#WeeklyIndexCheck

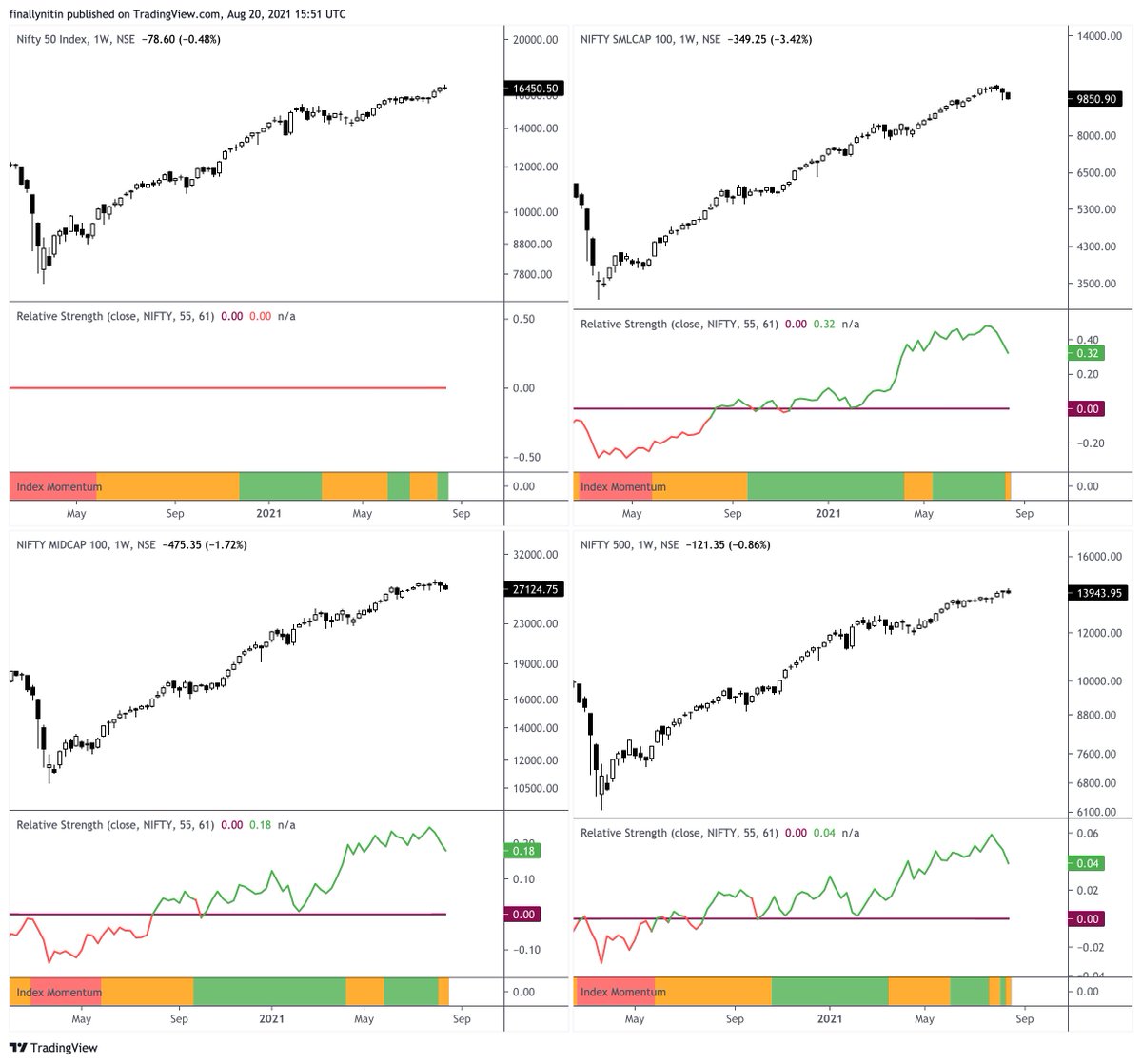

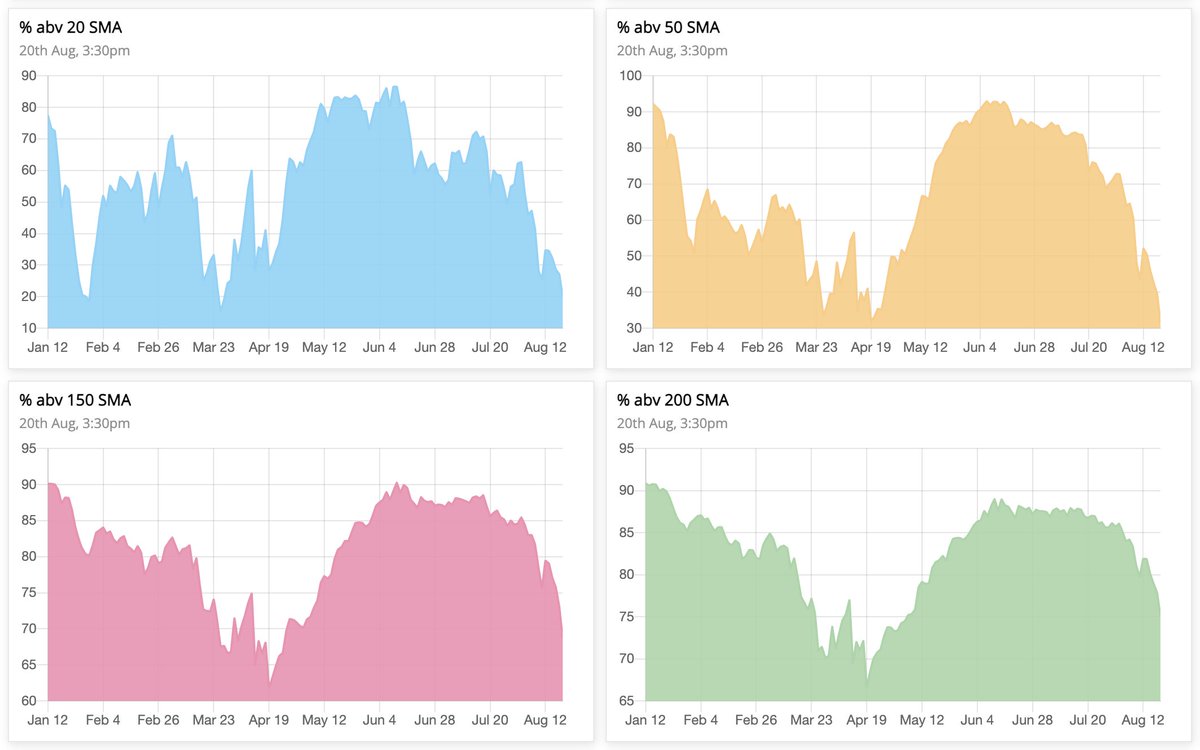

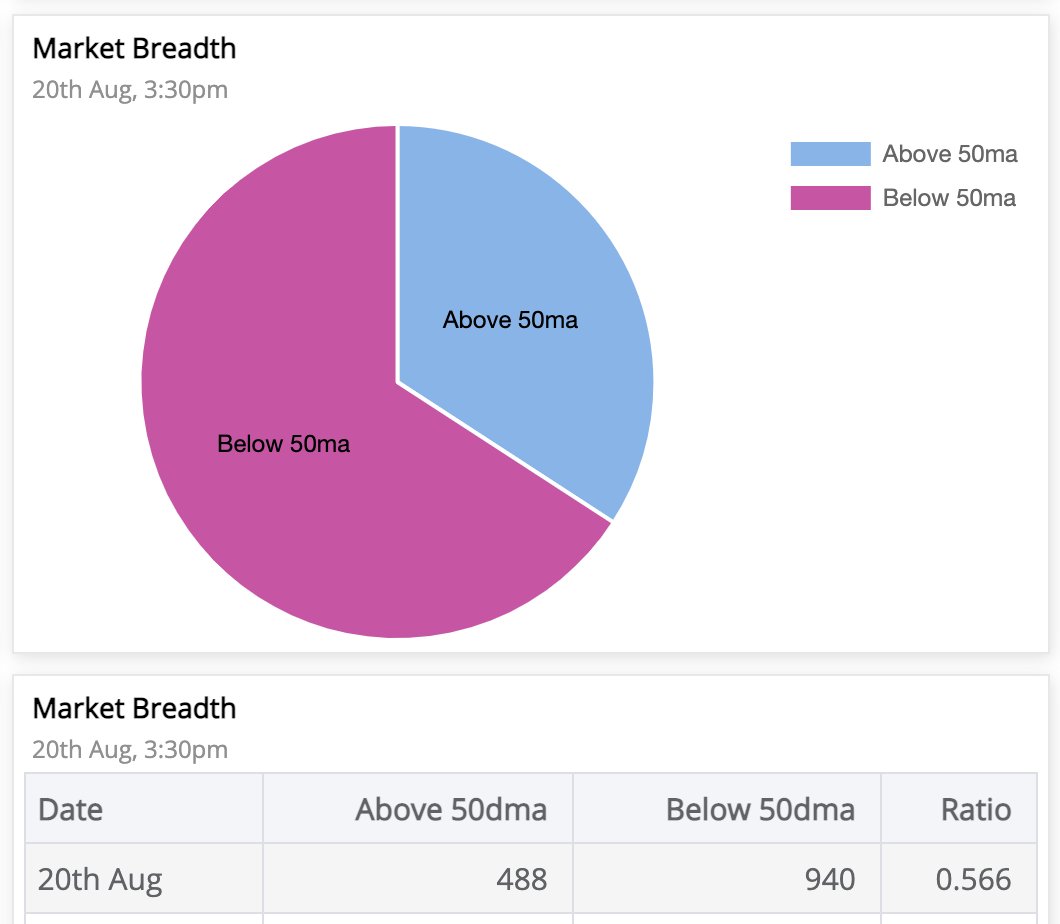

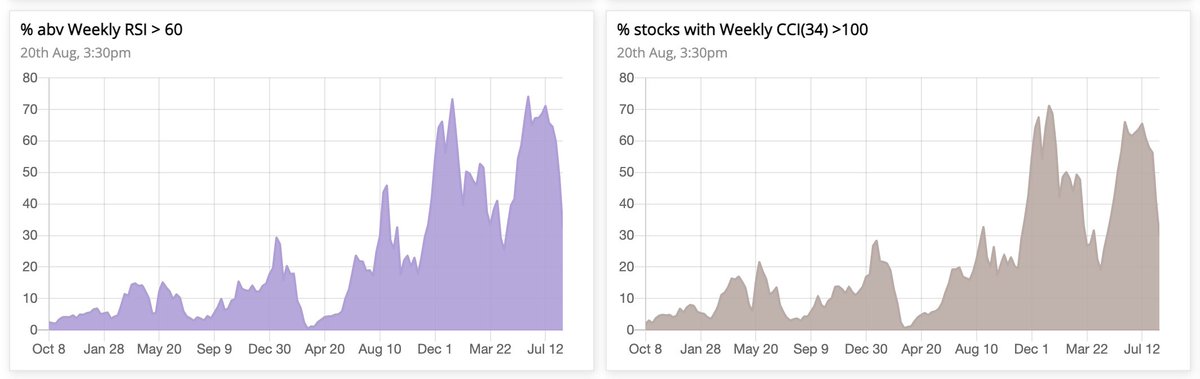

Uptrend still intact, deterioration in momentum, worsening market breadth.

