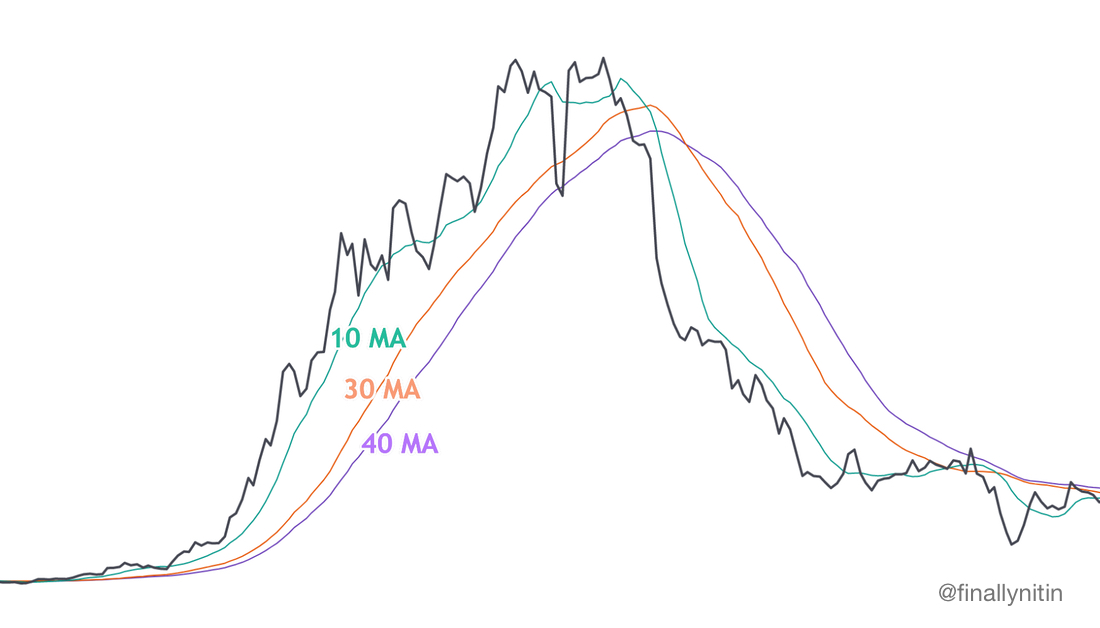

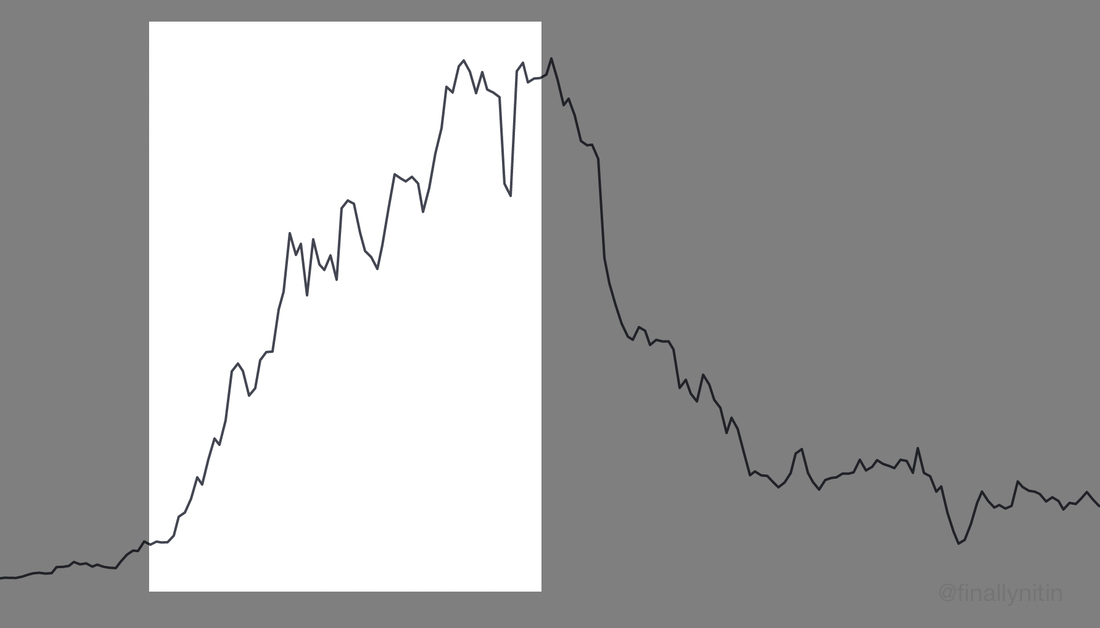

In his book “Trade Like a Stock Market Wizard”, @markminervini further improved this by adding that the 10-week MA should be above the 30-week & 40-week moving averages, & the 40-week MA should be rising for at least a month.

Loading suggestions...