Previously I made an introductory thread explaining Technical Analysis for beginners and simplified how to read price direction on the charts. 📈📉

Here's the second part explaining more on reading and interpretation of charts and Candlesticks.📊

A #Thread.

RETWEET (PART 2)🙂💥

Here's the second part explaining more on reading and interpretation of charts and Candlesticks.📊

A #Thread.

RETWEET (PART 2)🙂💥

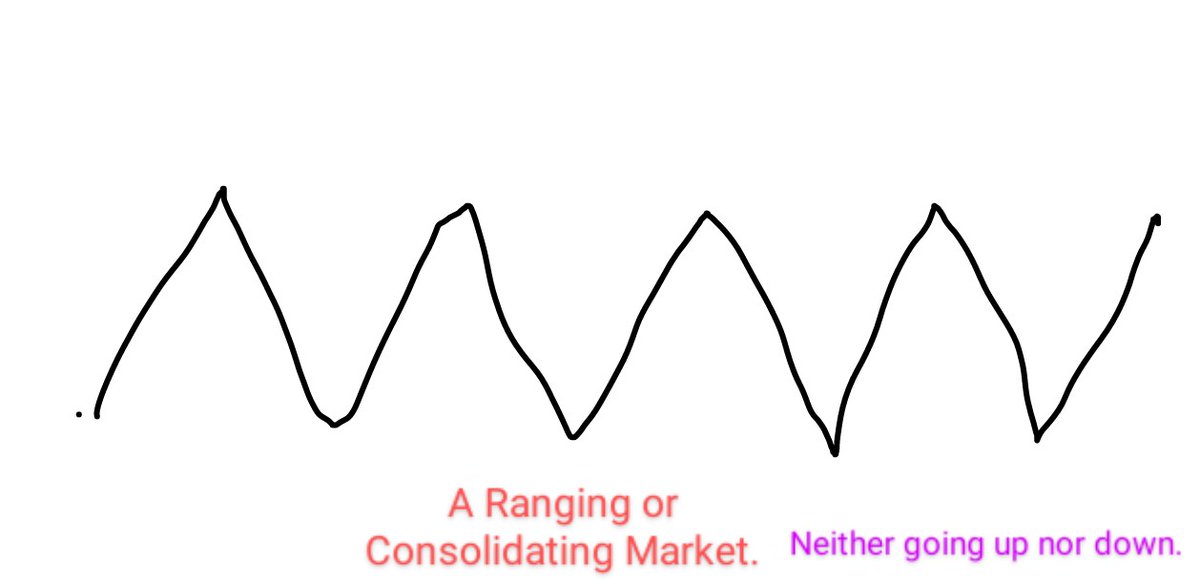

With the image above, we can deduce that the market is in a range or currently consolidating and is yet to make a solid move to a direction.

Now let's get practical.

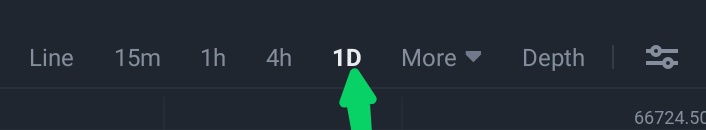

Open your Binance app and search for #Bitcoin using the $BTC/BUSD pair.

Click on 1D to change to a daily Chart.

Now let's get practical.

Open your Binance app and search for #Bitcoin using the $BTC/BUSD pair.

Click on 1D to change to a daily Chart.

So what do you do in a market like this?

The best advice is to stay out of the market and wait for price to make a "bold" move before you make any trading decision.

