"Asset Allocation 2.0"

Detail 🧵

Definition: 'Asset allocation is the process of investing across diversified 'Asset Classes'.

#investing #wealthcreation

1/20

👇👇

Detail 🧵

Definition: 'Asset allocation is the process of investing across diversified 'Asset Classes'.

#investing #wealthcreation

1/20

👇👇

2/

Don't care whats your age is - 'if you have missed creating wealth at early age, no regret.'

I started understating Asset Allocation, Wealth Creation & Investing in late 30s.. .

In-fact started planning & investment journey much later, I mean few years back only...

Don't care whats your age is - 'if you have missed creating wealth at early age, no regret.'

I started understating Asset Allocation, Wealth Creation & Investing in late 30s.. .

In-fact started planning & investment journey much later, I mean few years back only...

3/

Before you get into 'Planning & Investment' - few basics you have to accomplish:

❶ Pre close all investments linked with Insurance

❷ Buy enough of medical insurance outside office

❸ Buy a Term Insurance, min 1 Crore

Lets Begin 🕺💃👇

Before you get into 'Planning & Investment' - few basics you have to accomplish:

❶ Pre close all investments linked with Insurance

❷ Buy enough of medical insurance outside office

❸ Buy a Term Insurance, min 1 Crore

Lets Begin 🕺💃👇

4/

Types of 'Asset Classes'

⓵ Real Estate - Site, Flat, Farm Land & Comm

⓶ Gold & Silver - Physical

⓷ Equity - MFs, Stocks

⓸ Debt - Gilt, Short Term, Income, Maturity & Liquid

⓹ PF/VPF/ NPS

⓺ Cash - FDs & Liquid Funds

⓻ Start-ups

⓼ Cryptocurrency & Derivatives..

👇

Types of 'Asset Classes'

⓵ Real Estate - Site, Flat, Farm Land & Comm

⓶ Gold & Silver - Physical

⓷ Equity - MFs, Stocks

⓸ Debt - Gilt, Short Term, Income, Maturity & Liquid

⓹ PF/VPF/ NPS

⓺ Cash - FDs & Liquid Funds

⓻ Start-ups

⓼ Cryptocurrency & Derivatives..

👇

8/ Debt

Types of Debt Funds:

Liquid

Money Market

Dynamic Bond

Corporate Bond

Gilt

Credit Risk

Low, Medium & Long Duration

Ultra Short

Overnight etc.

Since I have sizable PF/VPF - I have not invested in any debt instruments.

More on Debt Investment👇

groww.in

Types of Debt Funds:

Liquid

Money Market

Dynamic Bond

Corporate Bond

Gilt

Credit Risk

Low, Medium & Long Duration

Ultra Short

Overnight etc.

Since I have sizable PF/VPF - I have not invested in any debt instruments.

More on Debt Investment👇

groww.in

9/ PF, VPF & NPS

A must asset class, what should be the percentage allocation, I will little later.

PF & VPF - we all are aware of it.

NPS - National Pension Scheme is a social security initiative by the Central Government. Please read details here👇

cleartax.in

A must asset class, what should be the percentage allocation, I will little later.

PF & VPF - we all are aware of it.

NPS - National Pension Scheme is a social security initiative by the Central Government. Please read details here👇

cleartax.in

10/ Cash

One more must asset class - required for 'Emergency Fund'

Where I should keep Cash? Definitely not below the bed unless its a black money.

Keep it in FDs, RDs, Saving a/c and Liquid Funds. Ensure you have access to it in 'No Time'

One more must asset class - required for 'Emergency Fund'

Where I should keep Cash? Definitely not below the bed unless its a black money.

Keep it in FDs, RDs, Saving a/c and Liquid Funds. Ensure you have access to it in 'No Time'

11/ Start-ups

There r around 7K plus start-ups in India, $ 2 B Invested and whooping $ 25 B Follow ons.

Now u decide, u want to start a "Start-up" or invest in "Start-up"🙂

Its a must try for those who hav already achieved Financial Freedom

Details here👇

angel.co

There r around 7K plus start-ups in India, $ 2 B Invested and whooping $ 25 B Follow ons.

Now u decide, u want to start a "Start-up" or invest in "Start-up"🙂

Its a must try for those who hav already achieved Financial Freedom

Details here👇

angel.co

12/ Cryptocurrency & Derivatives

Crypto - is the most talked about investment among the millennials. I dont mind allocating 2-5% if Indian Govt make it Legit Investment.

Derivatives - is a quick money maker or loser, I never made money here.

Crypto - is the most talked about investment among the millennials. I dont mind allocating 2-5% if Indian Govt make it Legit Investment.

Derivatives - is a quick money maker or loser, I never made money here.

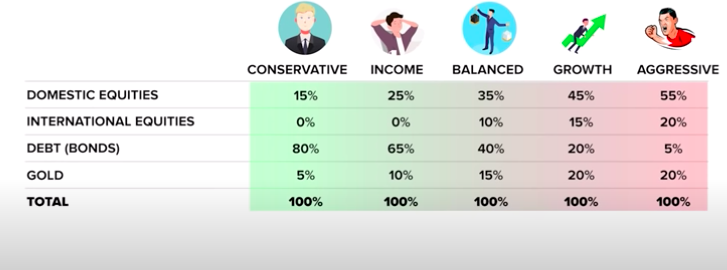

14/ What are the factors decide 'Asset Allocation'?

1. Age

2. Time Horizon

3. Financial Goals

4. Commitments & Dependents

5. Risk profile - Conservative, Income, Balanced, Growth & Aggressive

1. Age

2. Time Horizon

3. Financial Goals

4. Commitments & Dependents

5. Risk profile - Conservative, Income, Balanced, Growth & Aggressive

20/ When is your Asset Allocation is effective?

1. Improve Risk Reward Equation

2. Works best with assets having Weak Performance Co-relation

*End*

Please RT to reach-out individuals who are in the process of wealth creation.

🤝

1. Improve Risk Reward Equation

2. Works best with assets having Weak Performance Co-relation

*End*

Please RT to reach-out individuals who are in the process of wealth creation.

🤝

Loading suggestions...