Liverpool’s 2019/20 financial results covered a season when they won the Premier League, UEFA Super Cup and FIFA Club World Cup, but were eliminated in the last 16 of the Champions League. Finances adversely impacted by the pandemic. Some thoughts in the following thread #LFC

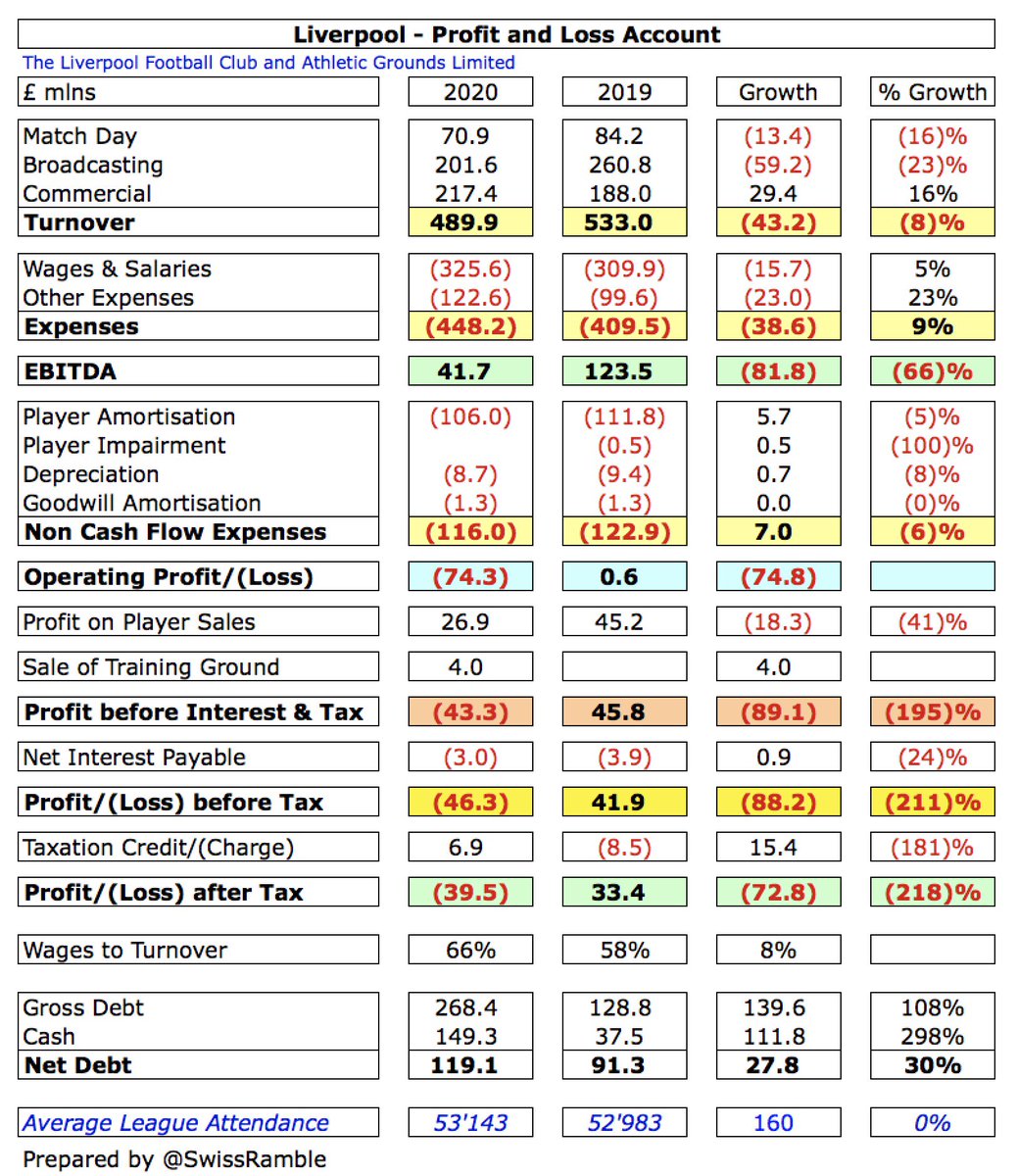

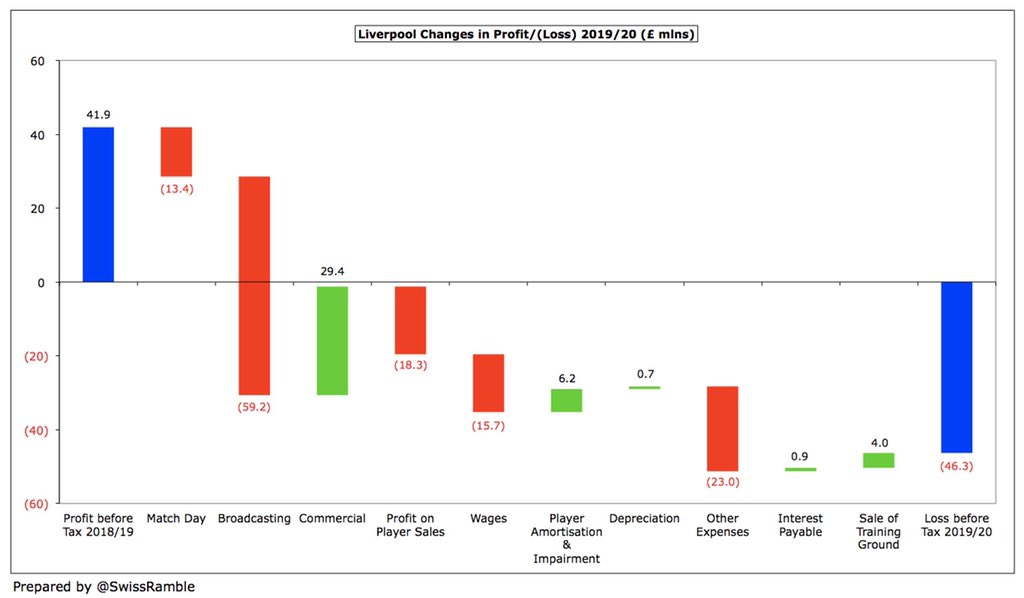

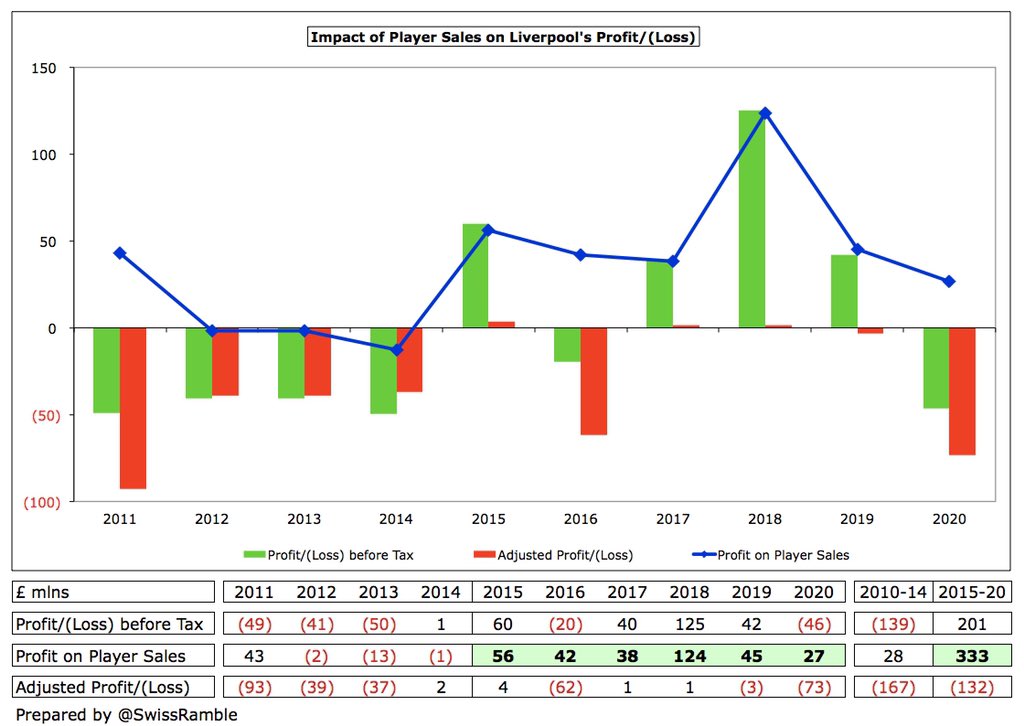

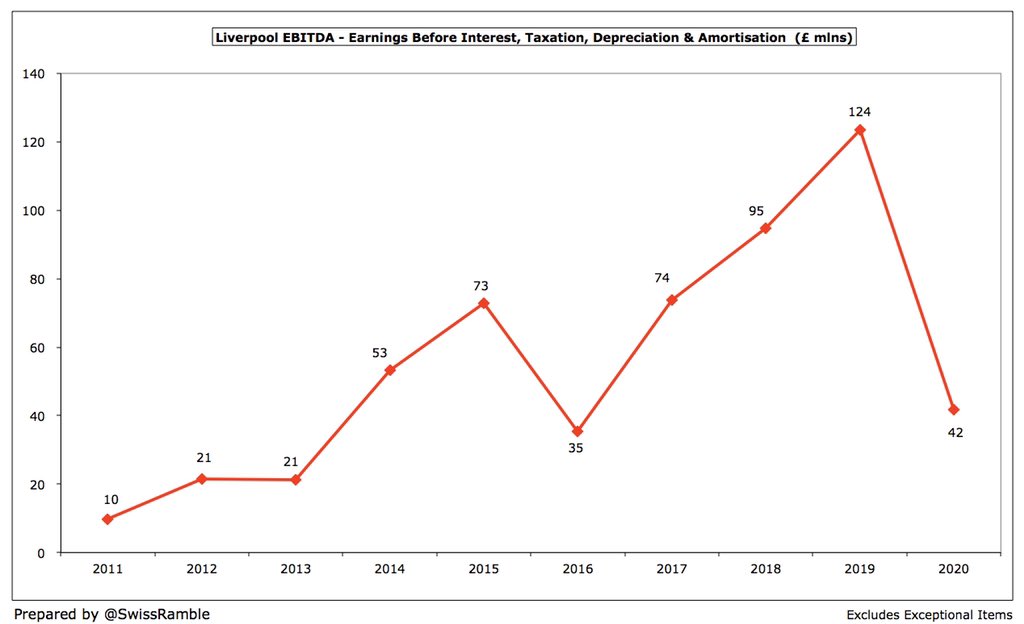

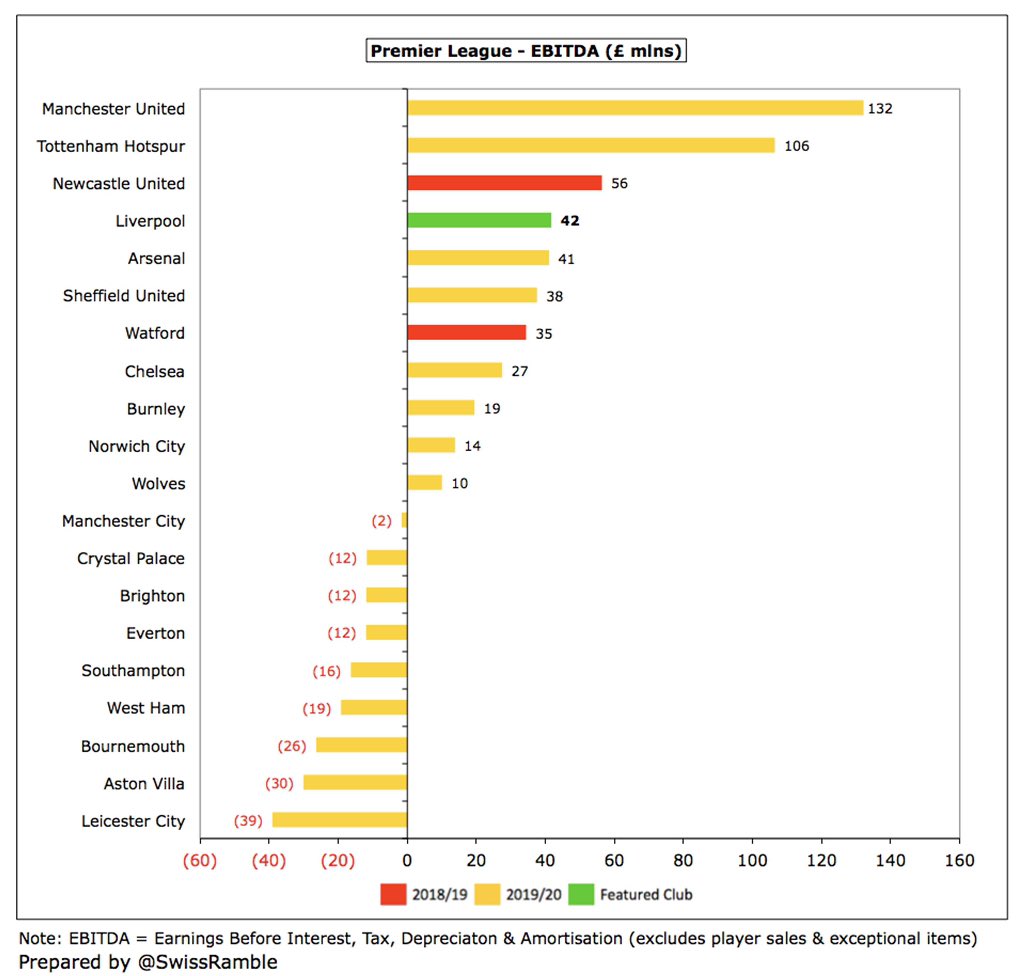

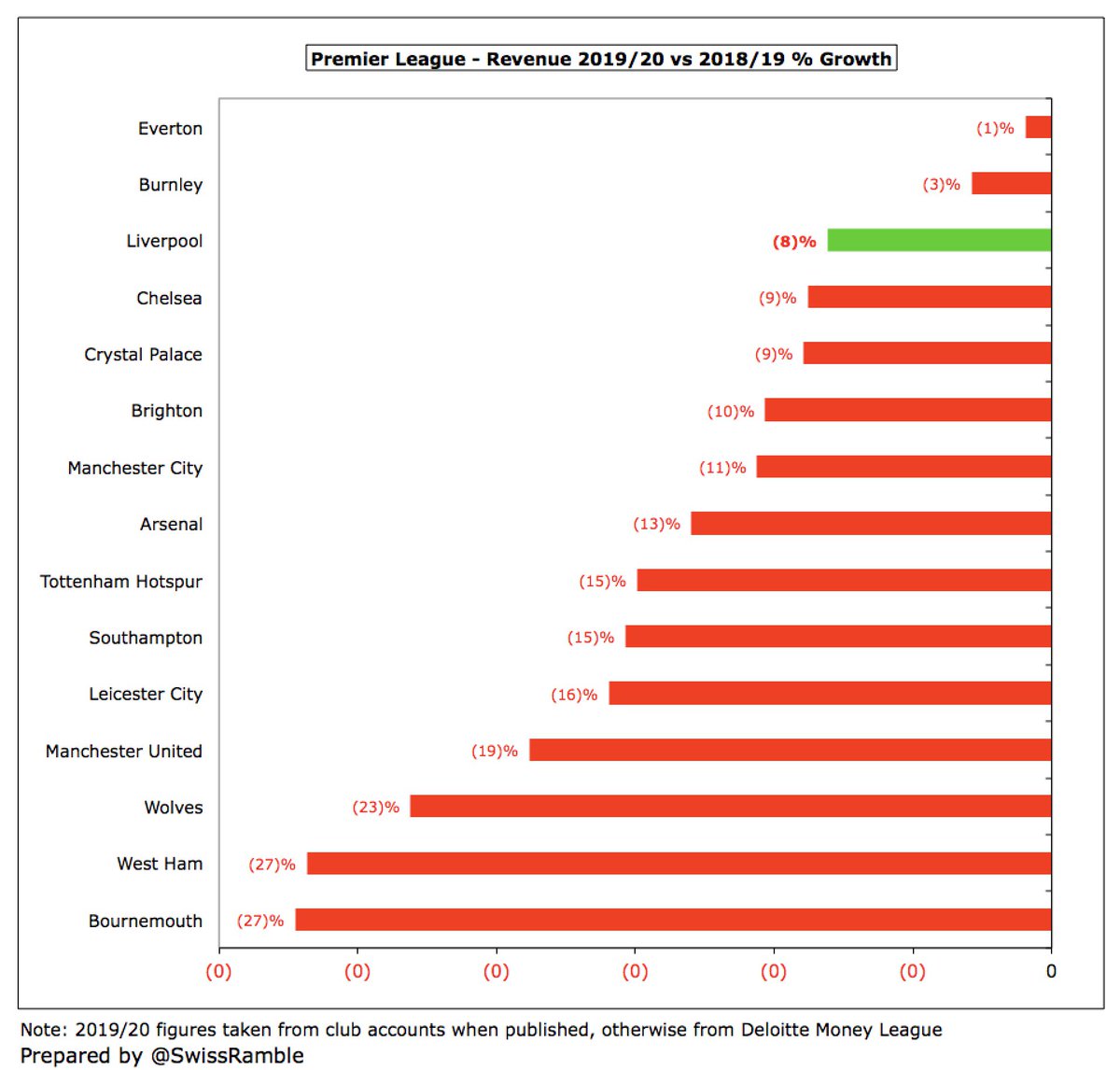

#LFC swung from £42m profit before tax to £46m loss, as impact of COVID-19 resulted in revenue falling £43m (8%) from £533m to £490m, while expenses increased £31m (6%). Profit on player sales fell £18m to £27m, but £4m gain from sale of Melwood. Loss after tax was £39m.