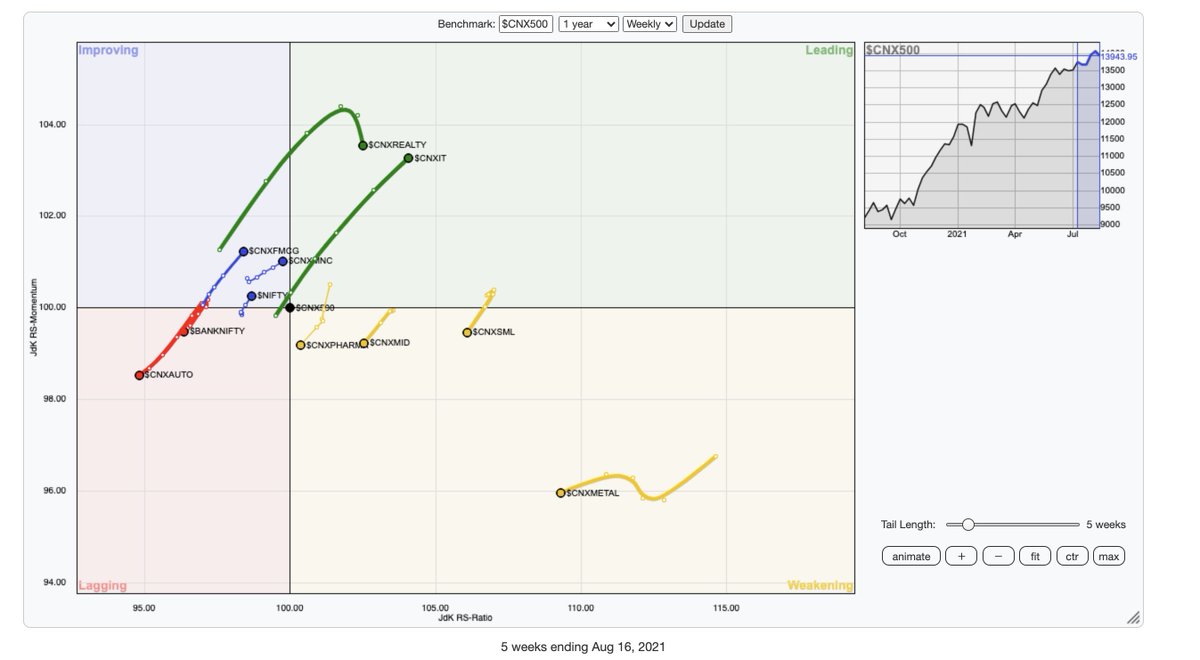

While the margin of outperformance is decreasing, CNXSMALLCAP, CNXMIDCAP & CNX500 are still outperforming NIFTY.

CNXMIDCAP, CNXSMALLCAP & CNX500 have lost momentum this week.

Uptrend still intact, deterioration in momentum, worsening market breadth.

While the margin of outperformance is decreasing, CNXSMALLCAP, CNXMIDCAP & CNX500 are still outperforming NIFTY.

CNXMIDCAP, CNXSMALLCAP & CNX500 have lost momentum this week.

Loading suggestions...