#WeeklyIndexCheck - Slowing down

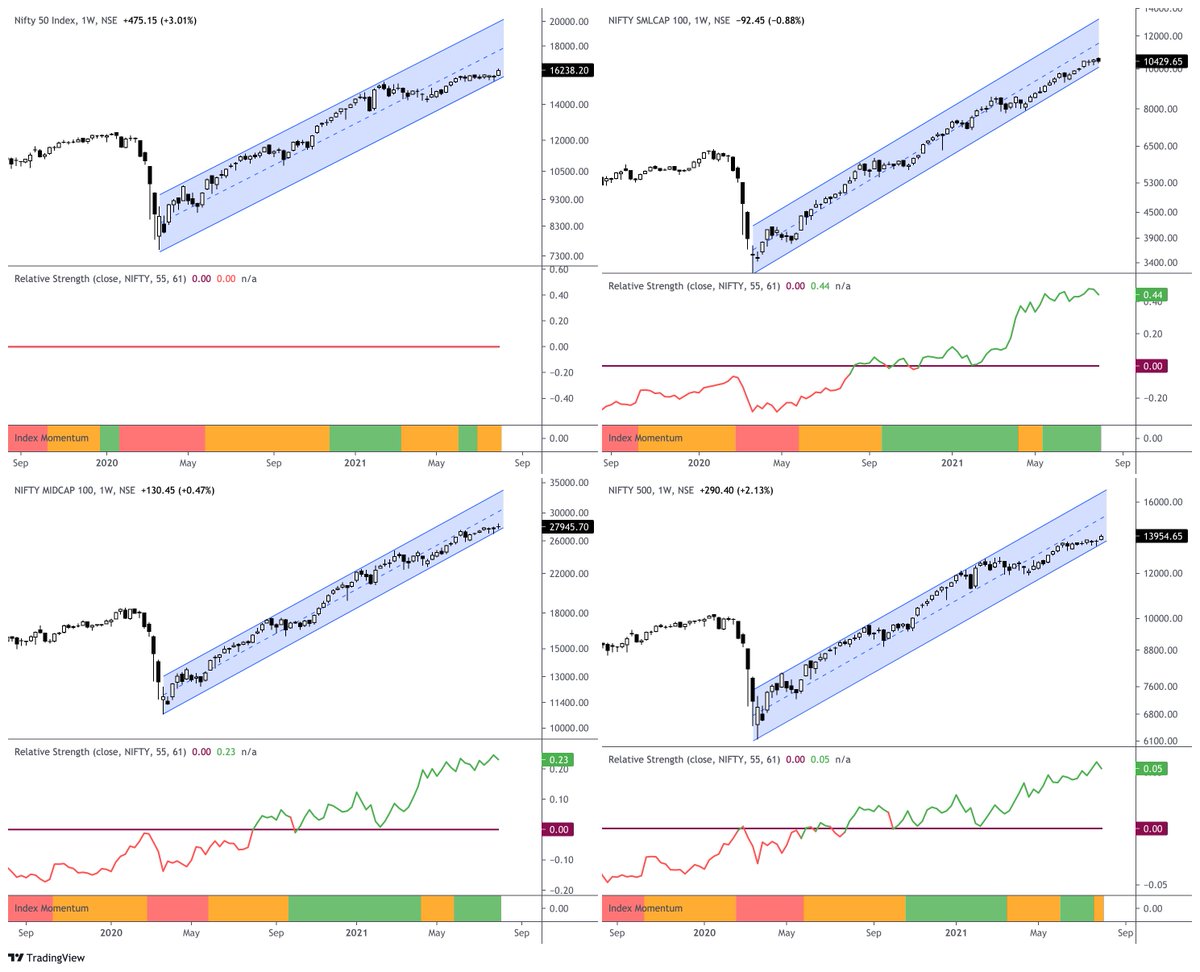

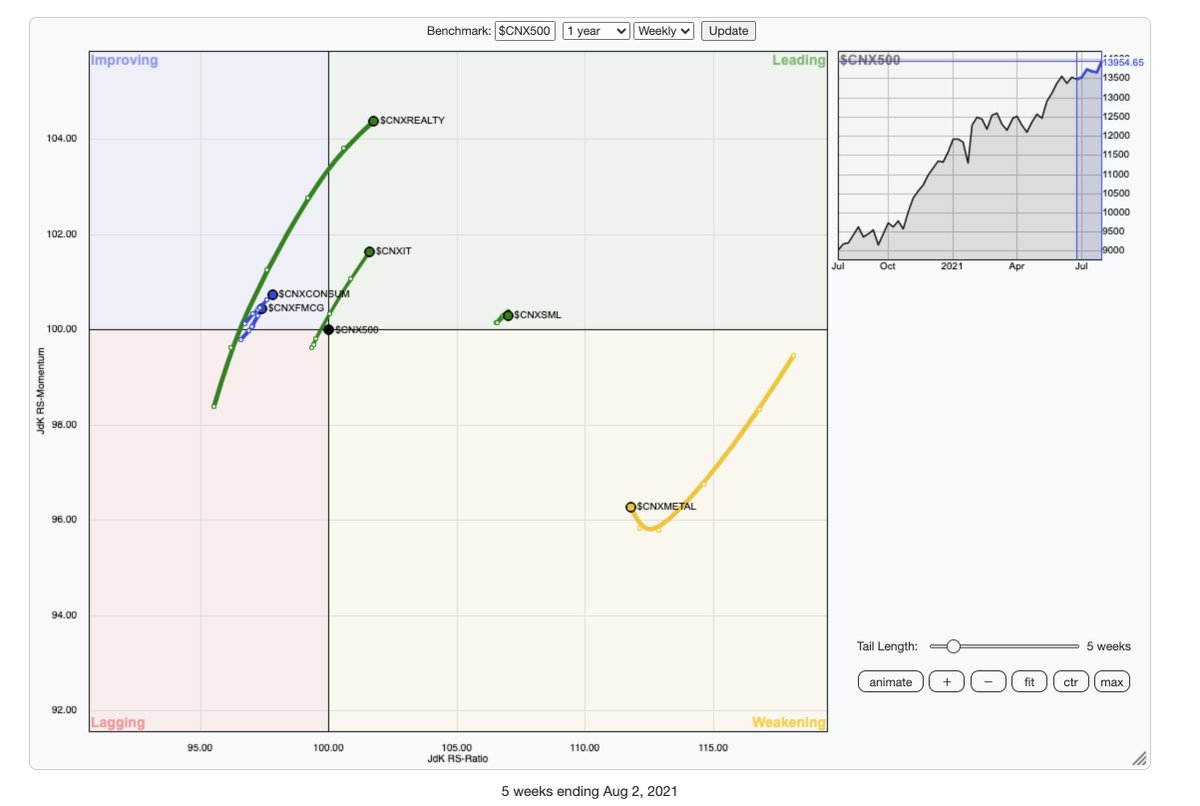

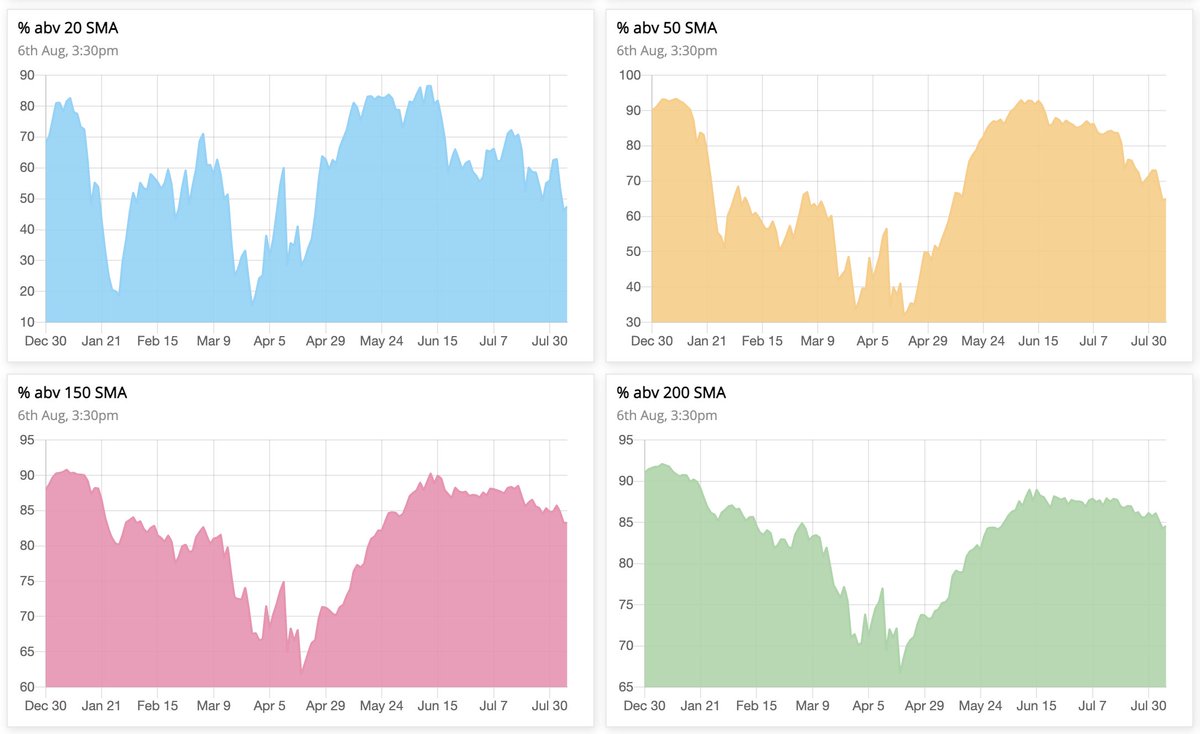

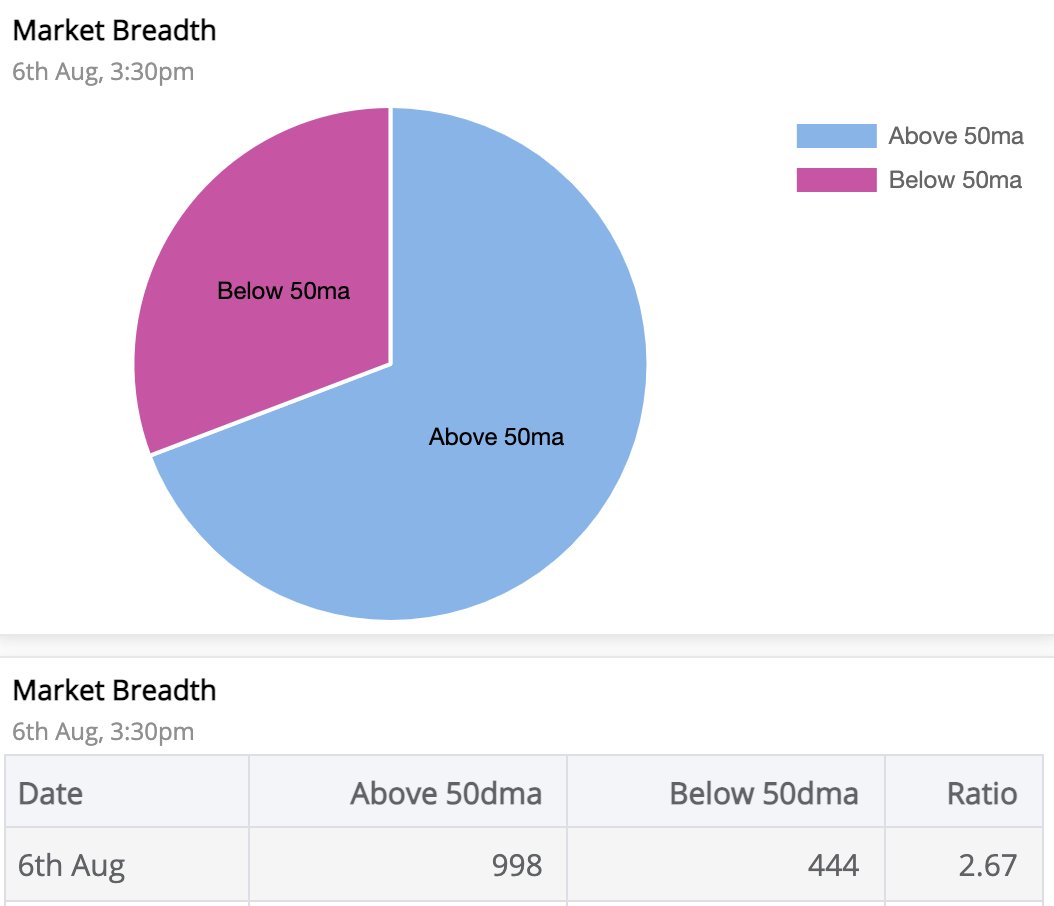

Long-term uptrend intact, but momentum is weakening.

CNXSMALLCAP, CNXMIDCAP & CNX500 are outperforming NIFTY. All are in an uptrend, but Nifty & CNX500 (and to an extent, CNXMIDCAP also) are showing weakening of momentum.

Long-term uptrend intact, but momentum is weakening.

CNXSMALLCAP, CNXMIDCAP & CNX500 are outperforming NIFTY. All are in an uptrend, but Nifty & CNX500 (and to an extent, CNXMIDCAP also) are showing weakening of momentum.

Loading suggestions...