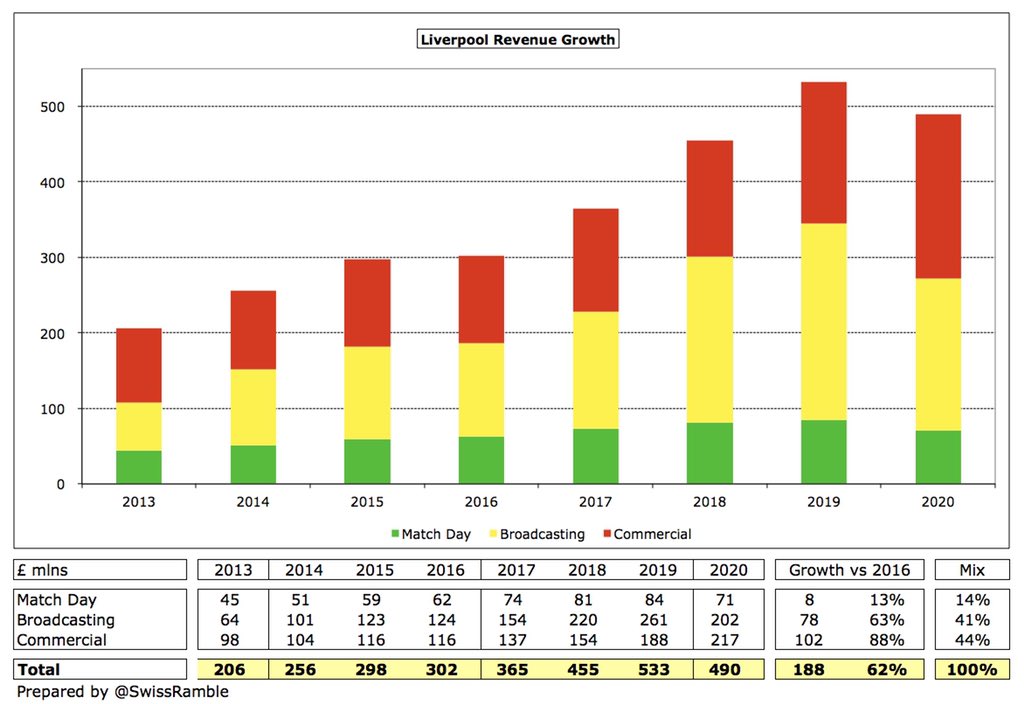

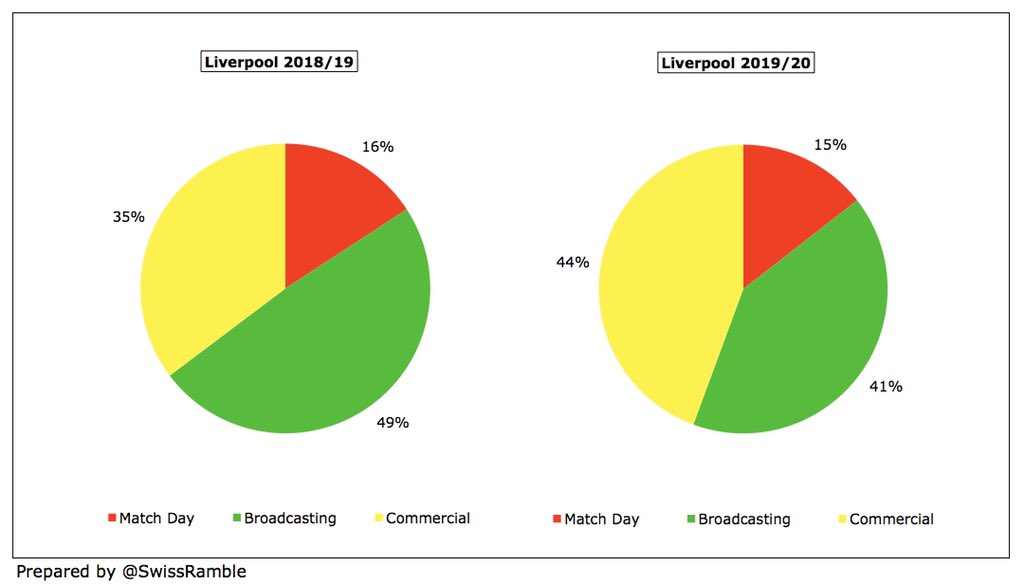

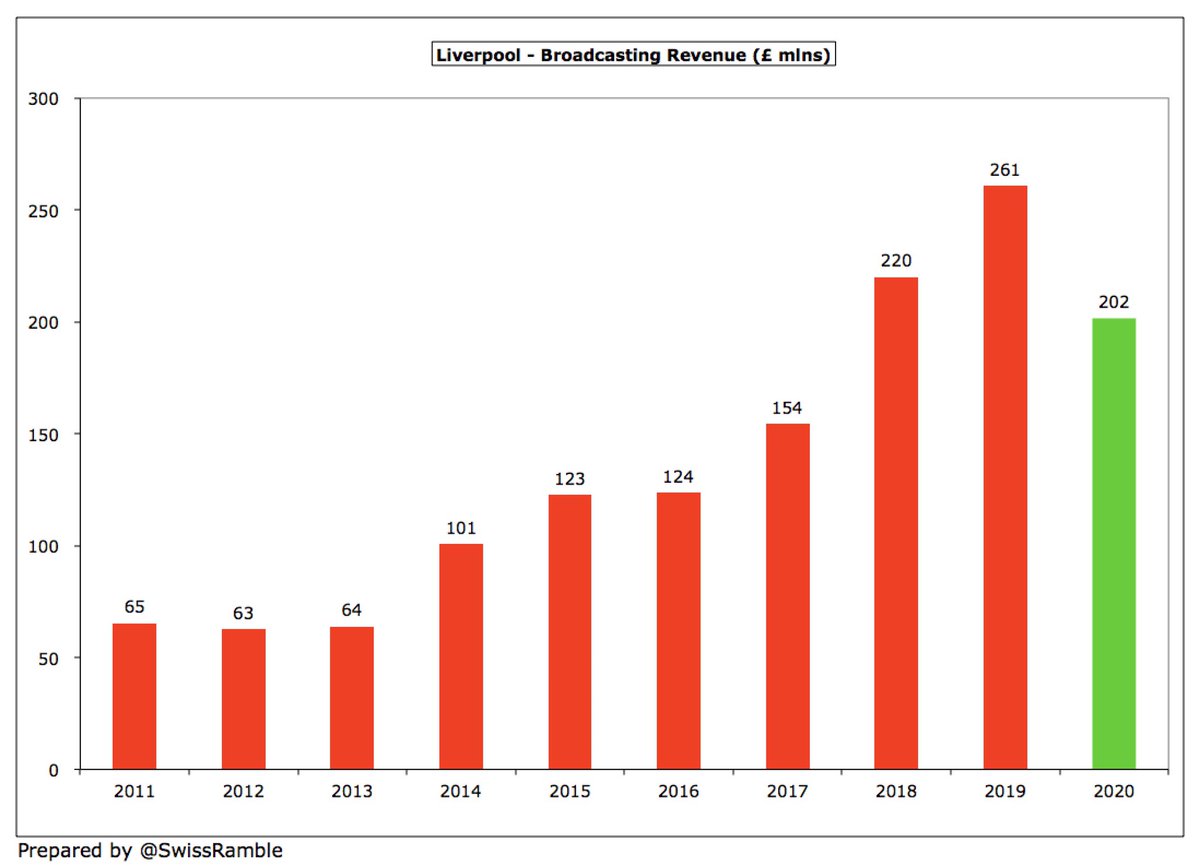

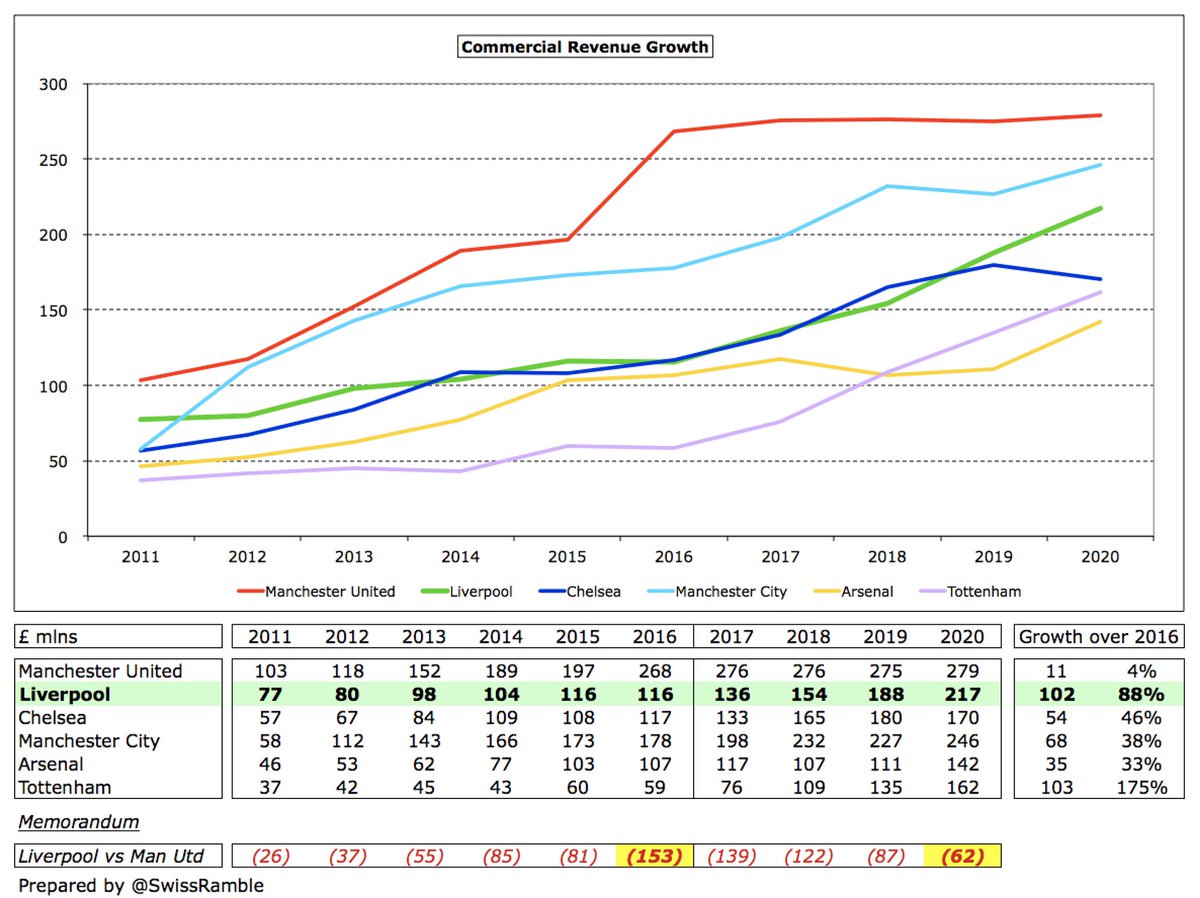

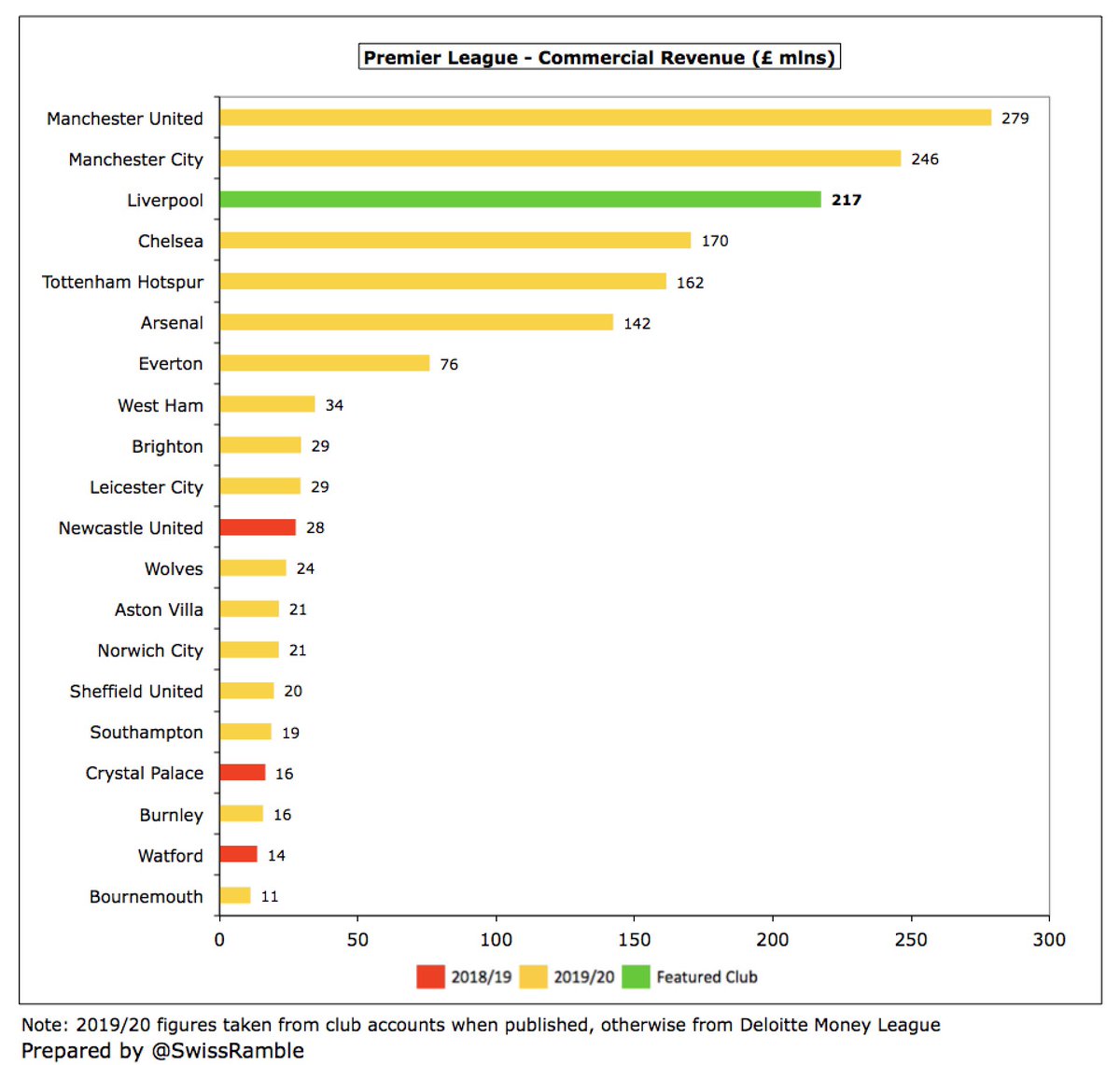

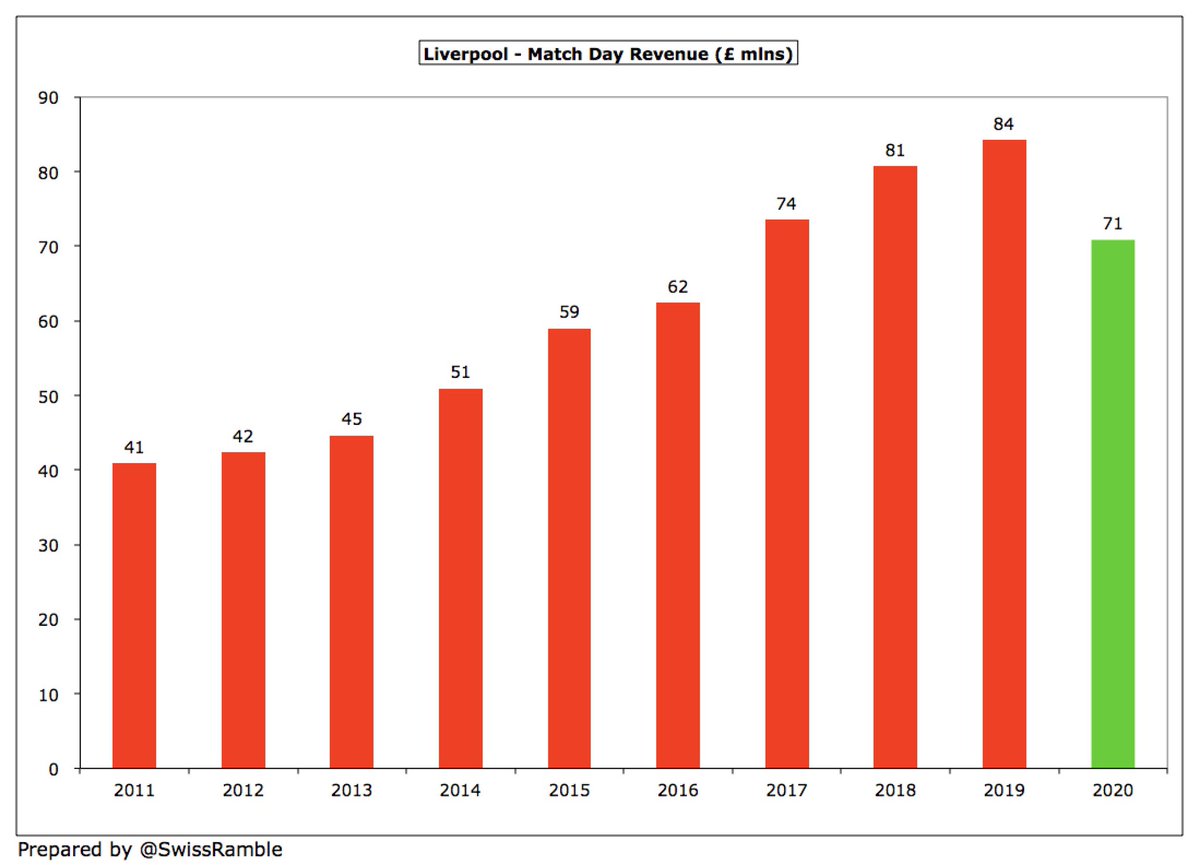

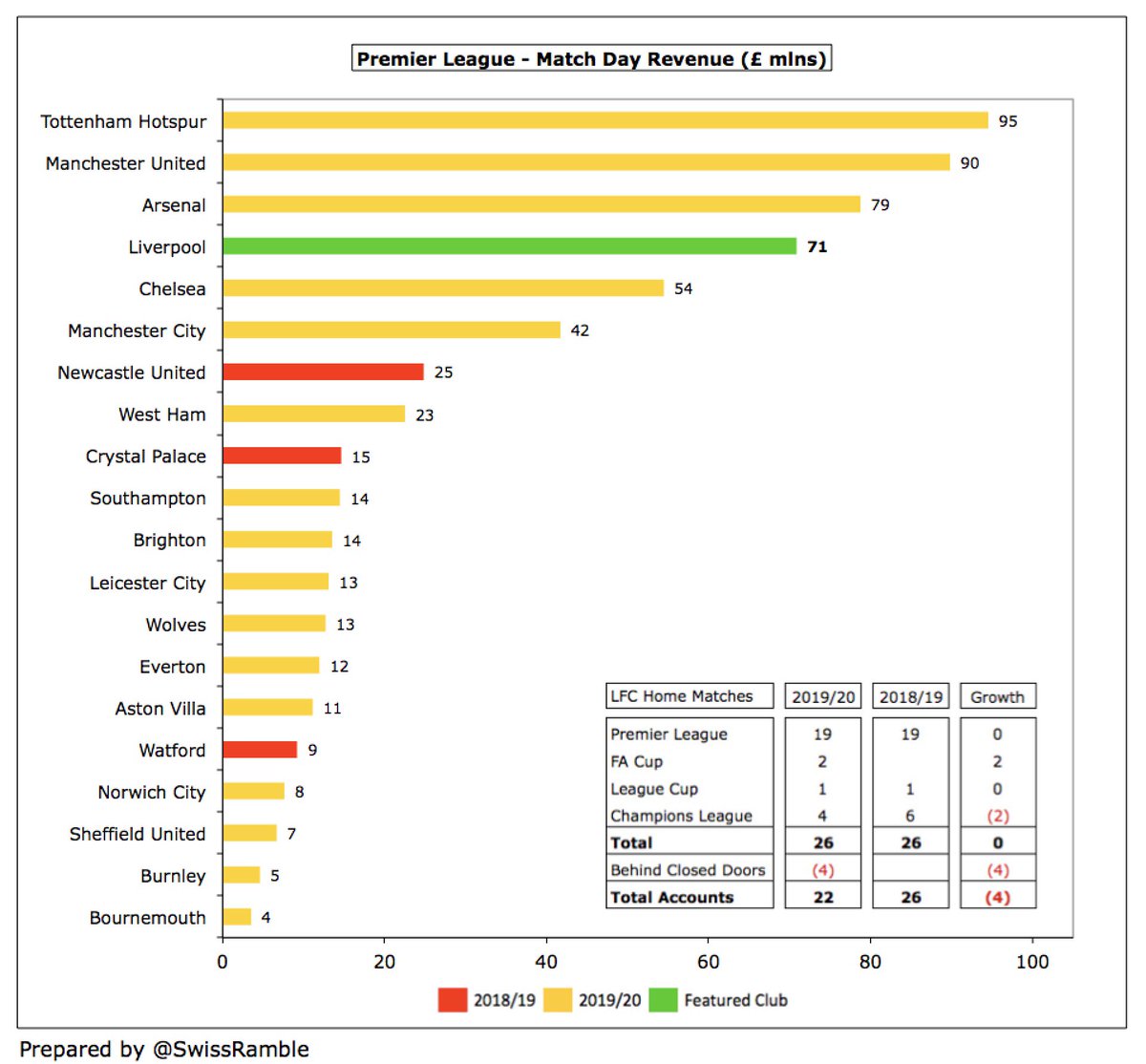

The main driver of the #LFC revenue reduction was broadcasting, which fell £59m (23%) from £261m to £202m, while match day dropped £13m (16%) from £84m to £71m. This was partially offset by commercial rising £29m (16%) from £188m to £217m.