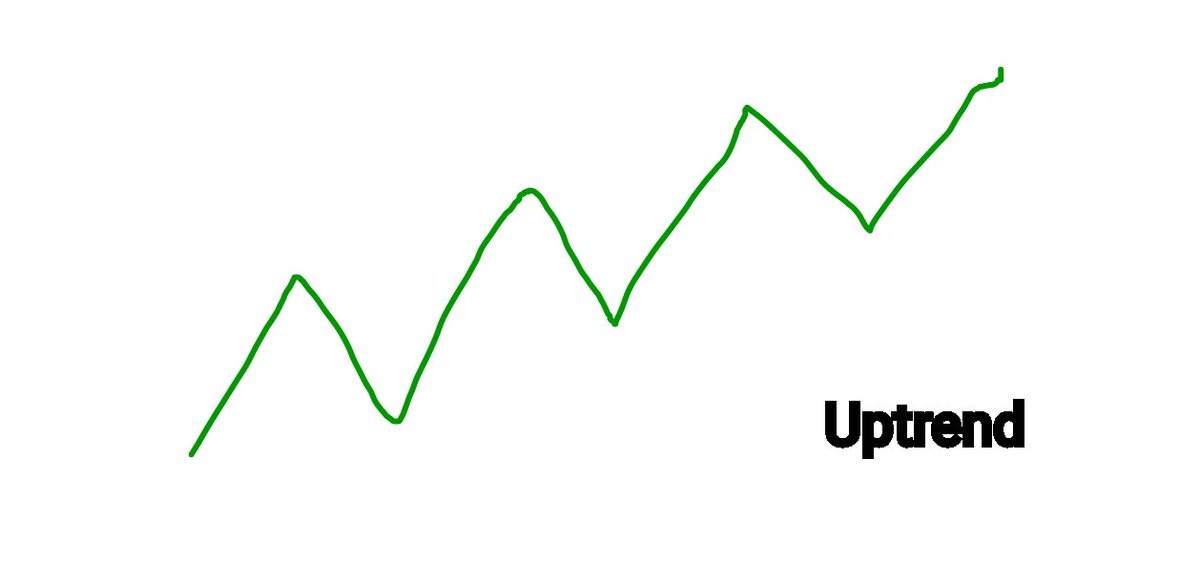

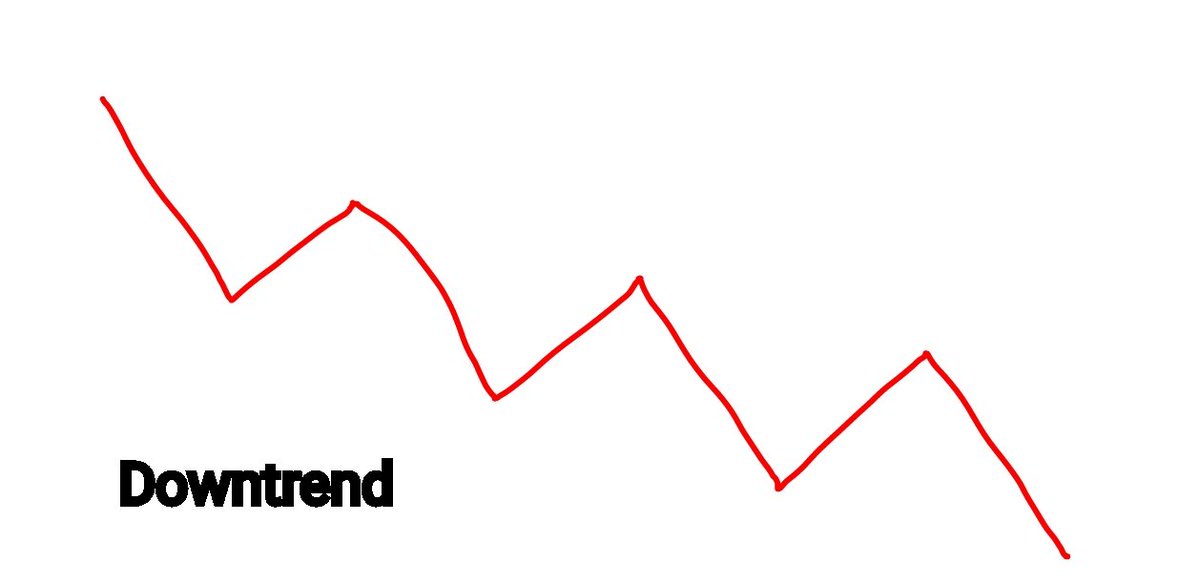

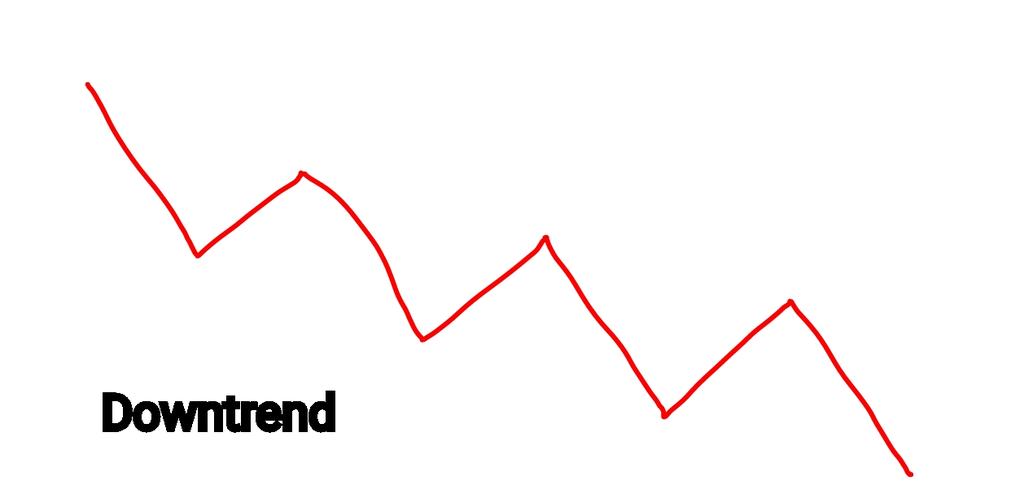

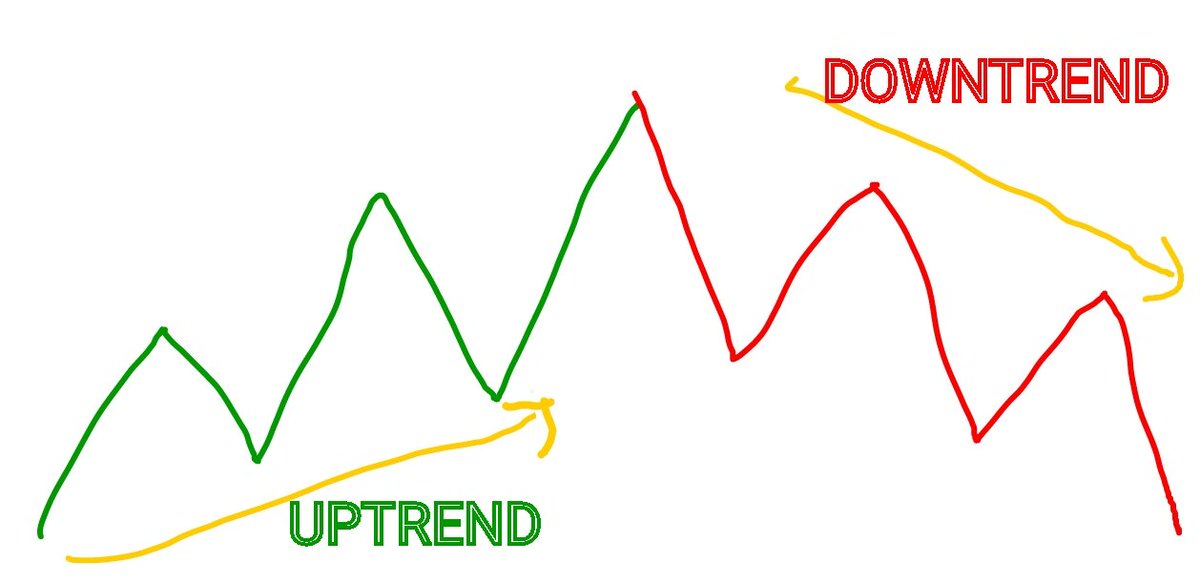

Now if you still don't understand how to identify trends on your chart, here are images to assist you.

