#Syngene - Thread⚡️

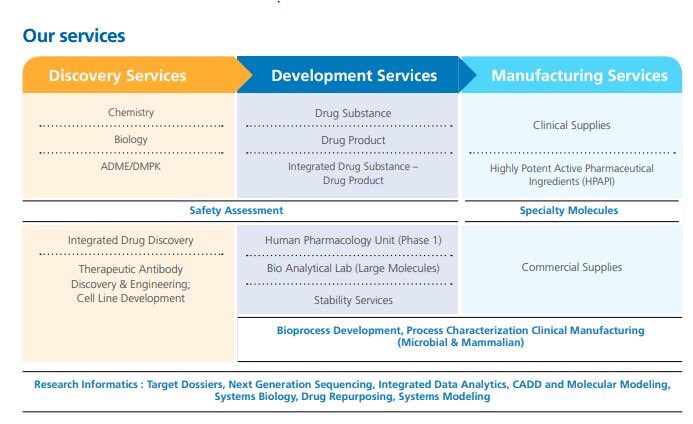

An integrated service provider offering end-to-end drug discovery, development, and manufacturing services on a single platform.

25+ years of unparalleled experience

@unseenvalue @AvadhMaheshwar2 @caniravkaria @Jitendra_stock @saketreddy @itsTarH

An integrated service provider offering end-to-end drug discovery, development, and manufacturing services on a single platform.

25+ years of unparalleled experience

@unseenvalue @AvadhMaheshwar2 @caniravkaria @Jitendra_stock @saketreddy @itsTarH

(2/n)

Syngene, a subsidiary of Biocon Ltd, was established in 1993 as India’s first Contract Research Organization.

CRO is a company that provides support to the pharma industry in the form of research services outsourced on a contract basis. CROs are designed to reduce costs.

Syngene, a subsidiary of Biocon Ltd, was established in 1993 as India’s first Contract Research Organization.

CRO is a company that provides support to the pharma industry in the form of research services outsourced on a contract basis. CROs are designed to reduce costs.

(8/n)

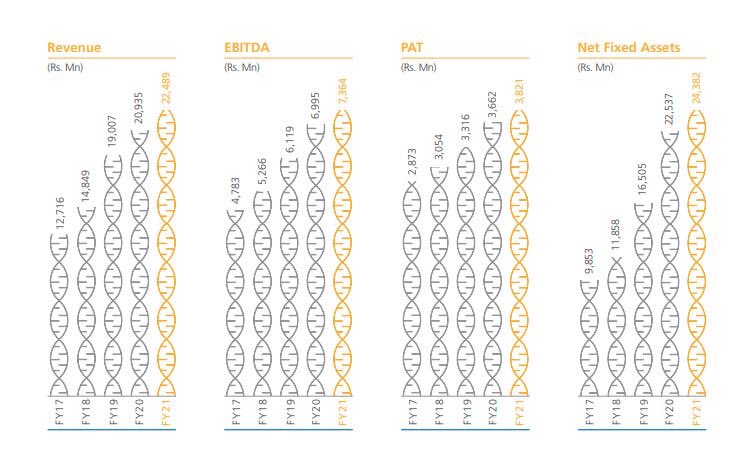

>Despite the tough FY21, Syngene has been able to increase its clients by 40+ (Total 402)

>EBITDA margin from operations increased by 220 basis points from 28.4% in FY20 to 30.6% in FY21

>Started manufacturing of small molecule API at Mangalore facility for some clients

>Despite the tough FY21, Syngene has been able to increase its clients by 40+ (Total 402)

>EBITDA margin from operations increased by 220 basis points from 28.4% in FY20 to 30.6% in FY21

>Started manufacturing of small molecule API at Mangalore facility for some clients

(10/n)

>Increasing number of small biotech companies: Emerging and virtual biotechnology companies often lack the internal infrastructure to run their own research

>Focus on cost optimization by biopharmaceuticals

>Increased complexity in drug development

>Increasing number of small biotech companies: Emerging and virtual biotechnology companies often lack the internal infrastructure to run their own research

>Focus on cost optimization by biopharmaceuticals

>Increased complexity in drug development

(11/n)

Generic medicines continue to play an important role in increasing patient access to affordable healthcare+increasing demand for biological therapies, growing focus on specialty medicines, and advancements in cell and gene therapies are fueling the growth of CMO market

Generic medicines continue to play an important role in increasing patient access to affordable healthcare+increasing demand for biological therapies, growing focus on specialty medicines, and advancements in cell and gene therapies are fueling the growth of CMO market

(14/n)

Biologics facility:

Enhanced Mammalian capability by addition of 2,000L reactor

Added 500L microbial facility to enhance offering and cater to wide variety of drugs ranging from anti-cancer to hormonal disorder

Biologics facility:

Enhanced Mammalian capability by addition of 2,000L reactor

Added 500L microbial facility to enhance offering and cater to wide variety of drugs ranging from anti-cancer to hormonal disorder

(15/n)

Guidance-FY22

EBITDA margin to be ~30%

Mid-teen growth in revenue from operations

The focus will be on investment-led growth with expansion in infrastructure, staff headcount, and capability additions across core businesses and ramp-up of sales presence in key markets

Guidance-FY22

EBITDA margin to be ~30%

Mid-teen growth in revenue from operations

The focus will be on investment-led growth with expansion in infrastructure, staff headcount, and capability additions across core businesses and ramp-up of sales presence in key markets

(16/n)

Elite client additions like Amgen, Zoetis, Herbalife, GSK, etc, and multiple year extension of BMS, Baxter contracts, the company remains well poised to capture opportunities in the global CRO space.

Company has announced a capex of Rs7.5-9bn for FY22E.

Elite client additions like Amgen, Zoetis, Herbalife, GSK, etc, and multiple year extension of BMS, Baxter contracts, the company remains well poised to capture opportunities in the global CRO space.

Company has announced a capex of Rs7.5-9bn for FY22E.

(17/n)

Mangalore API Plant: Large scale operations once the USFDA inspection and approval comes through

Impact on near-term profitability as investments in the CMO segment are characterized by longer gestation periods compared to the faster scale up in CRO business.

Mangalore API Plant: Large scale operations once the USFDA inspection and approval comes through

Impact on near-term profitability as investments in the CMO segment are characterized by longer gestation periods compared to the faster scale up in CRO business.

(18/n)

Favourable trends, advanatge of quality workforce at low cost, high margin business, and given that innovator CMO space is highly complementary to the CRO space + Syngene’s track record of working with innovators positions the company for scaling up the business and GROW!

Favourable trends, advanatge of quality workforce at low cost, high margin business, and given that innovator CMO space is highly complementary to the CRO space + Syngene’s track record of working with innovators positions the company for scaling up the business and GROW!

(19/n)

Source: Investor Presentation, Screener, Research Reports, FY21 Annual Report, @soicfinance Syngene Stock Analysis > youtu.be

Source: Investor Presentation, Screener, Research Reports, FY21 Annual Report, @soicfinance Syngene Stock Analysis > youtu.be

Loading suggestions...