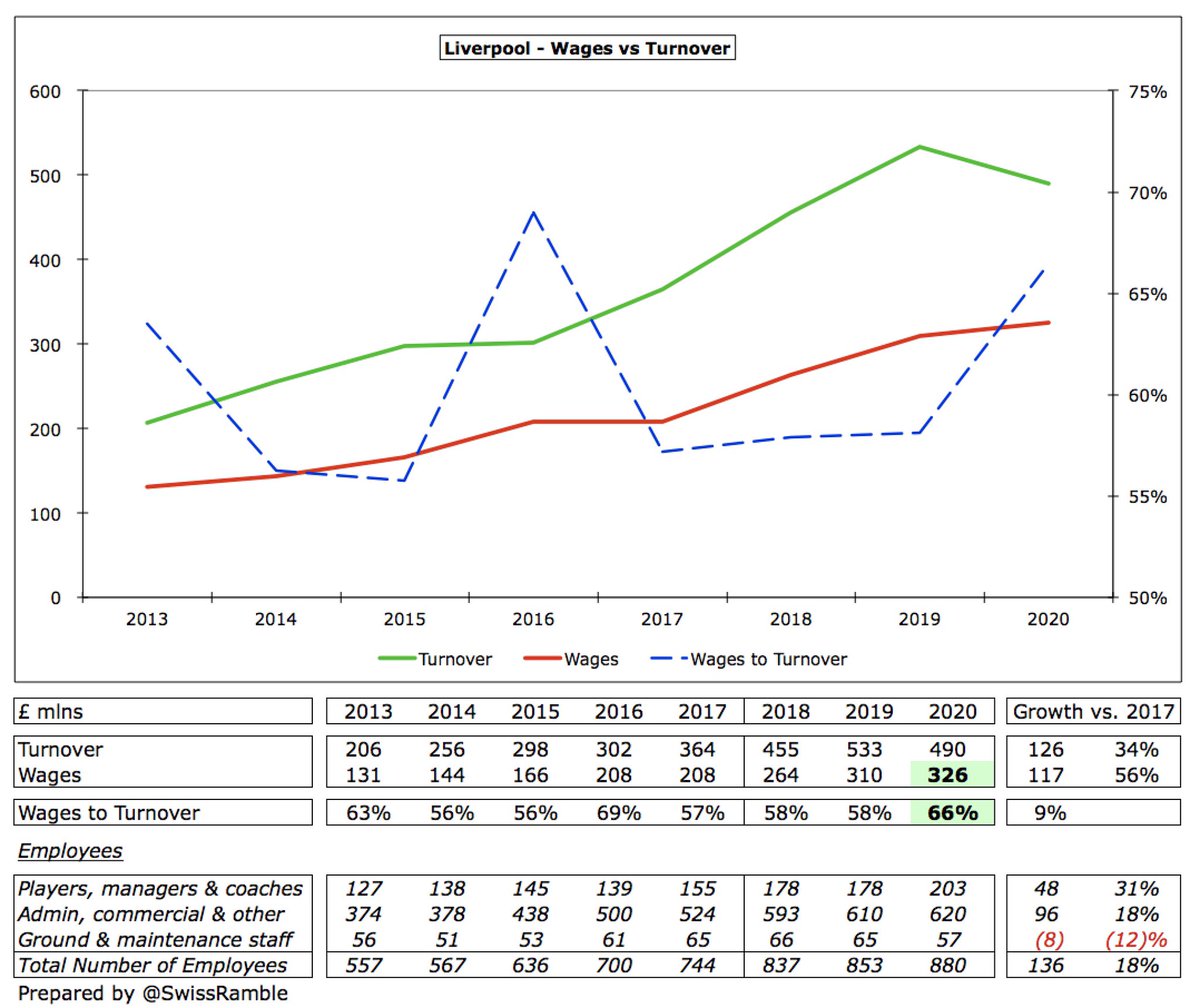

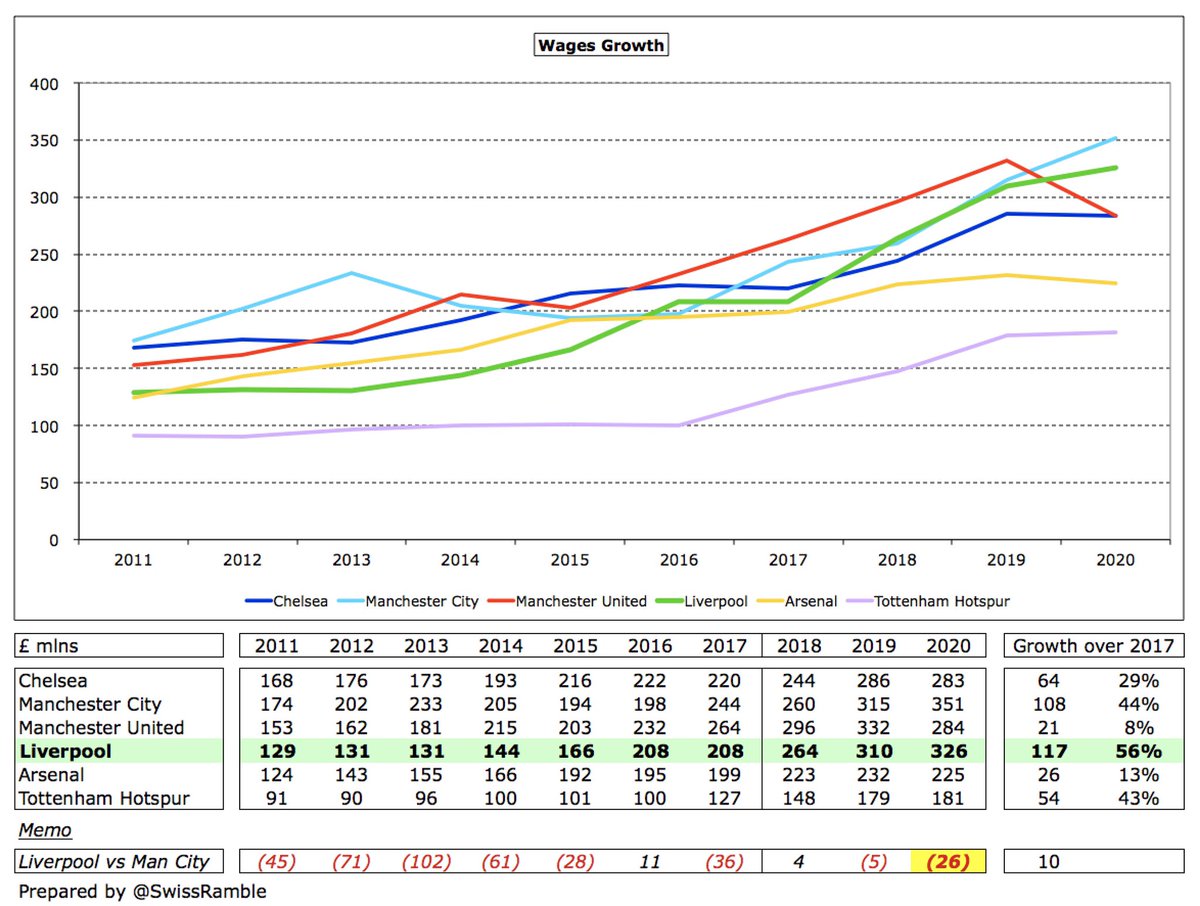

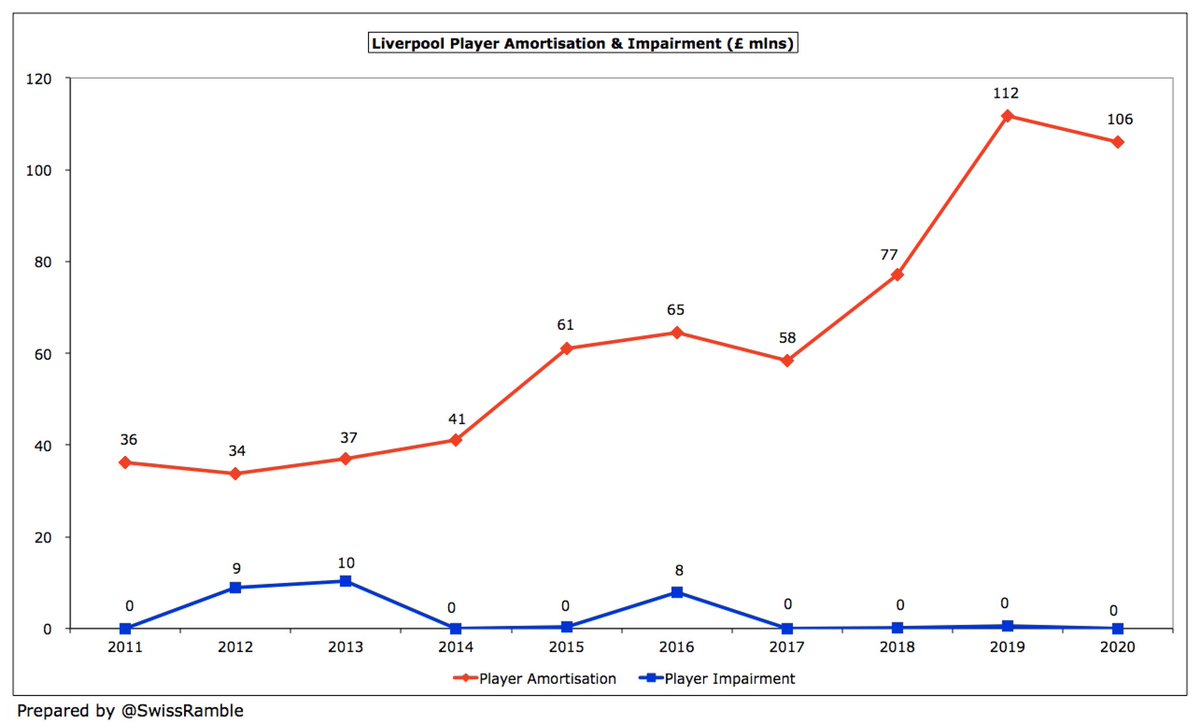

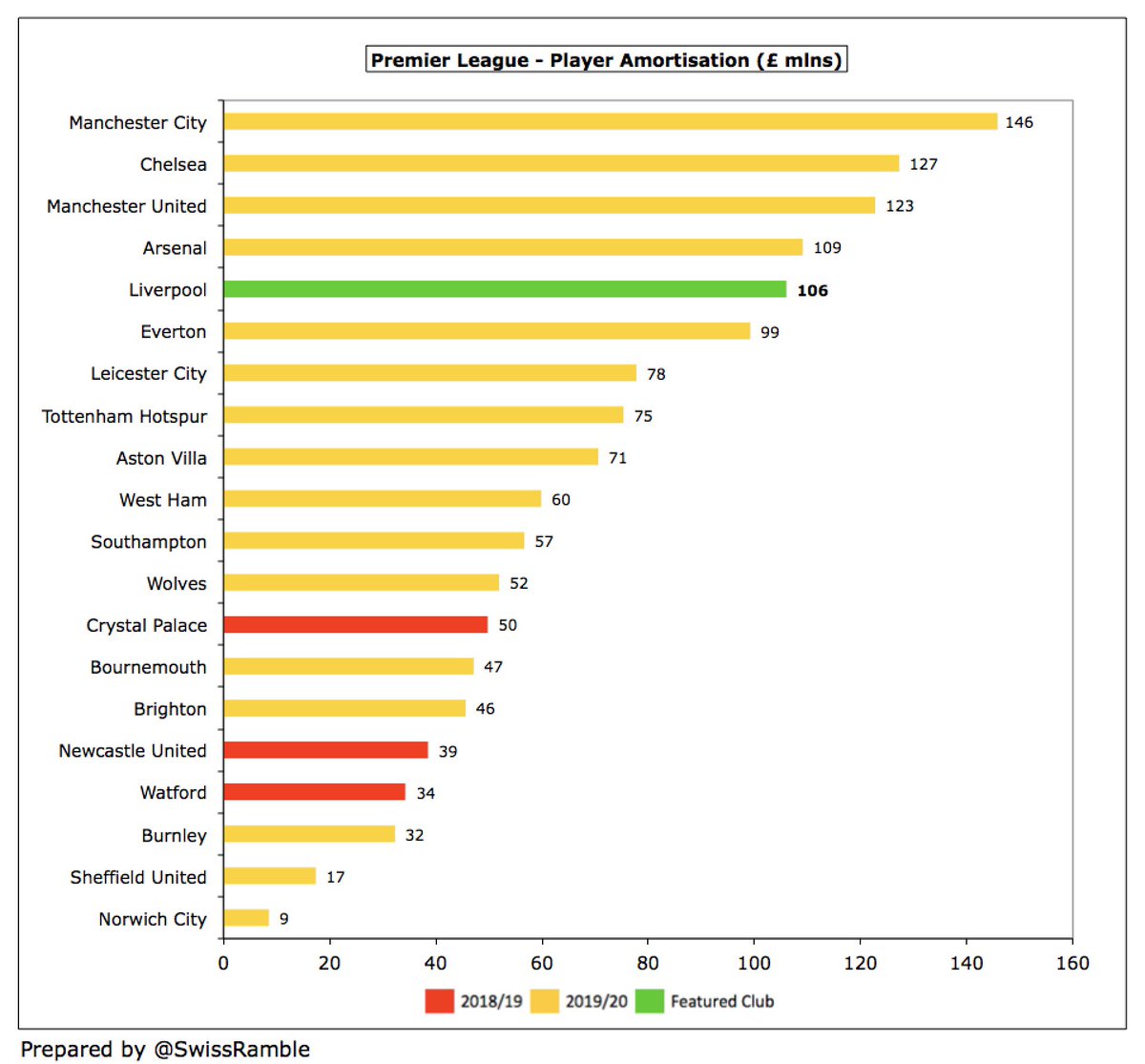

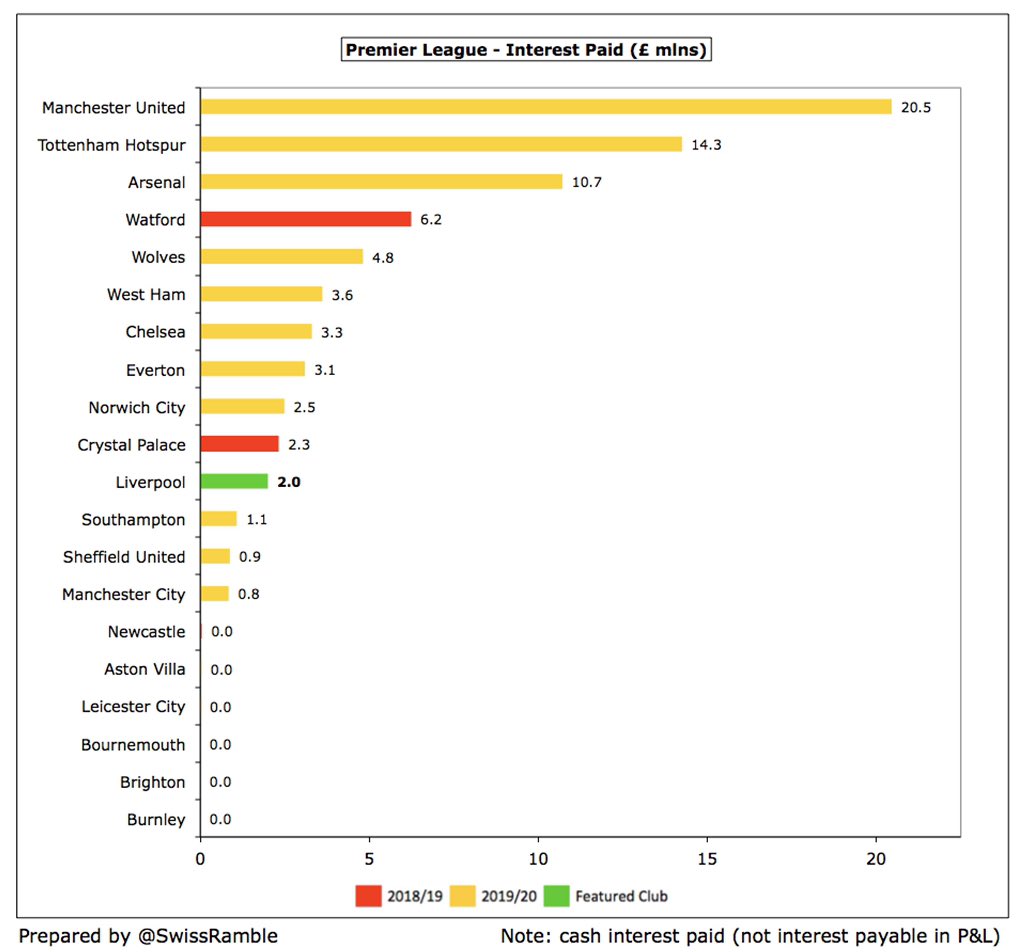

Despite #LFC revenue decline, there was sizeable cost growth with wages rising £16m (5%) from £310m to £326m and other expenses increasing £23m (23%) from £100m to £123m. However, player amortisation fell £6m (5%) to £106m and net interest payable was down £1m to £3m.

Clearly, #LFC figures have been significantly hit by the pandemic, which has resulted in money lost from a rebate to broadcasters and games played behind closed doors, while revenue for games played after 31st May accounting close has been deferred to 2020/21 accounts.

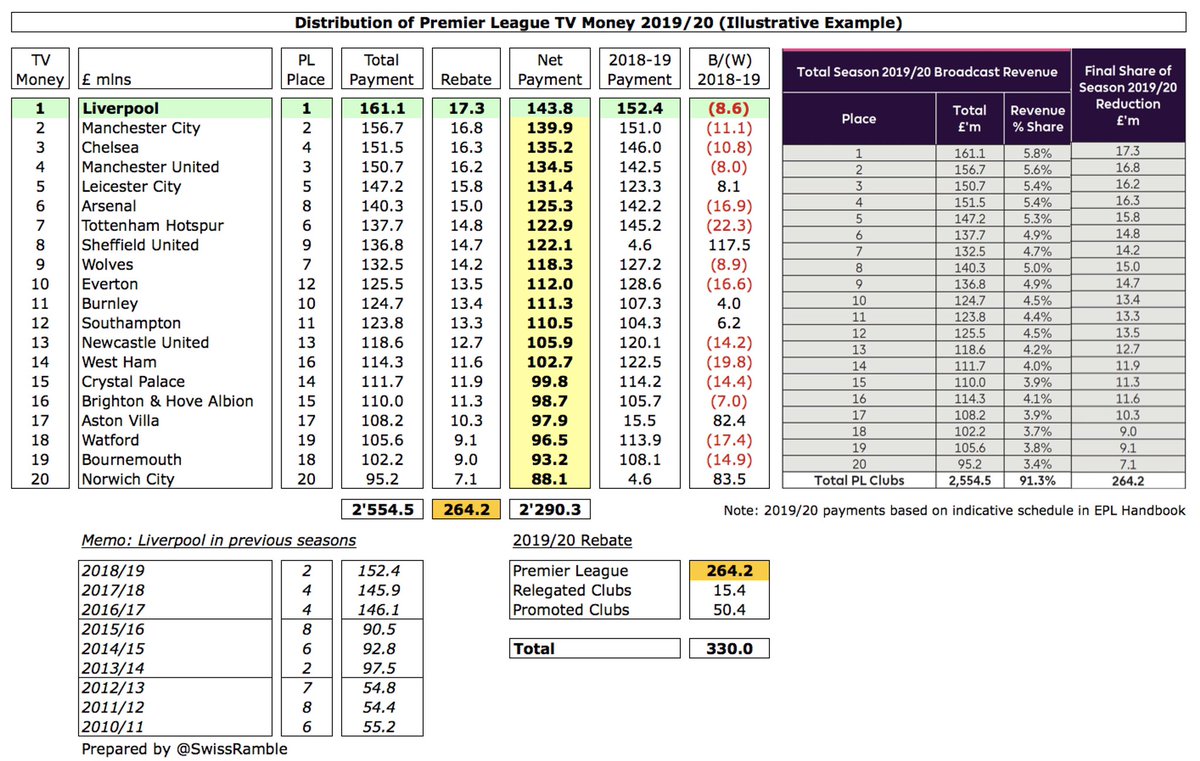

My rough estimate is that COVID resulted in £60m reduction to #LFC revenue, split between £25m lost (match day £11m, TV rebates £14m) and £35m broadcasting deferred to 2020/21. Without this, revenue would have been a club record £550m and the club would have made £10m profit.