The best advice is to stay out of the market and wait for price to make a "bold" move before you make any trading decision.

Now if you still don't understand how to identify trends on your chart, here are images to assist you.

Now you know how to interprete market charts in a simple way by using trends and know what decisions to make and when to make them.

Congratulations for reaching this point..🙂

Now it's time to go deeper on Candlesticks.

Congratulations for reaching this point..🙂

Now it's time to go deeper on Candlesticks.

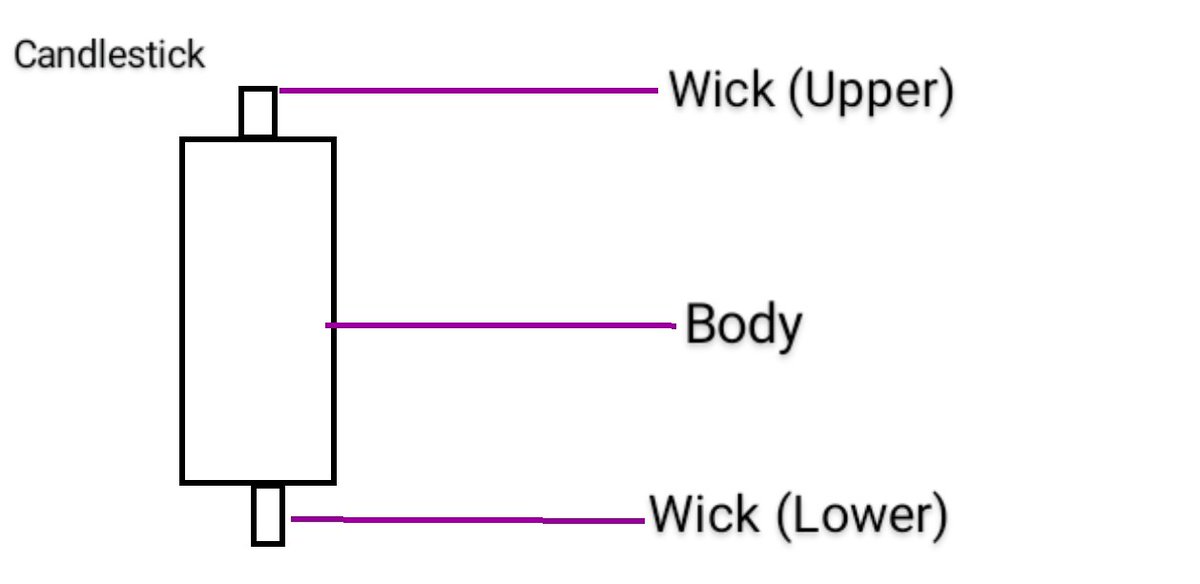

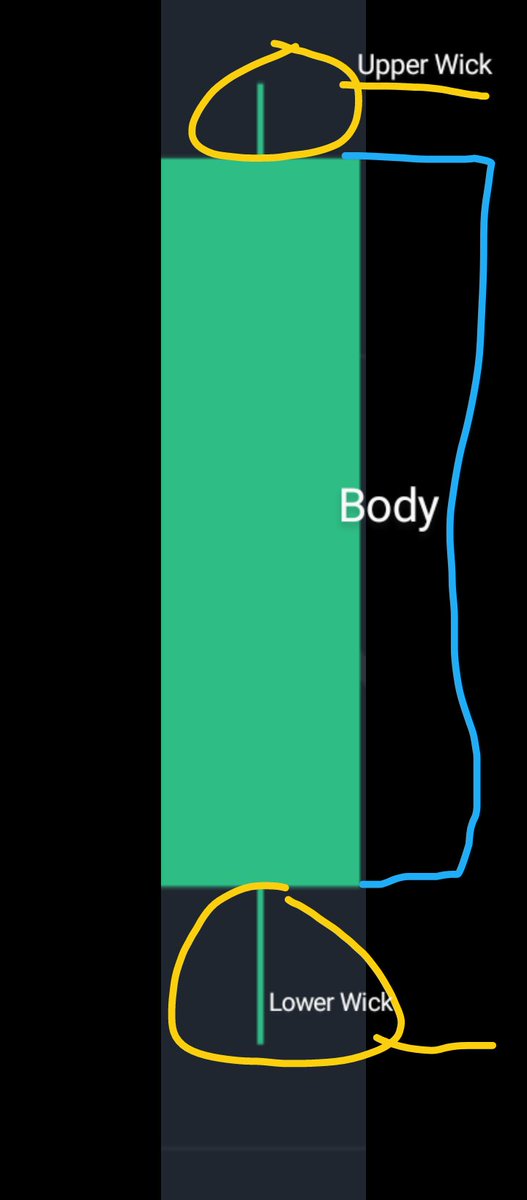

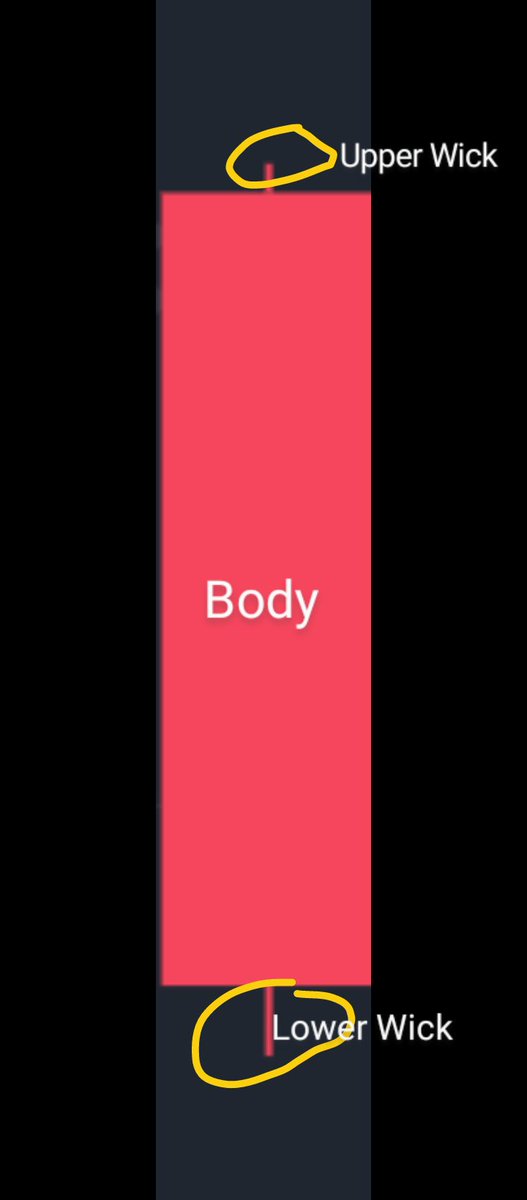

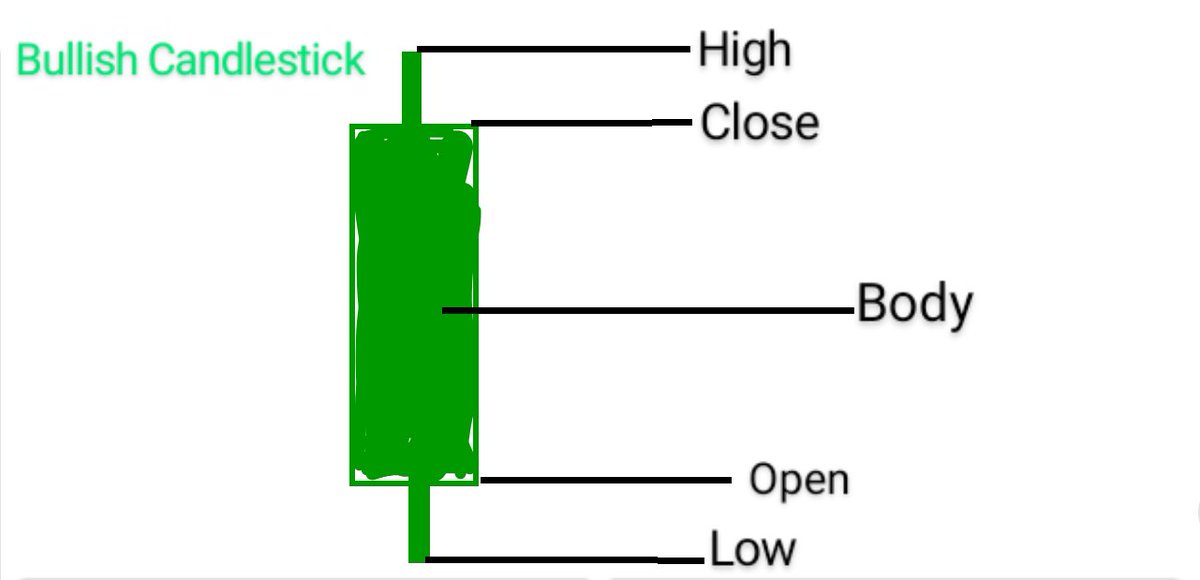

