Glenmark Life Sciences (GLS) IPO notes 🔬

Plans to take the capacity to 1762KL (currently 762KL) in the next 4 years.

Hit the 'retweet' & help us educate more investors

A thread 🧵👇

#IPOwithJST

Plans to take the capacity to 1762KL (currently 762KL) in the next 4 years.

Hit the 'retweet' & help us educate more investors

A thread 🧵👇

#IPOwithJST

11/ Risks:

- High Customer churn: Only 41% of the customers stayed from FY19 to FY21.

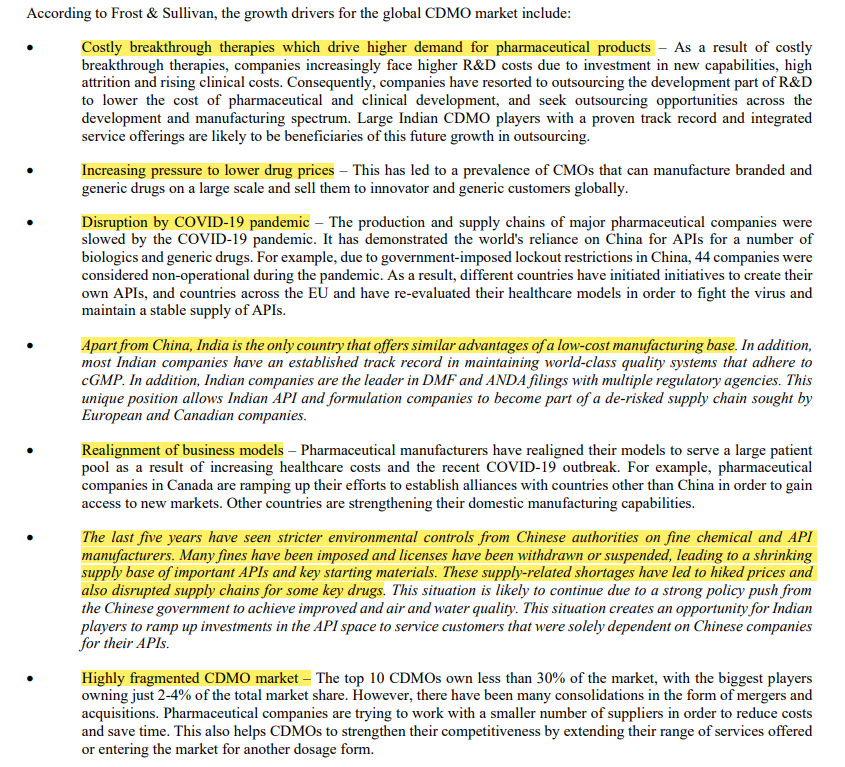

- Imports 40% of RM from China: could face huge pricing pressure which they are not able to pass on.

- Regulatory & compliance risks

- Client concentration: 56% of rev from the top 5 customers

- High Customer churn: Only 41% of the customers stayed from FY19 to FY21.

- Imports 40% of RM from China: could face huge pricing pressure which they are not able to pass on.

- Regulatory & compliance risks

- Client concentration: 56% of rev from the top 5 customers

13/

- Increased competition in their respective products: pricing pressure

- Working capital risk: have huge credit terms up to 180 days

- High employee attrition of 18-20%

- Failure to get the environmental clearances for new facilities.

- Increased competition in their respective products: pricing pressure

- Working capital risk: have huge credit terms up to 180 days

- High employee attrition of 18-20%

- Failure to get the environmental clearances for new facilities.

14/

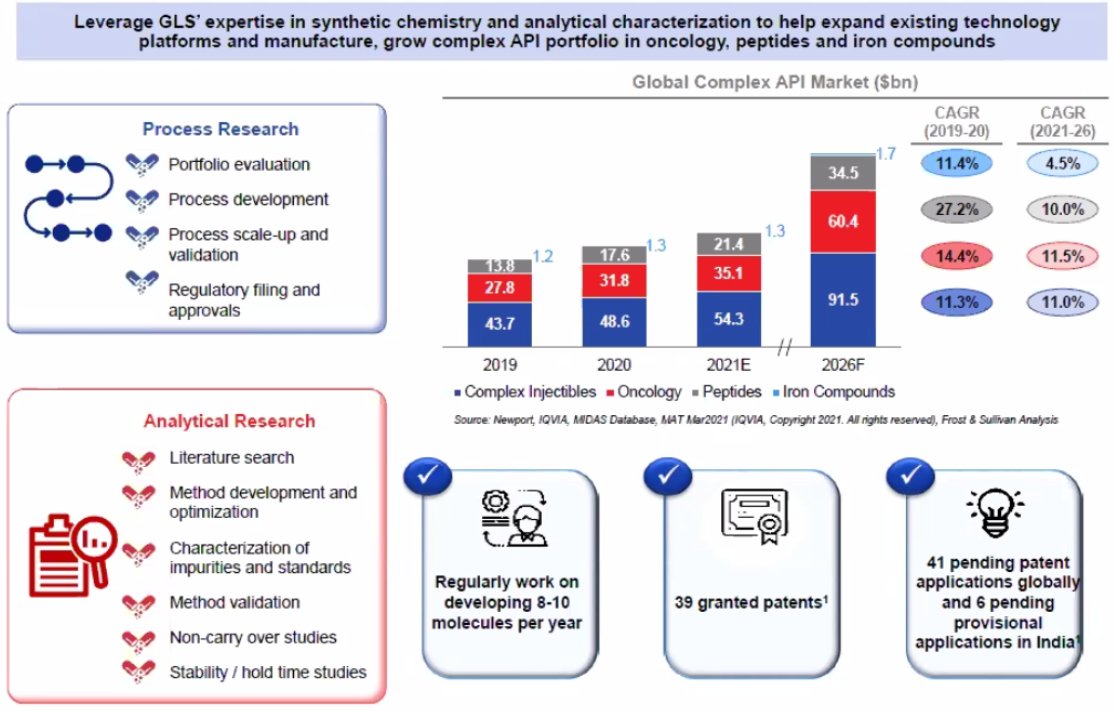

We believe Glenmark Life sciences IPO which is currently valued at 4.6x EV/sales, 15x EV/EBITDA & 25x Price/Earnings & following the lucrative strategy to become bigger in complex APIs, is rather reasonably valued.

End of thread.

We believe Glenmark Life sciences IPO which is currently valued at 4.6x EV/sales, 15x EV/EBITDA & 25x Price/Earnings & following the lucrative strategy to become bigger in complex APIs, is rather reasonably valued.

End of thread.

To understand more about the business dynamics of the API sector in depth

Watch this video by Sajal Sir @unseenvalue, hosted by @soicfinance (Better get the whole webinar from them)

youtu.be

Watch this video by Sajal Sir @unseenvalue, hosted by @soicfinance (Better get the whole webinar from them)

youtu.be

Loading suggestions...