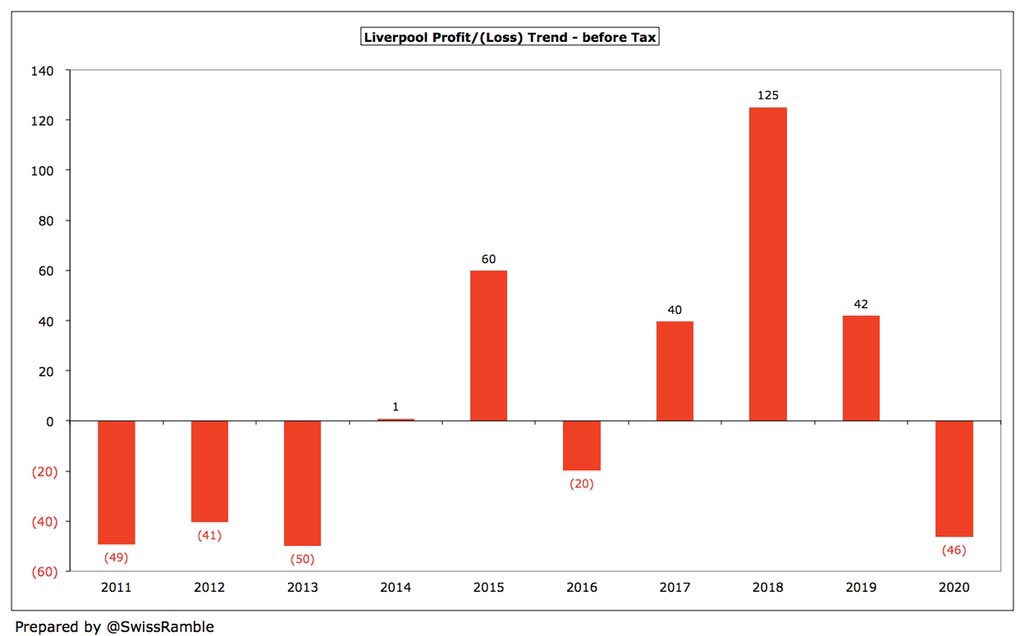

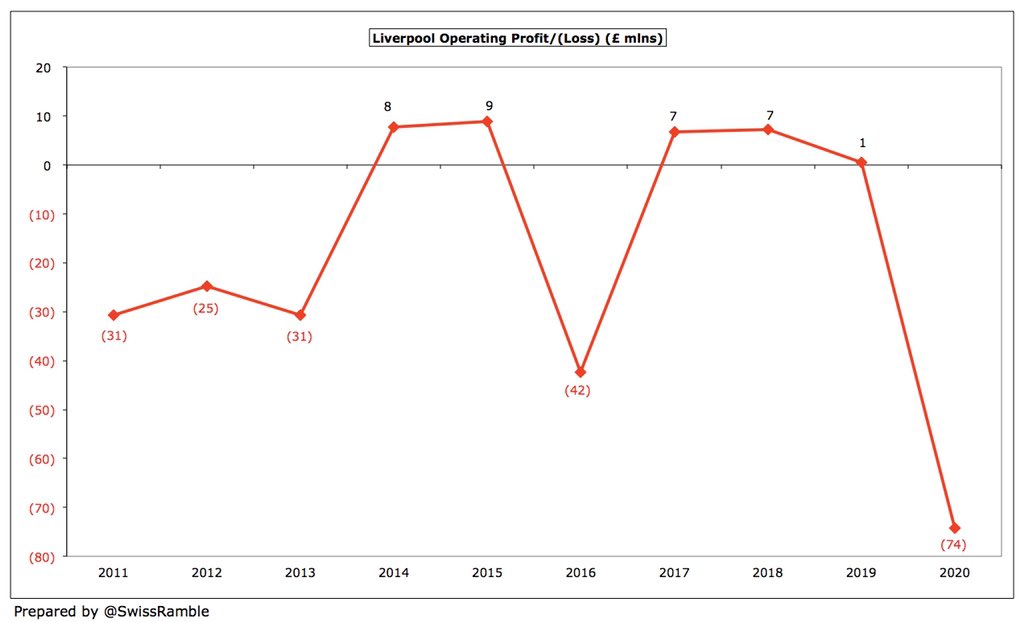

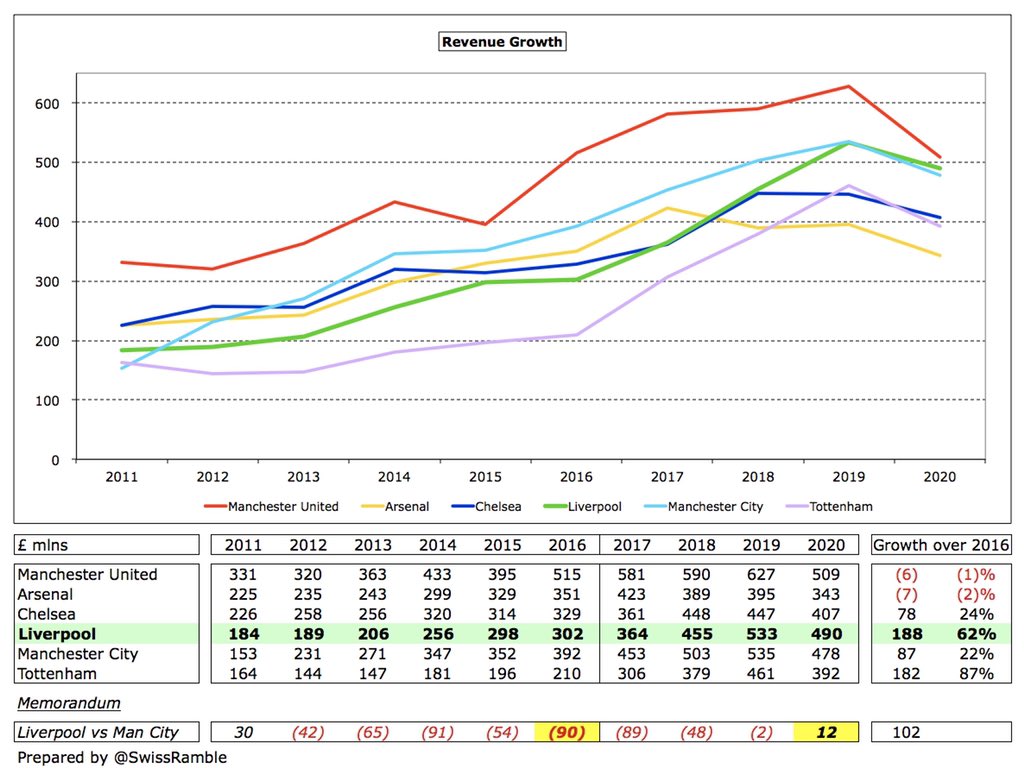

This is the first time #LFC have posted a loss since 2016. In fact, even with the chunky loss in 2020, their profits in last 6 years add up to around £200m. The preceding 4 years (2011-14) saw total losses of £139m, so the improvement in the club’s financial position is evident.

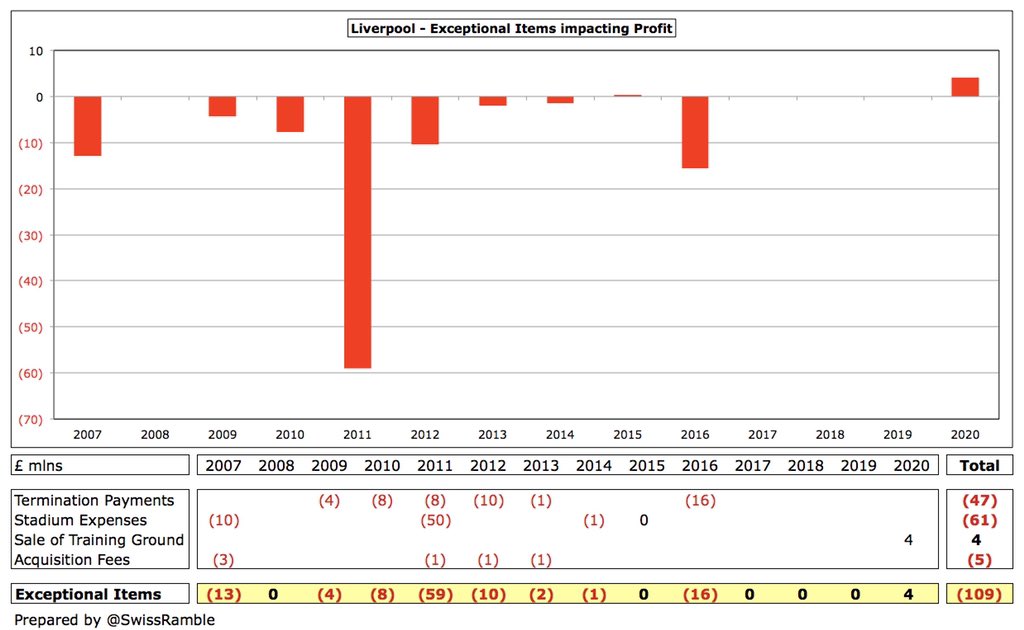

#LFC have also benefited from the absence of exceptional charges, which had increased costs by £113m in the decade up to 2016, mainly stadium development £61m and sacked managers £47m. Instead, 2020 included £4m profit from sale of Melwood training ground (proceeds £9.7m)

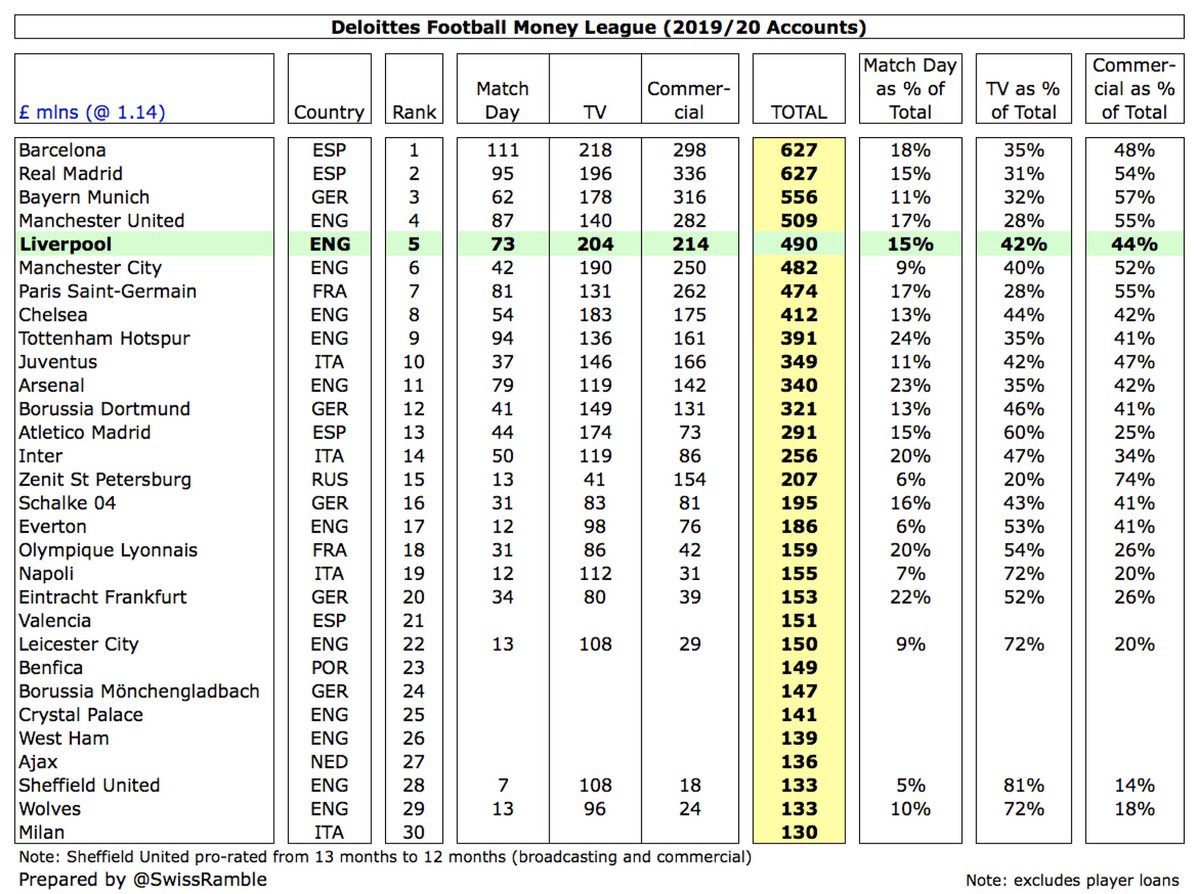

Despite the decrease in 2019/20, #LFC revenue has still grown by £188m (62%) in the last four years, largely due to commercial £102m and broadcasting £78m. Thanks to the TV rebate and revenue deferral, commercial is now the largest revenue stream with 44%.

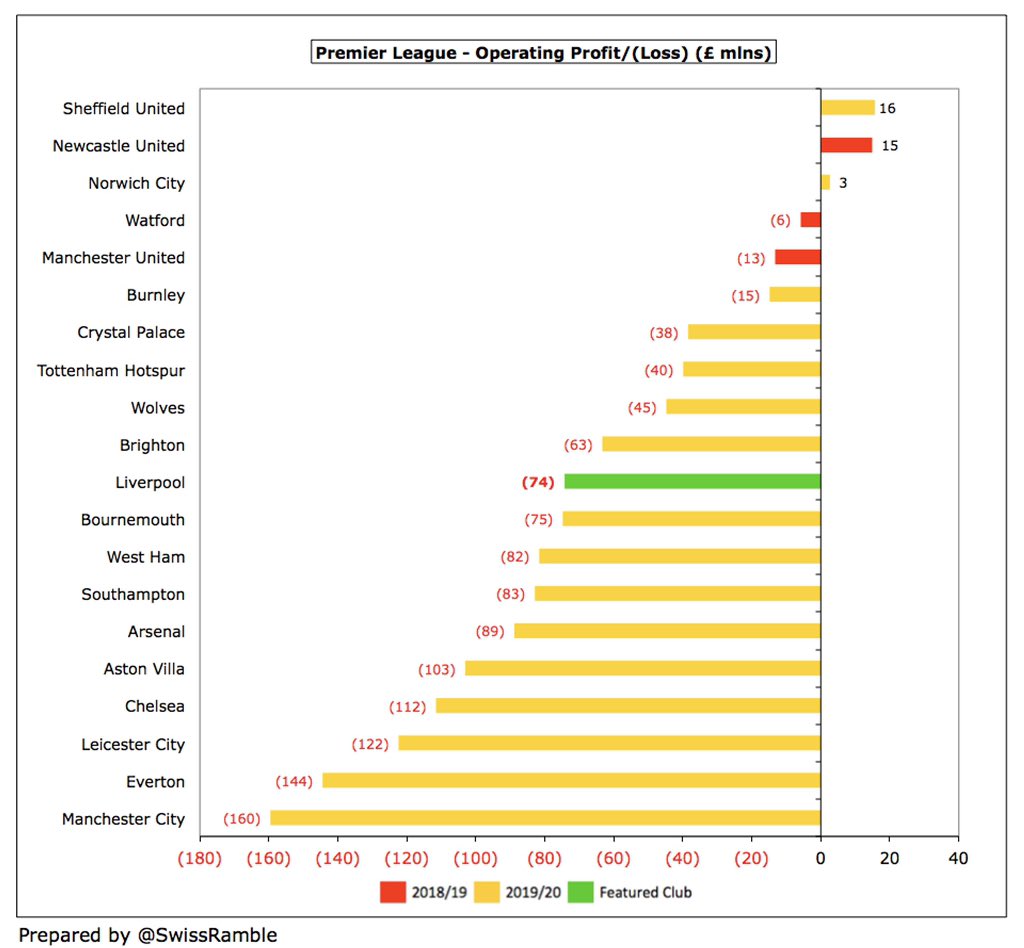

It is also worth noting that #LFC have been more impacted by COVID-19 than many others, as their accounts close relatively early on 31st May, so more revenue has been deferred to the 2020/21 accounts than clubs whose accounts close on 30th June or 31st July.