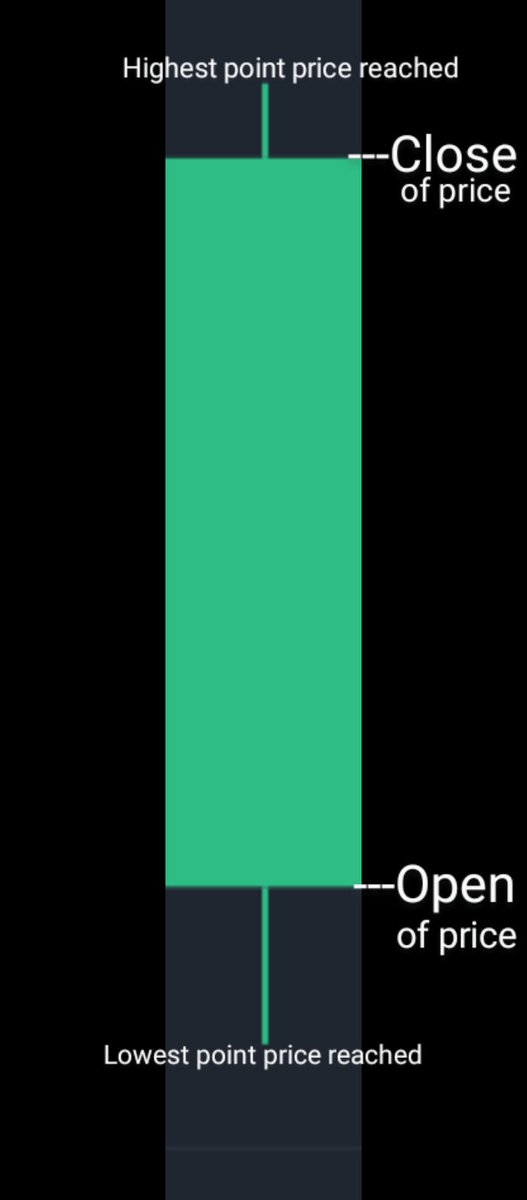

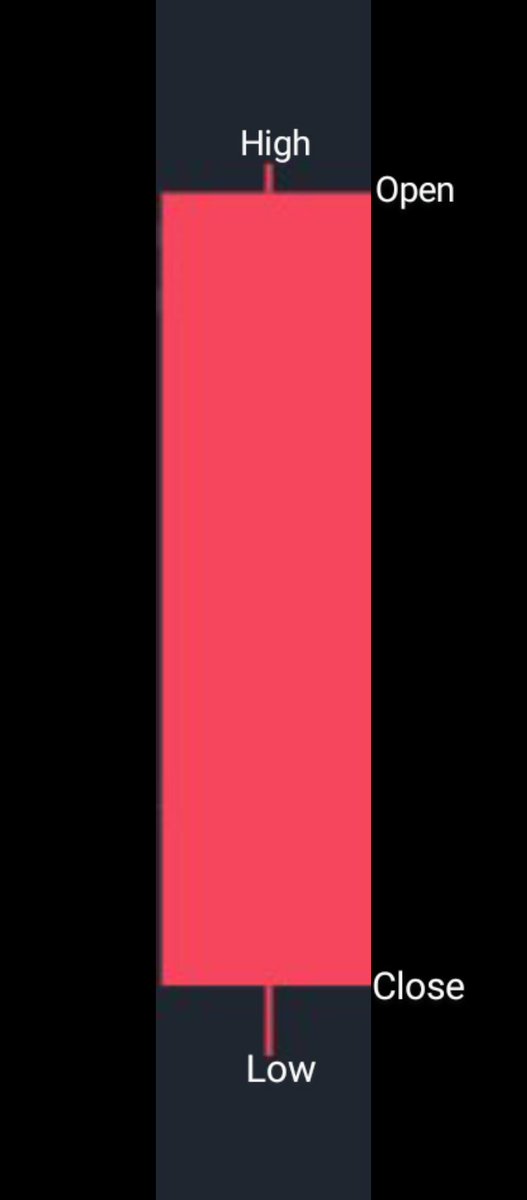

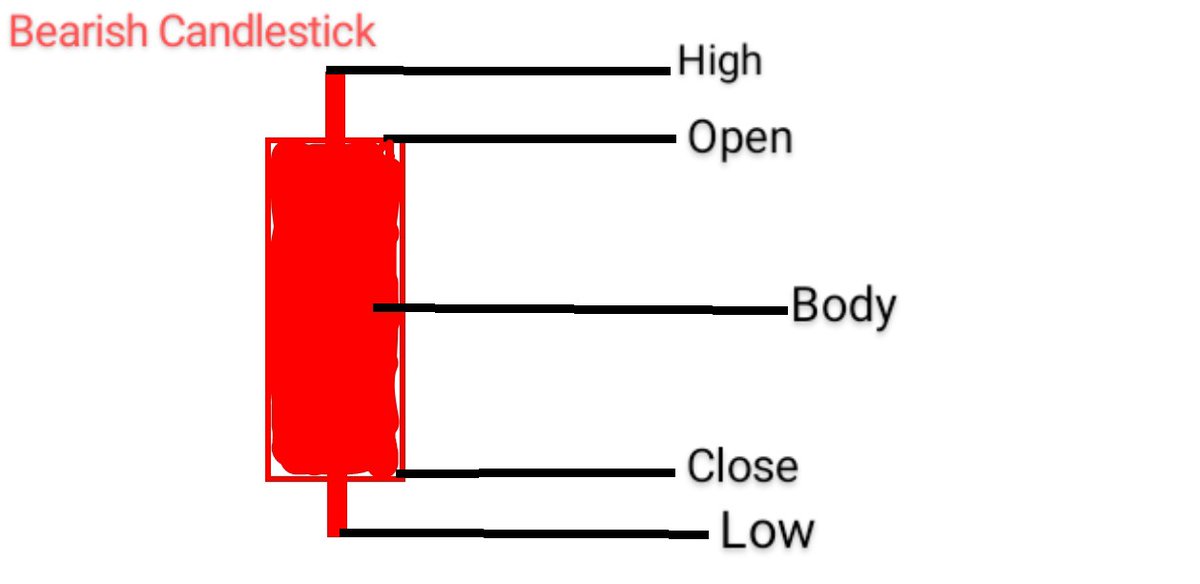

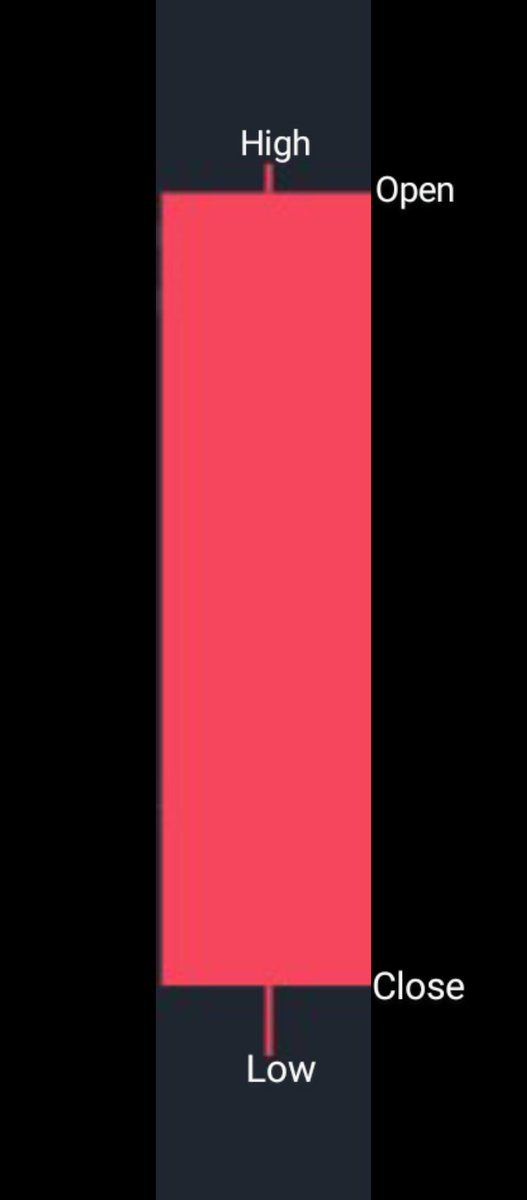

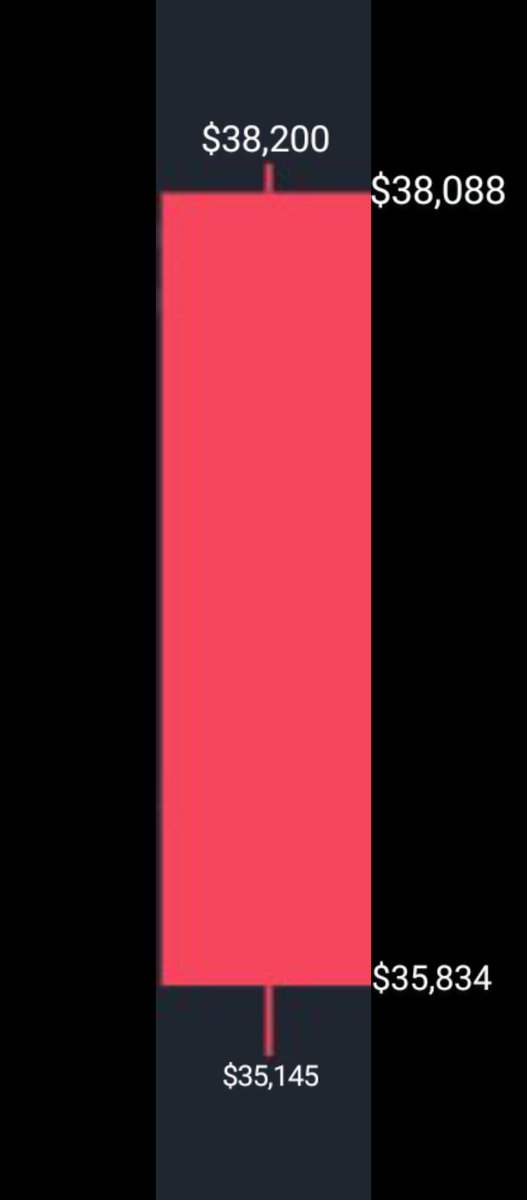

A candlestick is a block that interprets the interaction of price in a certain period or time window or what we simply call a "timeframe" in trading.

