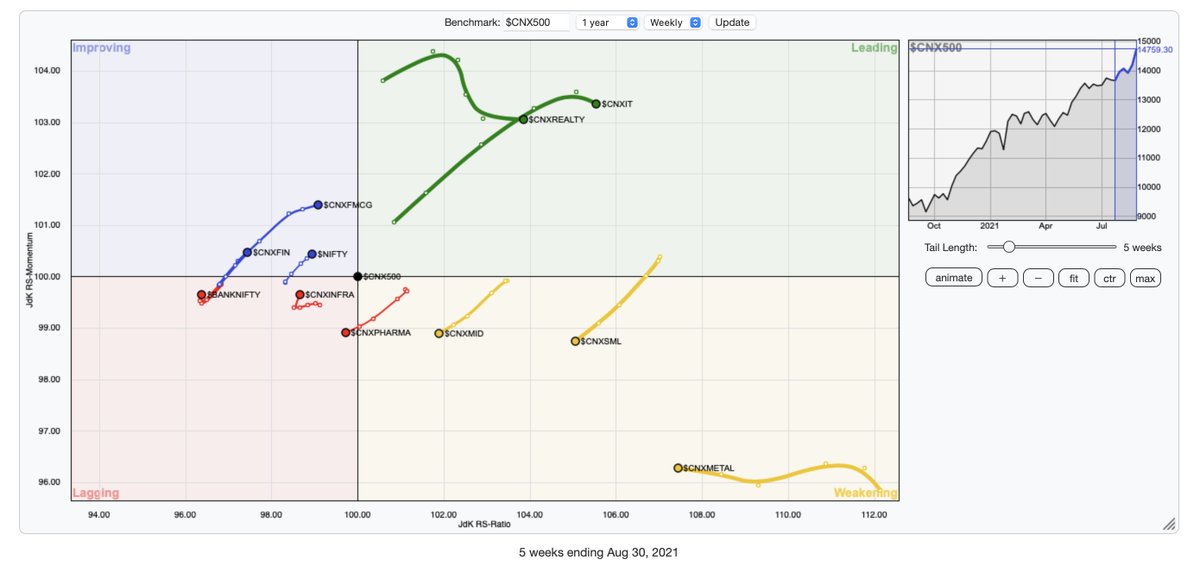

While the margin of outperformance is decreasing, midcaps & smallcaps are still outperforming NIFTY, & have now started to regain the lost momentum.

Uptrend intact. Broader markets' momentum & market breadth improving.

While the margin of outperformance is decreasing, midcaps & smallcaps are still outperforming NIFTY, & have now started to regain the lost momentum.

Loading suggestions...