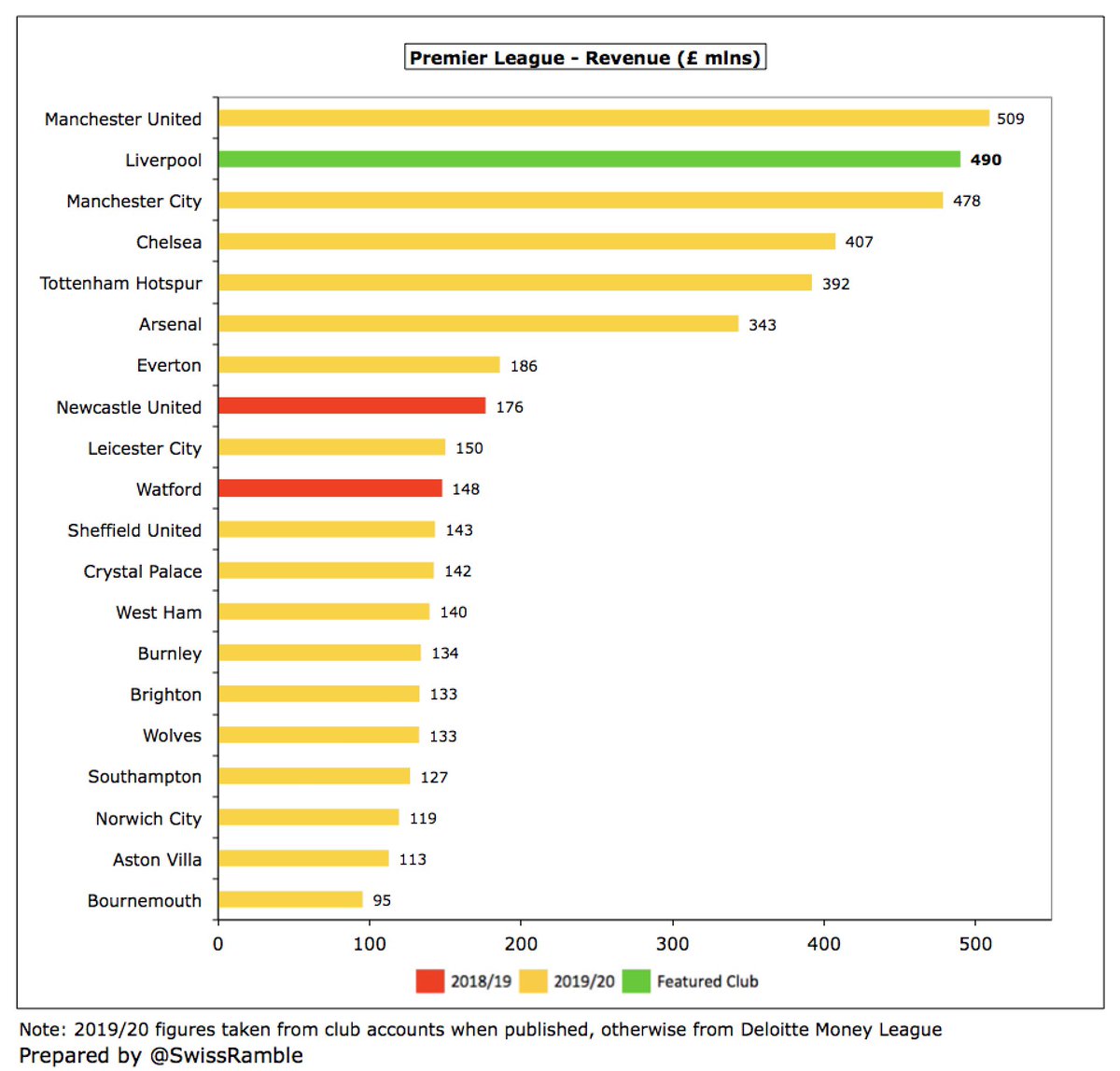

#LFC climbed 2 places to 5th in the Deloitte Money League, which ranks clubs globally by revenue. This is the first time they have been in the top five since 2002 and means they have improved 4 places in 3 years. However, still miles behind Barcelona and Real Madrid, both £627m.

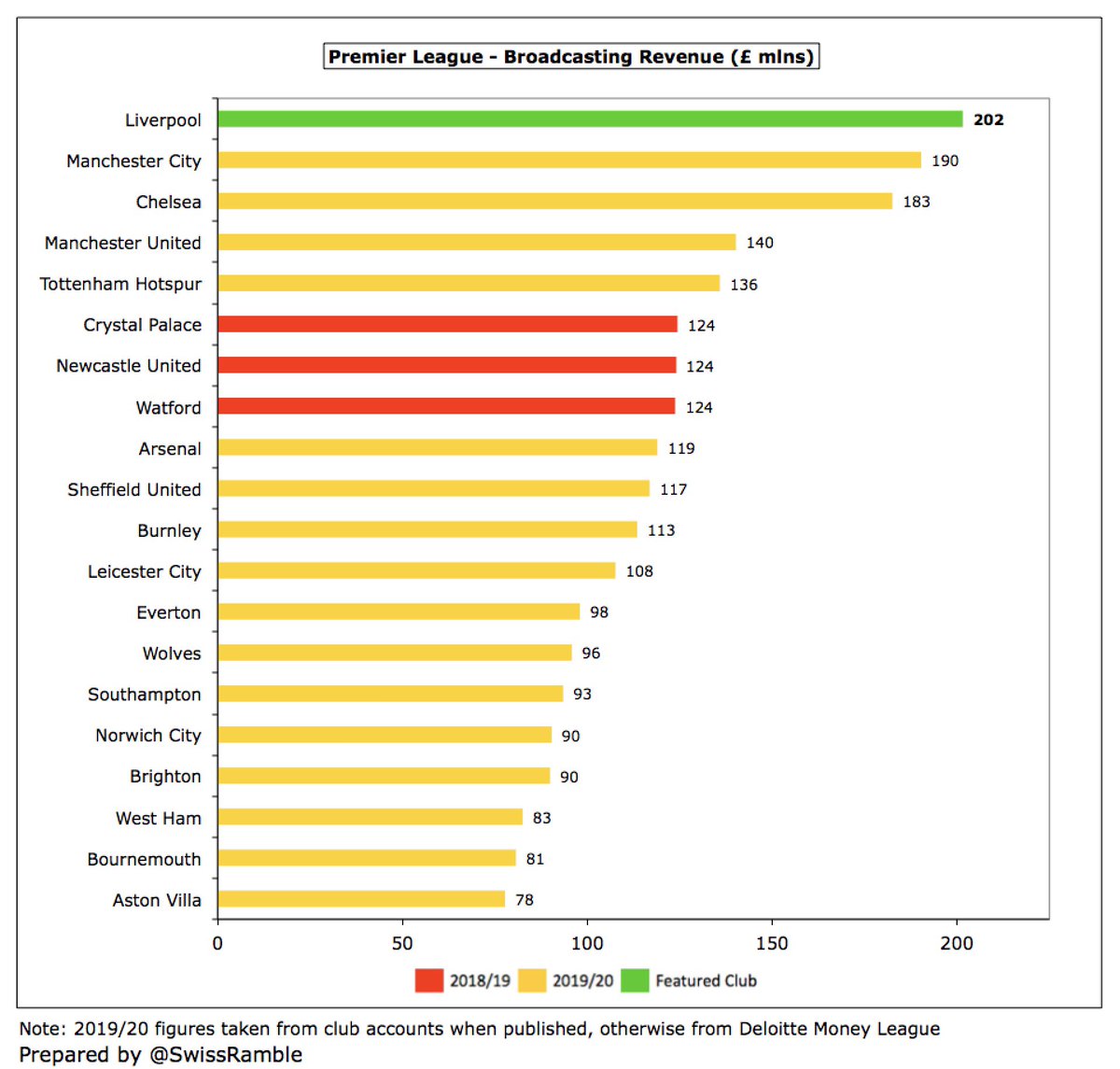

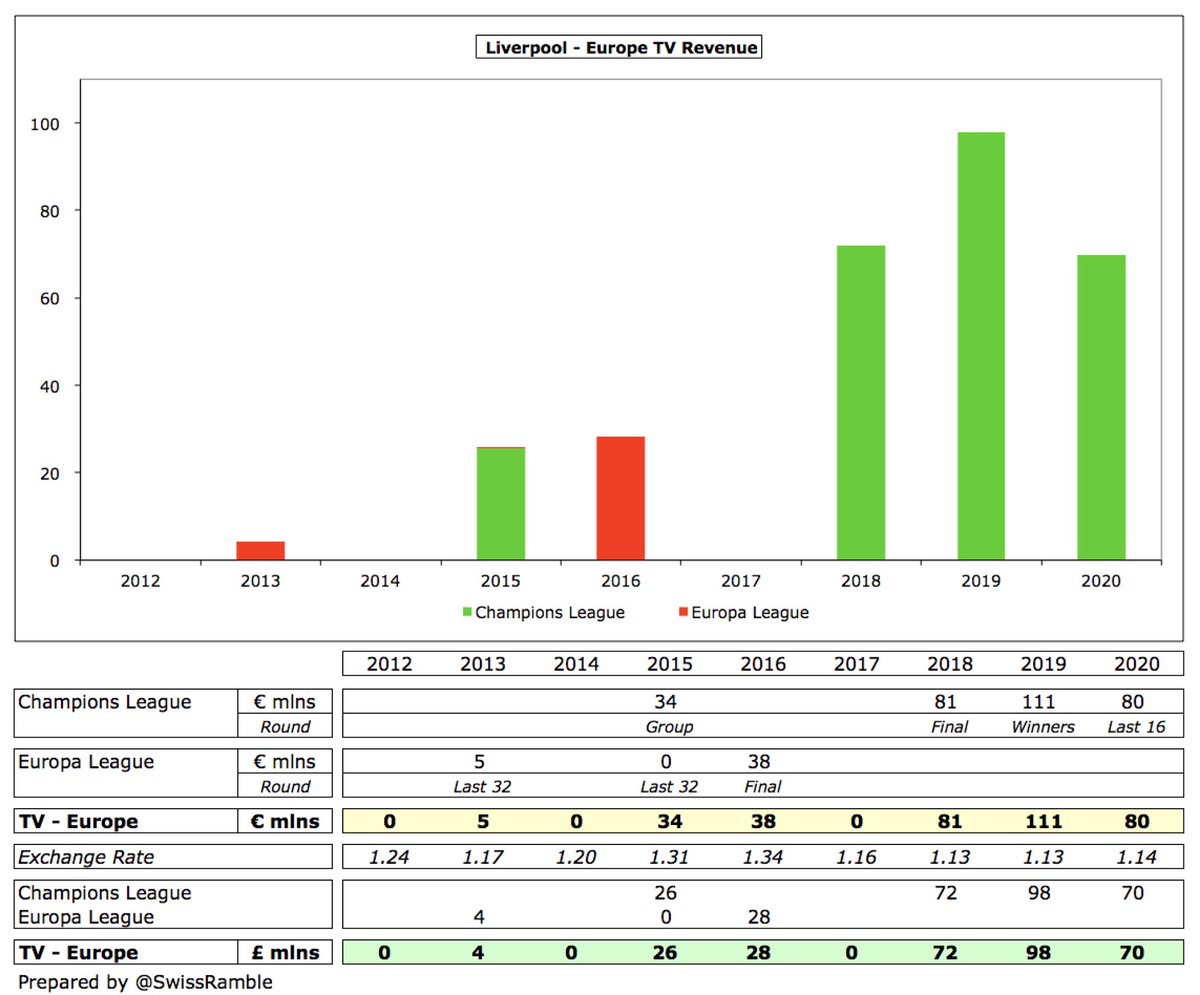

#LFC broadcasting income fell £59m (23%) from £261m to £202m. Premier League significantly impacted by revenue from 9 games slipping to 2020/21 accounts and rebate to broadcasters. However, still highest in England and second highest worldwide, only surpassed by Barcelona £218m.

As the 2019/20 season was extended beyond the 30th June accounting close, #LFC Premier League TV money was less than prior year, offset by better league position, though most of the revenue decrease has been deferred into the 2020/21 accounts, so is only a timing difference.