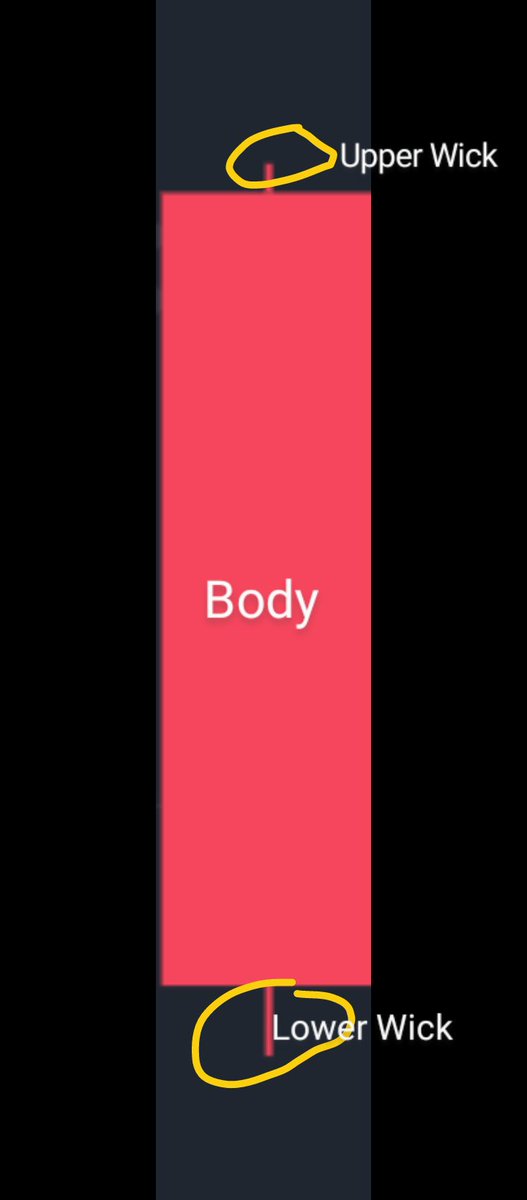

A candlestick consists of two parts:-

- Body

- Wicks

And they show these info about price:

- Open

- Close

- High and

- Low.

A candlestick consists of two parts:-

- Body

- Wicks

And they show these info about price:

- Open

- Close

- High and

- Low.

