#WeeklyIndexCheck - Cautiously Bullish

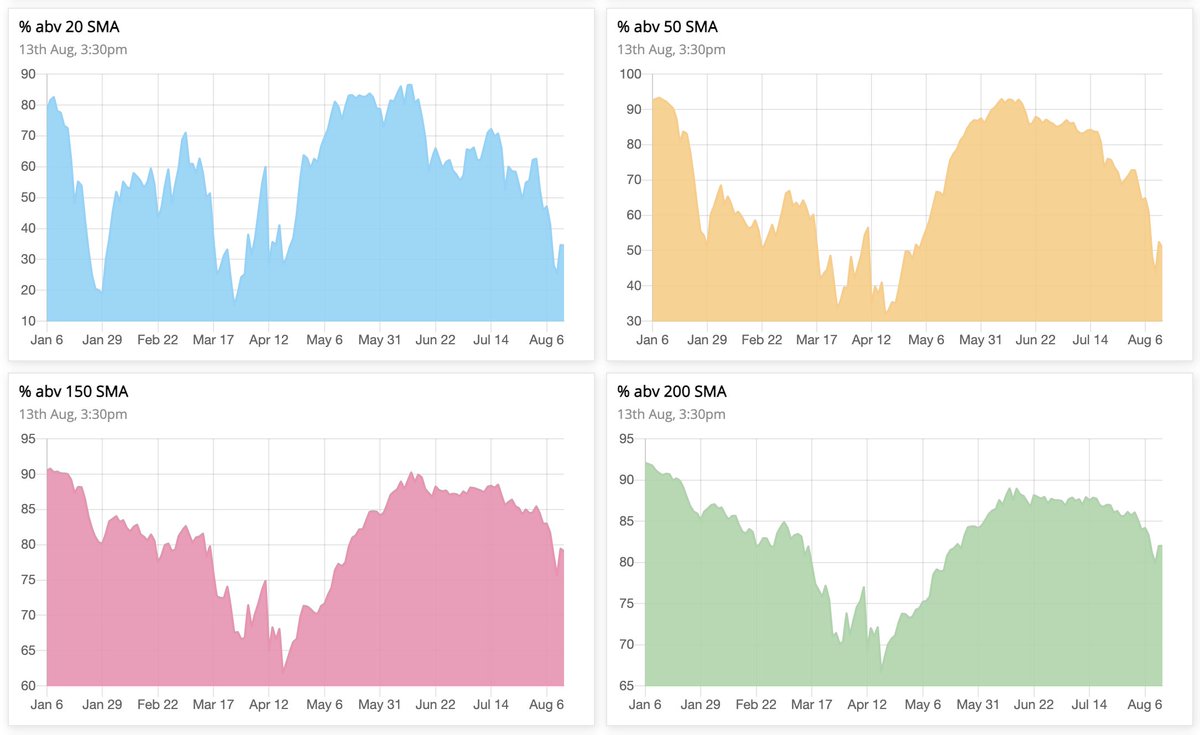

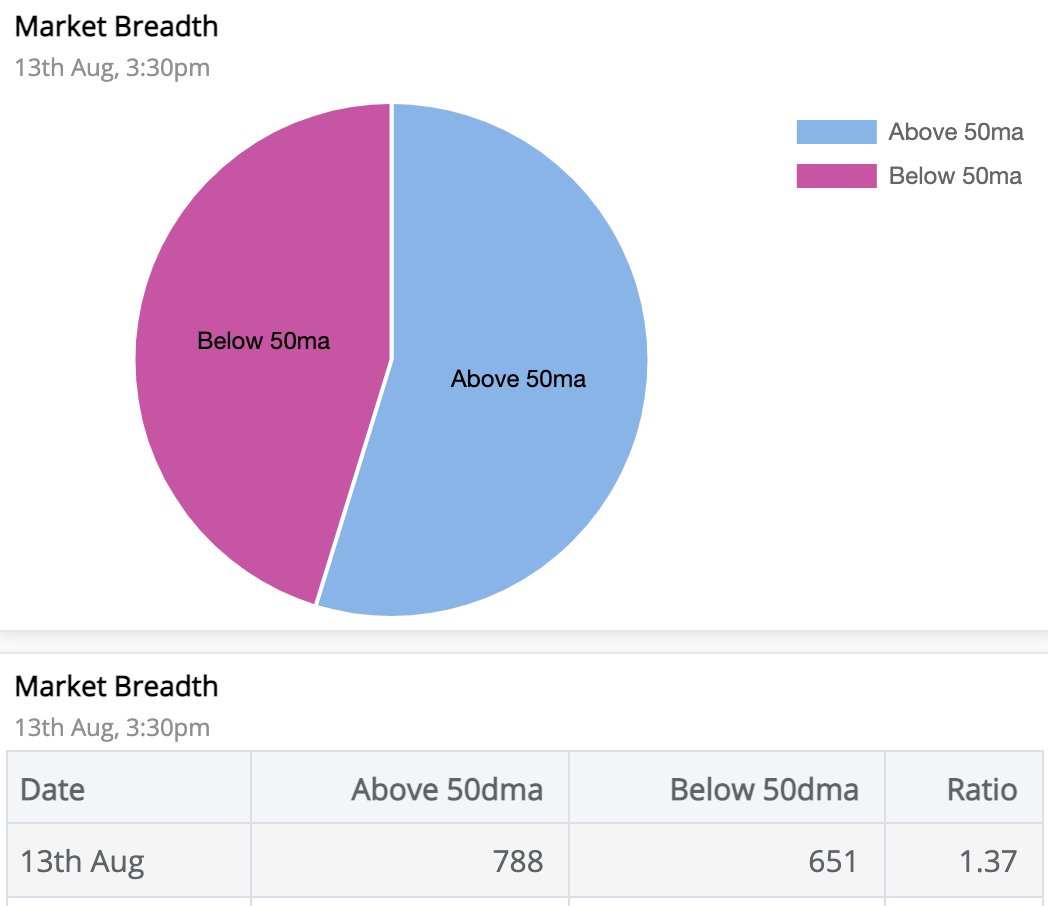

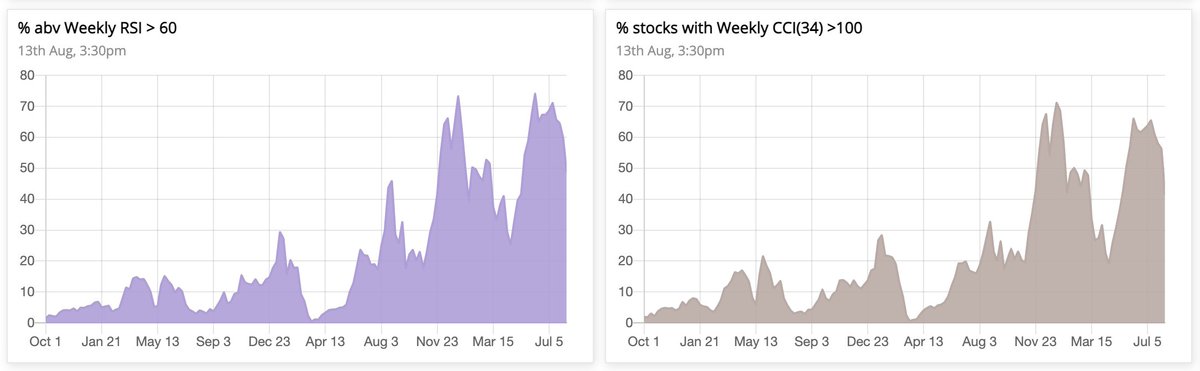

Long-term uptrend intact, some improvement in momentum, but market breadth weakening.

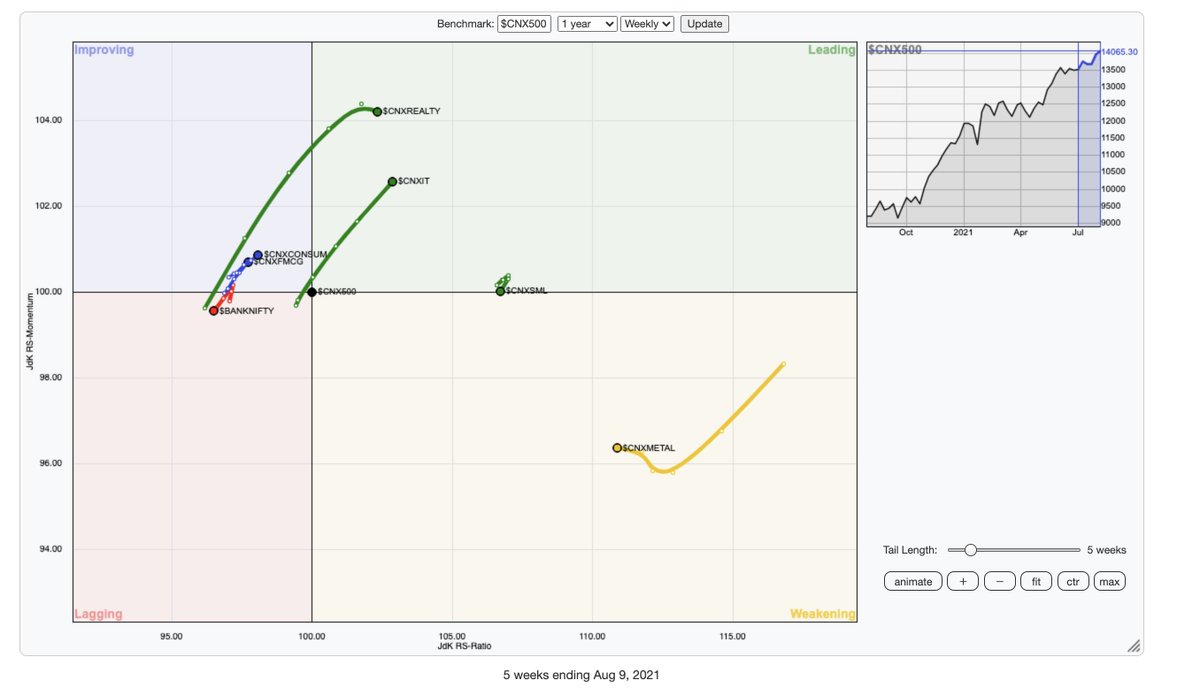

CNXSMALLCAP, CNXMIDCAP & CNX500 are outperforming NIFTY.

CNXMIDCAP is showing weakening of momentum.

NIFTY & CNX500 have regained lost momentum.

Long-term uptrend intact, some improvement in momentum, but market breadth weakening.

CNXSMALLCAP, CNXMIDCAP & CNX500 are outperforming NIFTY.

CNXMIDCAP is showing weakening of momentum.

NIFTY & CNX500 have regained lost momentum.

Loading suggestions...