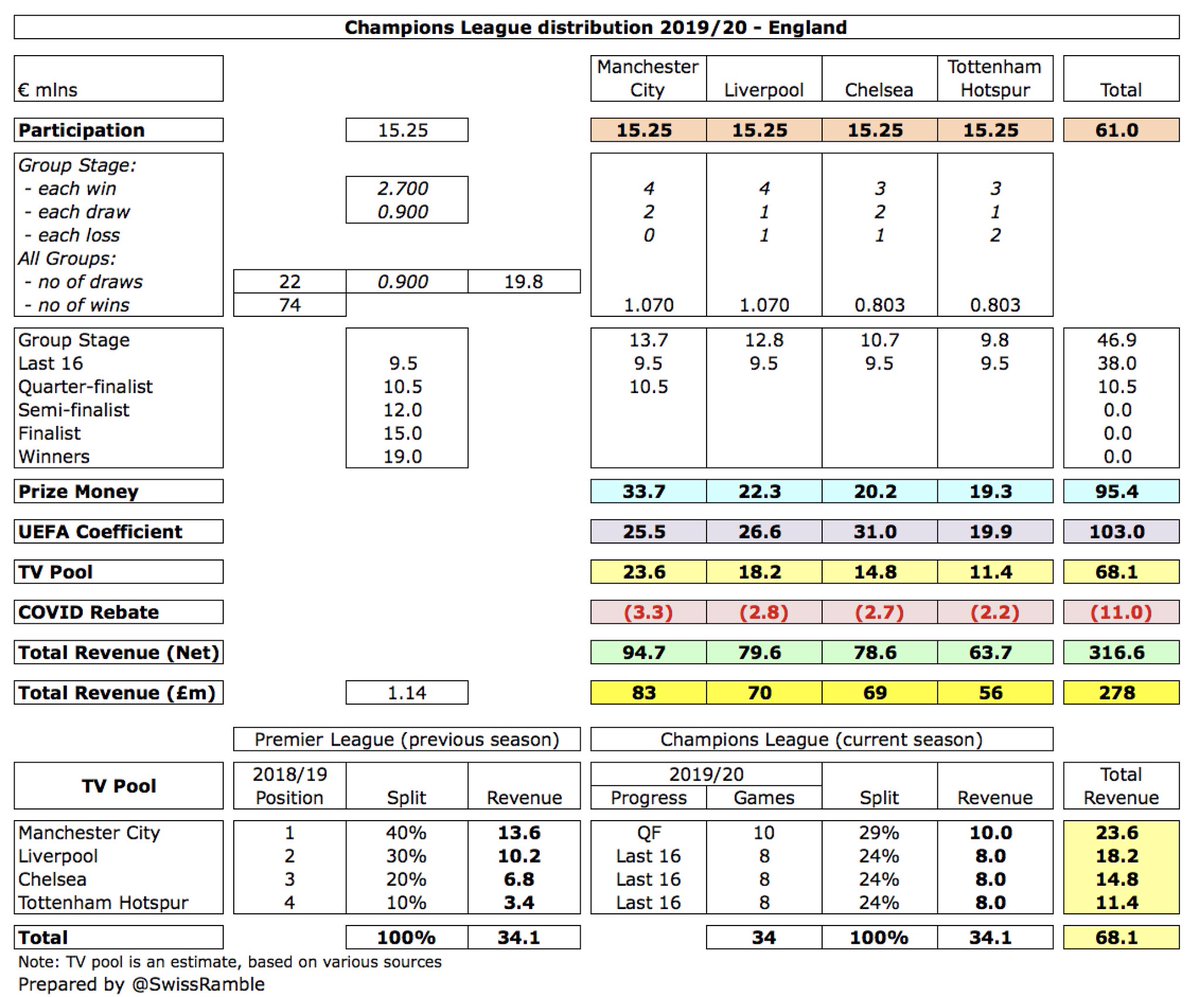

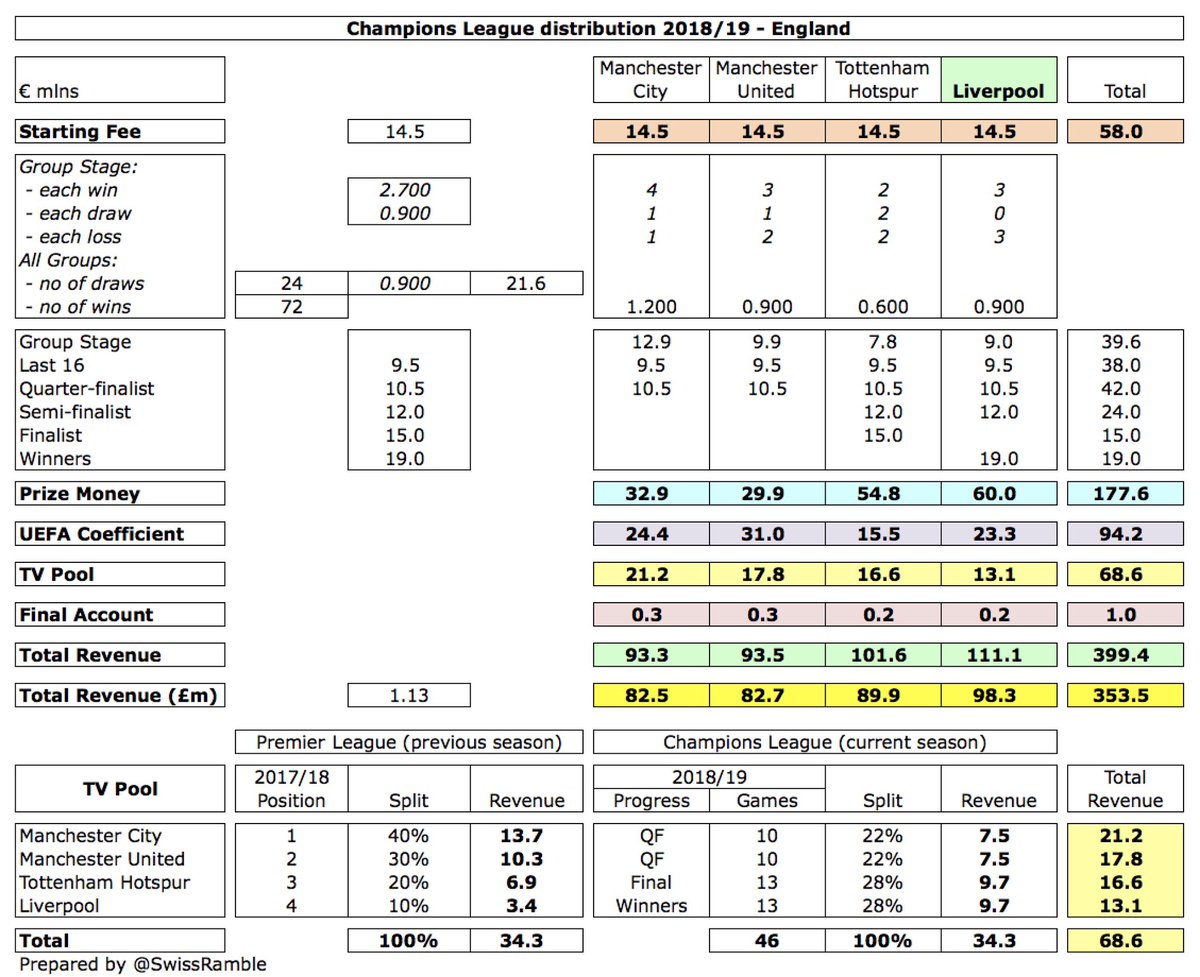

#LFC earned £70m (€80m) after reaching Champions League last 16. This was £28m less than previous season when they won the competition, but still second highest of English clubs. In addition, received £4m for 2018/19 final (played after financial year-end), but £2m COVID rebate.

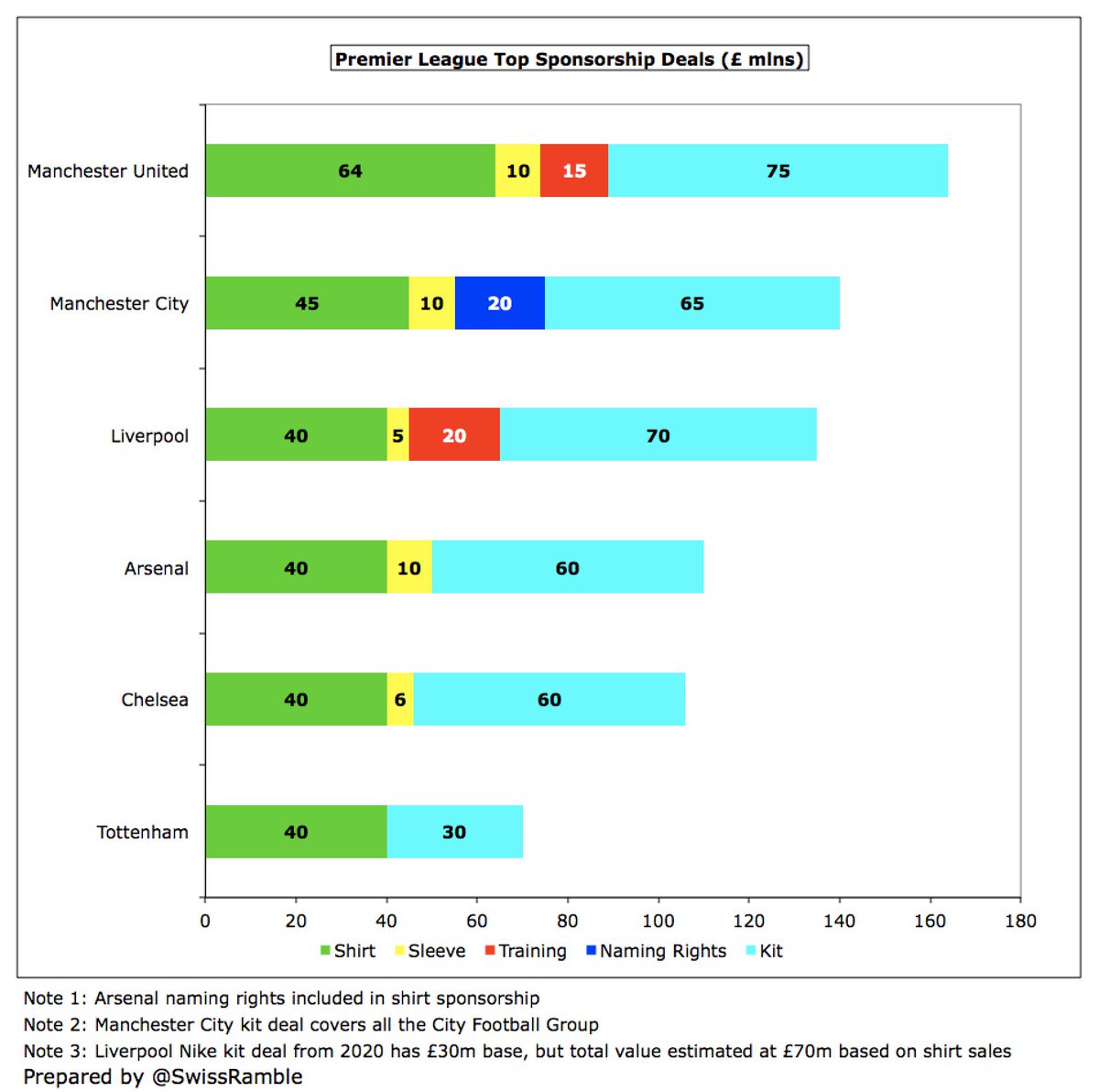

#LFC Standard Chartered shirt sponsorship worth £40m, while New Balance £45m kit supplier deal replaced by Nike 2020/21: lower £30m base, but 20% merchandising royalty (usually 7.5%) takes it to estimated £70m. AXA training kit reportedly £20m expanded to include training centre.

#LFC average attendance of 53,143 (for games played with fans) is 6th highest in the Premier League. Club has announced plans to expand Anfield Road End to increase capacity to 61,000 at an estimated cost of £60m. Ticket prices frozen in 2019/20 for fourth consecutive season.

Despite the revenue fall, #LFC wage bill rose £16m (5%) from £310m to £326m. Highly incentivized bonus scheme for winning the Premier League, Champions League, etc. Wages have increased by £117m (56%) in the last 3 years, the highest growth of the Big Six.

#LFC wages to turnover ratio worsened from 58% to 66%, the club’s highest since 2016, though this was still one of the better results in the Premier League. If we adjust for the estimated COVID revenue loss, it would have been a highly respectable 59%.

