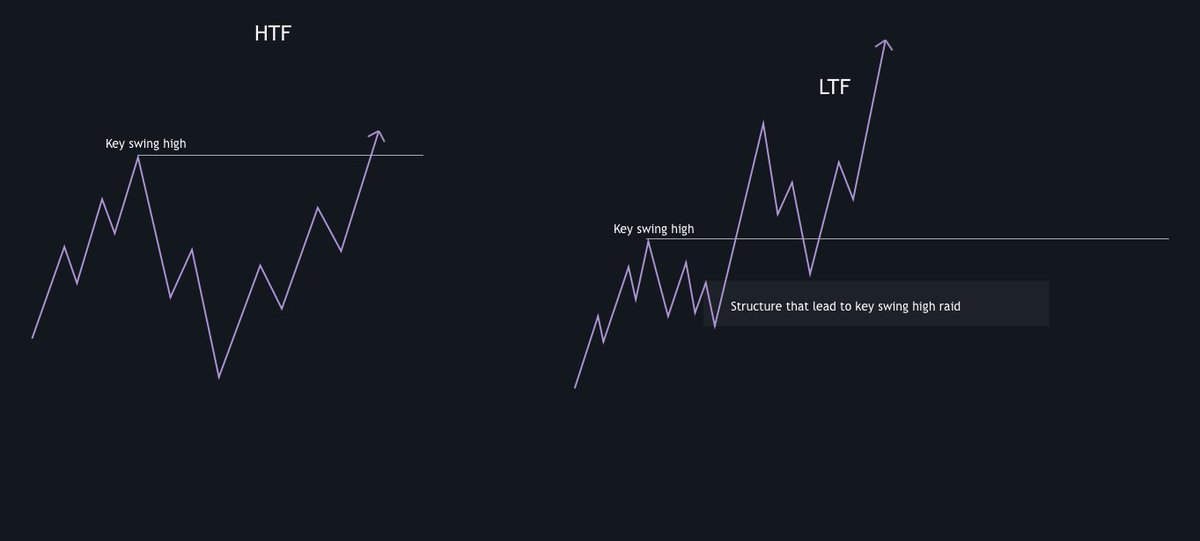

Once you see that area break down you can confidently enter the market. Where you place your SL is different for each scenario and down to how you trade.

The important thing to take from this is that rather than try to sell the top, be patient and wait for LTF structure to fail.

The important thing to take from this is that rather than try to sell the top, be patient and wait for LTF structure to fail.

There are other tools you can use such as divergences and watching the footprint to add confluence to the set-up. Context is key.

Scalpers will catch more of these but if you're swing trading you're more likely to get chopped up as you're looking to play the bigger move.

Scalpers will catch more of these but if you're swing trading you're more likely to get chopped up as you're looking to play the bigger move.

I've also found this to work best when in line with the flow of the market (for obvious reasons) rather than trying to catch a HTF bottom.

But if you do have other tools you use to catch reversals then this could be a nice addition to your execution of SFP's.

Study LTF PA 🤝

But if you do have other tools you use to catch reversals then this could be a nice addition to your execution of SFP's.

Study LTF PA 🤝

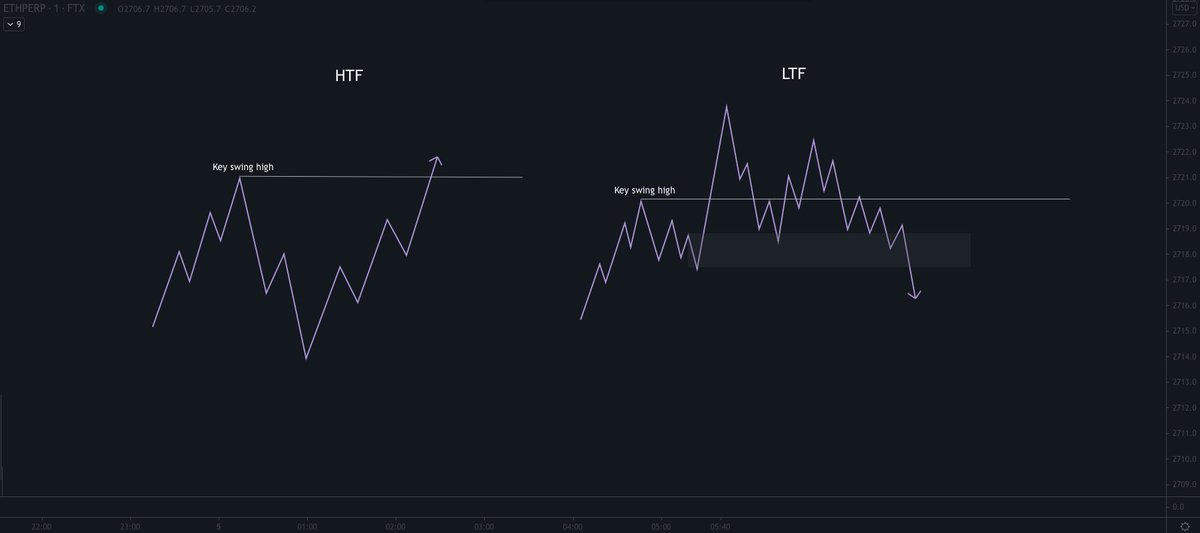

Showing you the recent high in #BTC as an example with the footprint as confluence.

Even with all this information i've shared here, you'll still struggle to execute unless you watch the market every single day.

It's easier to do things in hindsight. Actually executing these trades takes a lot of patience and high concentration. Most importantly, chart time.

It's easier to do things in hindsight. Actually executing these trades takes a lot of patience and high concentration. Most importantly, chart time.

Loading suggestions...