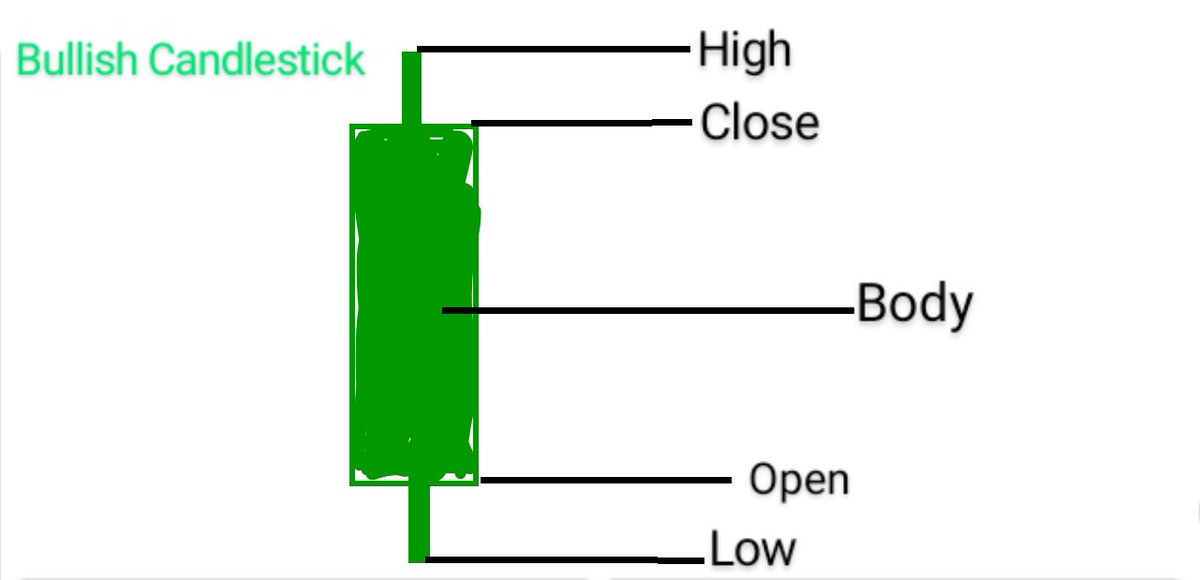

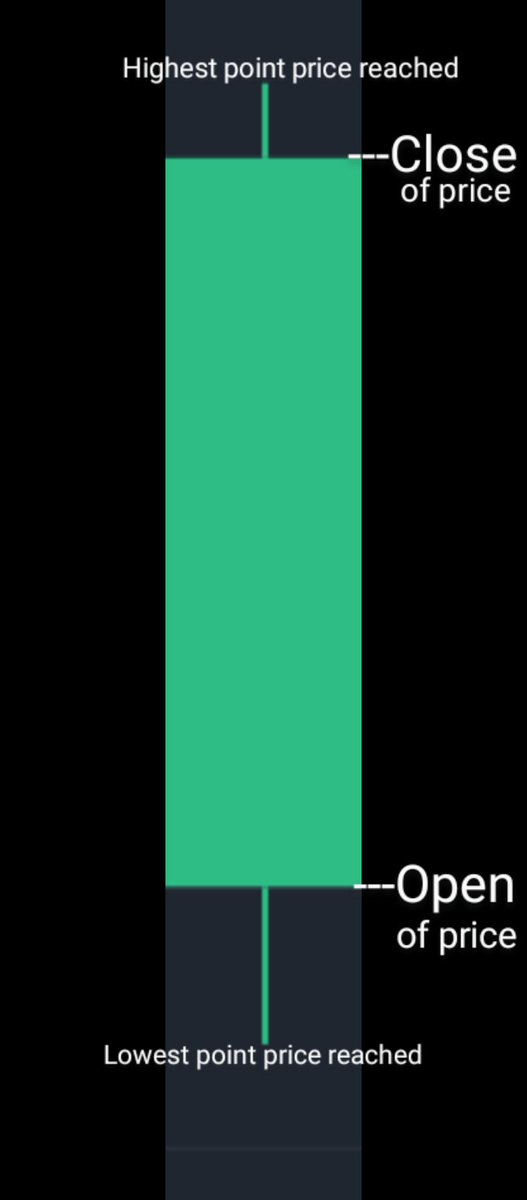

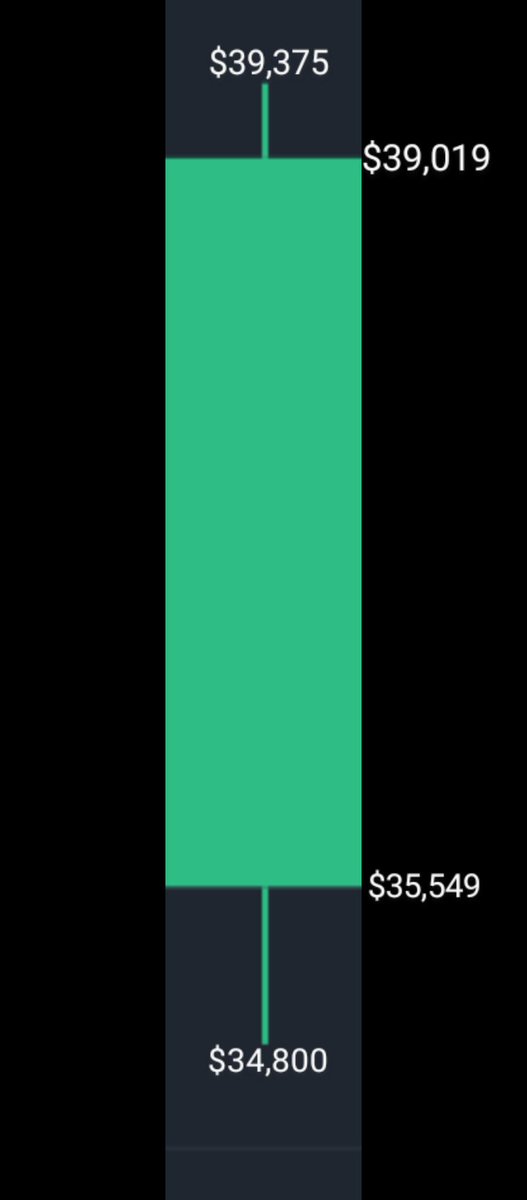

If the close of a Candlestick is higher than the open which you can see in the above image, that means we have a bullish Candlestick.

The "High" is the highest point price got to, while the "Low" is the lowest point price got to in that timeframe.

The "High" is the highest point price got to, while the "Low" is the lowest point price got to in that timeframe.

above which means on the day which the candlestick belongs to, price opened (started) at a low price and the ended at a higher price which means that day was bullish for #BTC.

Press on the candle and hold, a dialogue box at the right will show you the details of price that day.