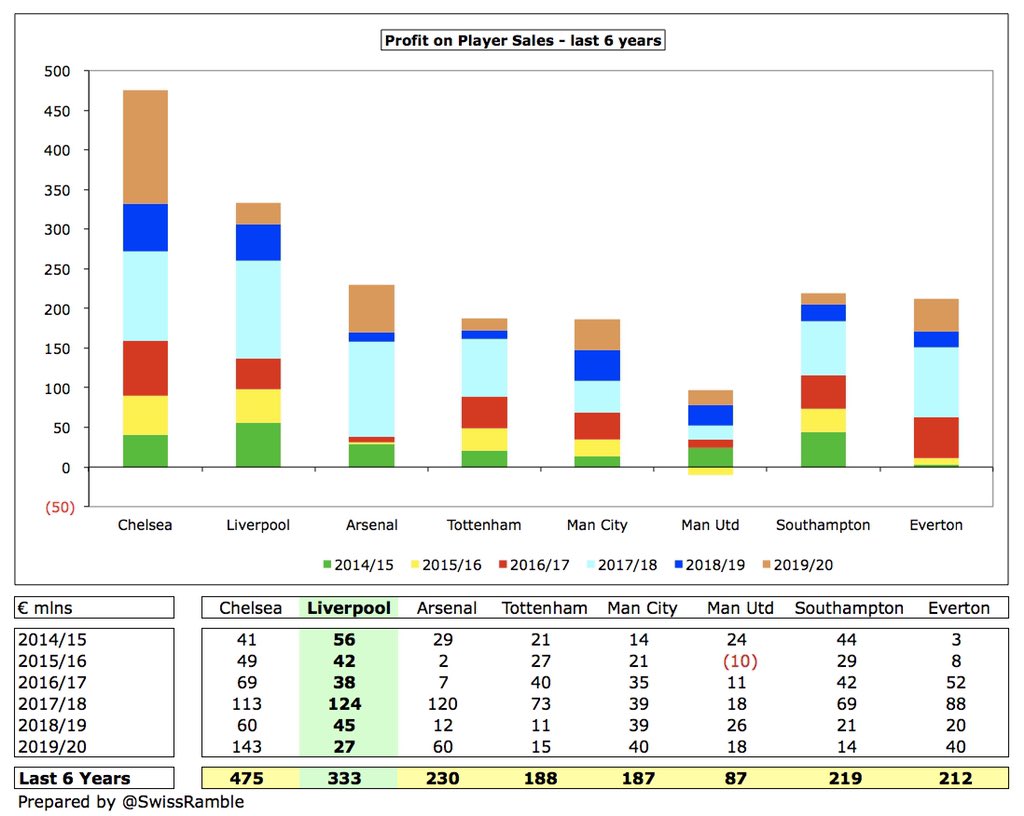

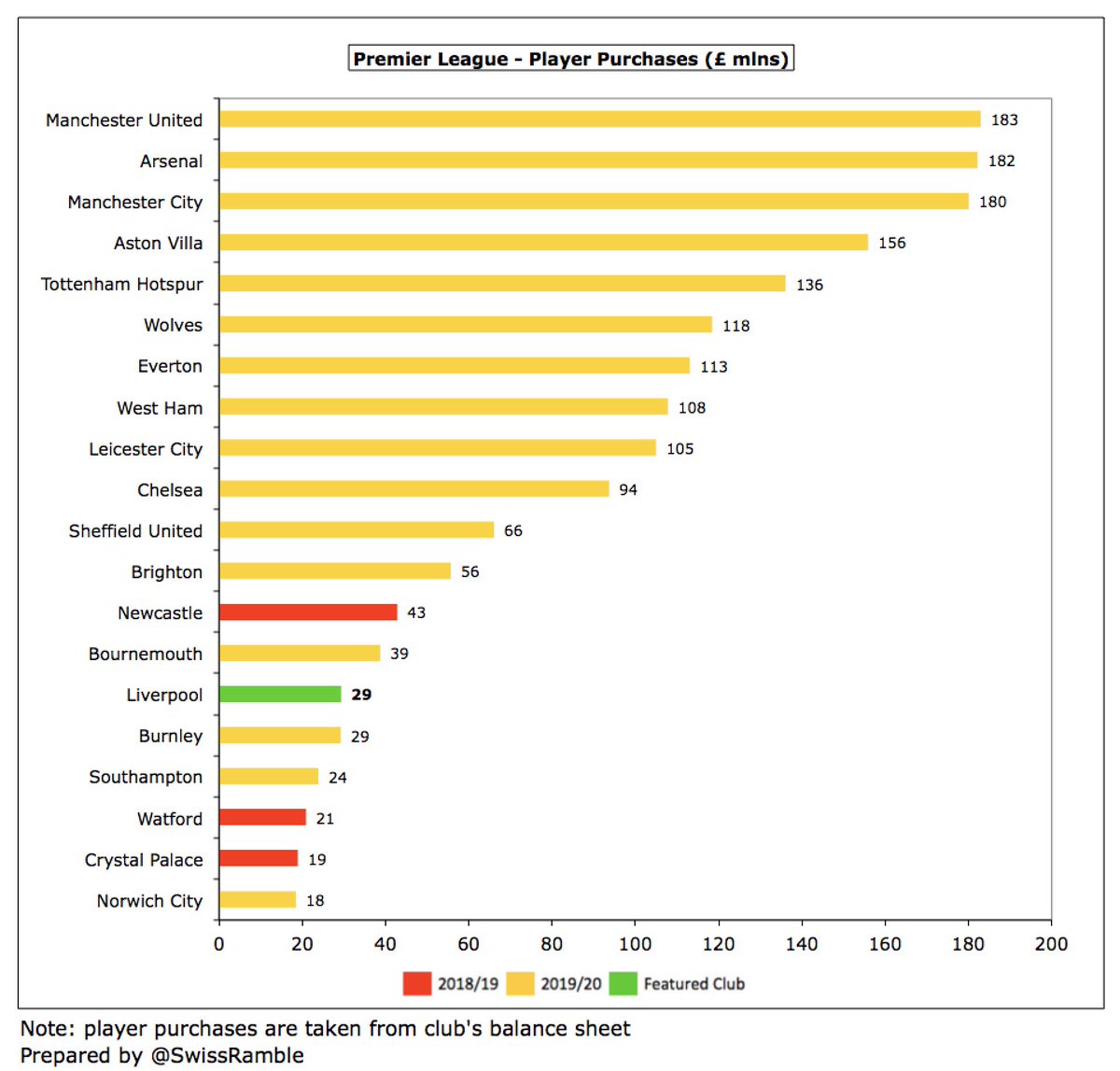

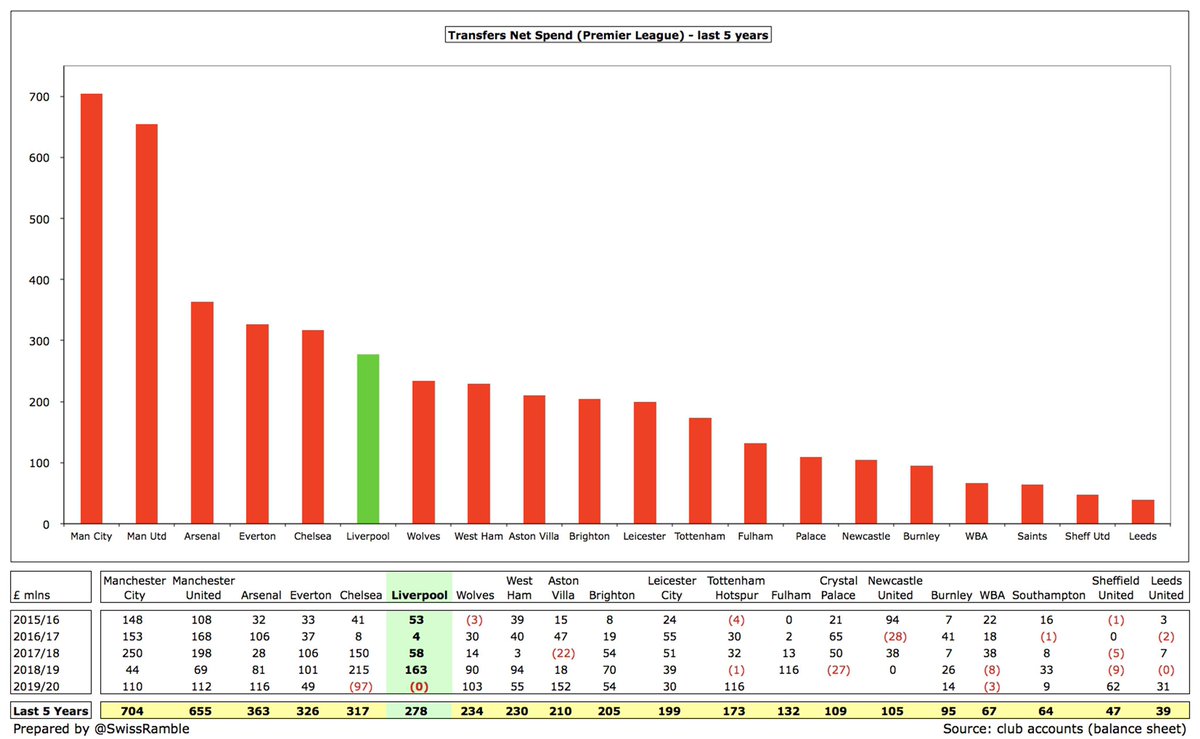

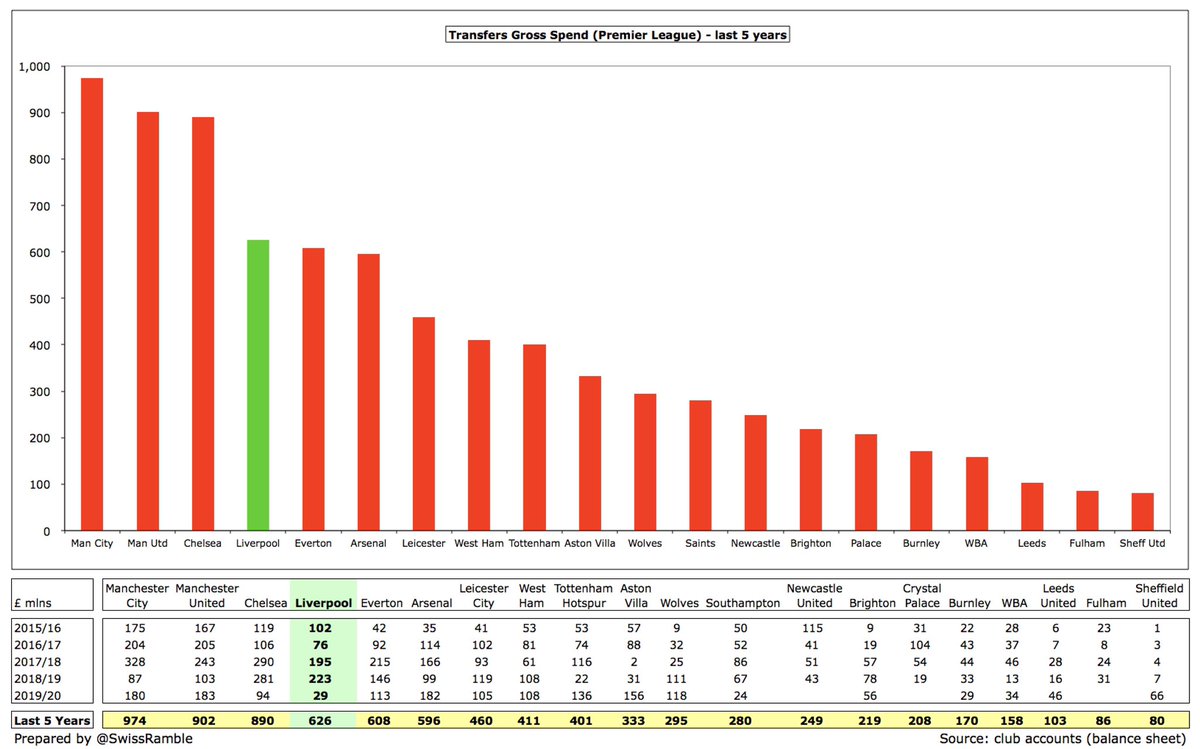

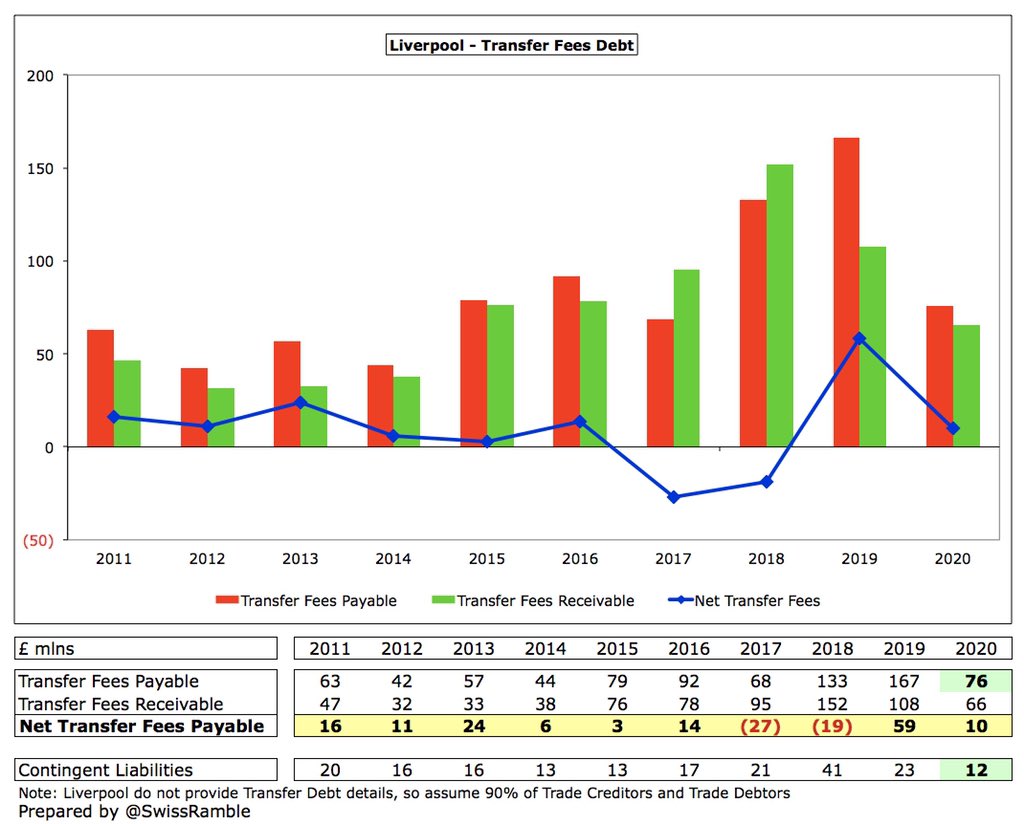

That said, #LFC have spent a lot of money in the