Press on the candle and hold, a dialogue box at the right will show you the details of price that day.

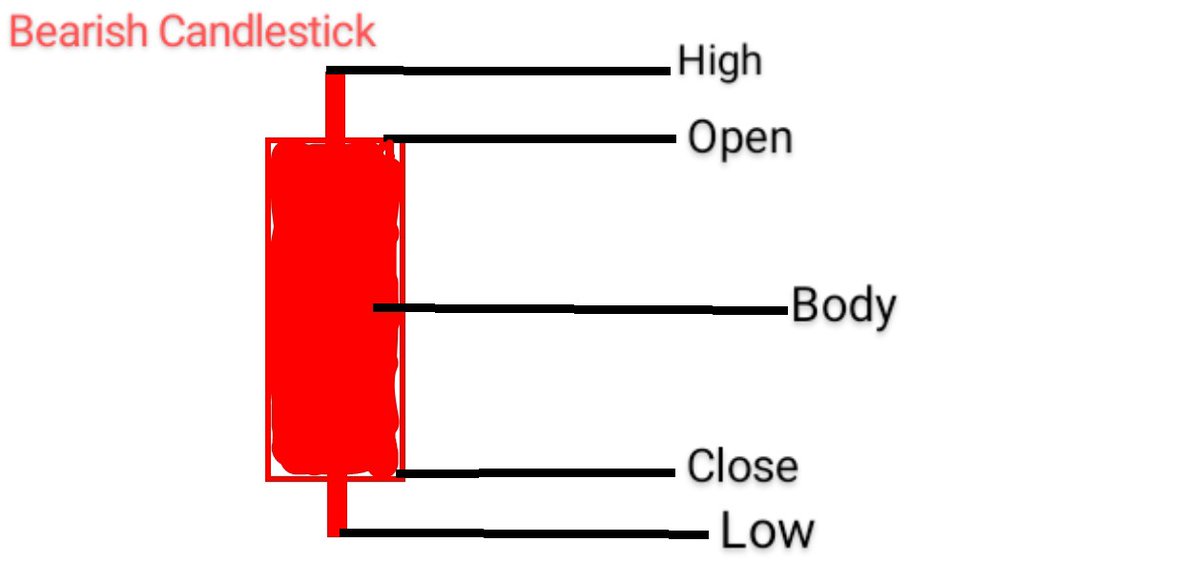

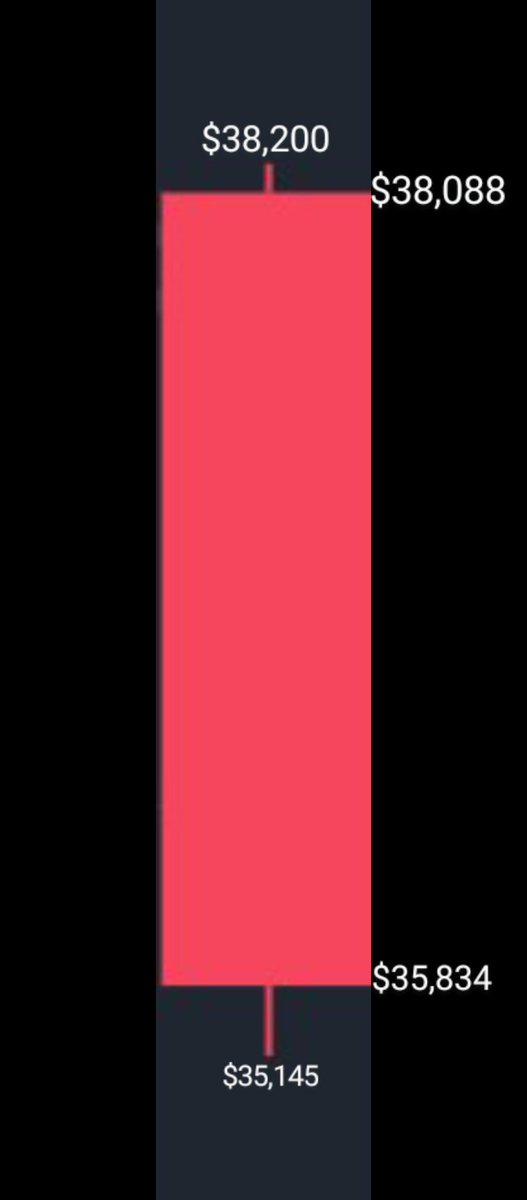

That on the 18th of June 2021, $BTC OPENED at a price of $38,088, dipped to a LOW of $35,145, and the HIGHEST price #BTC got to was $38,200 before CLOSING at a price of $35,834.

OPEN: $38,088

HIGH: $38,200

LOW: $35,145

CLOSE: $35,834.

Let's input these parameters on the candle.

OPEN: $38,088

HIGH: $38,200

LOW: $35,145

CLOSE: $35,834.

Let's input these parameters on the candle.

Now from this thread you've known:

- Types of Trends.

- How to identify trends and markets.

- Types of Candlesticks.

- How to Interprete Candlesticks on Charts.

Congratulations to stepping up in technical analysis.💥😊.

- Types of Trends.

- How to identify trends and markets.

- Types of Candlesticks.

- How to Interprete Candlesticks on Charts.

Congratulations to stepping up in technical analysis.💥😊.

In the next thread I'll be teaching you Support and Resistance and how to place trades based on this strategy.

Follow and Turn on post notifications to get it when it drops.😊

I remain your favorite Cryptocurrency Coach @ThePaulOla

Follow and Turn on post notifications to get it when it drops.😊

I remain your favorite Cryptocurrency Coach @ThePaulOla

If you found value in this thread, kindly RETWEET for others to see.

Here's the beginning of the thread to retweet.

Here's the beginning of the thread to retweet.

And if you're looking for PART 1 of this thread, here it is.

Loading suggestions...