transfer market with a £761m outlay in the last six years (net spend £337m). They did more last summer, bringing in Jota, Thiago and Tsimikas, but didn’t exactly push the boat out.

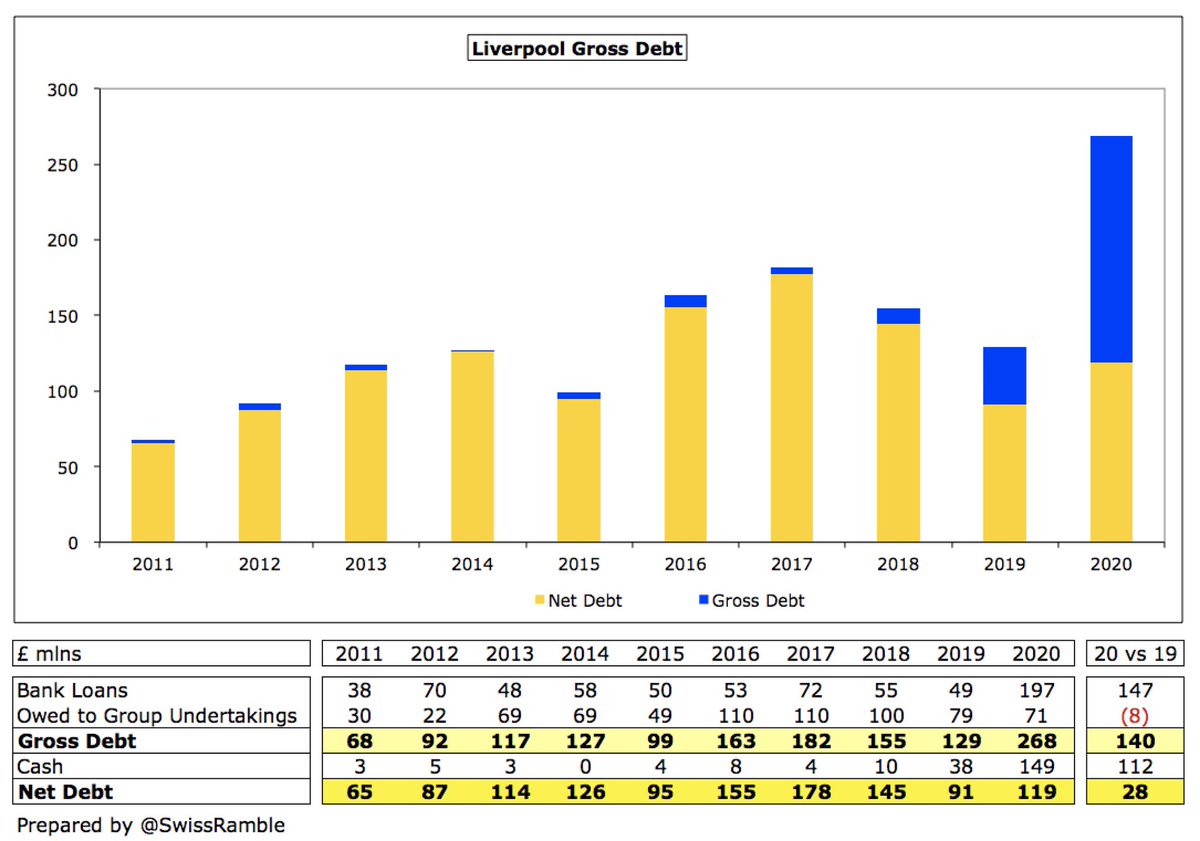

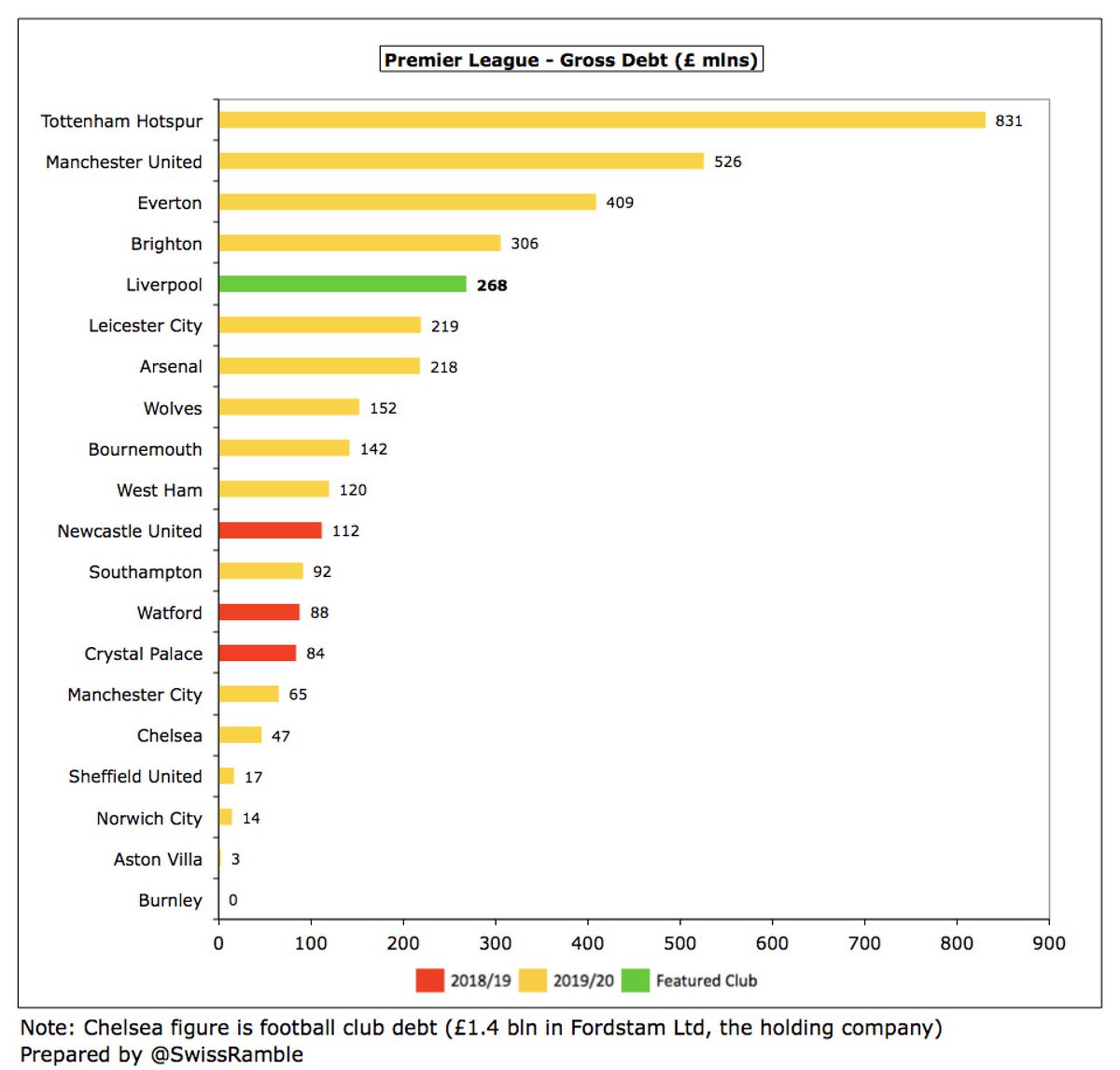

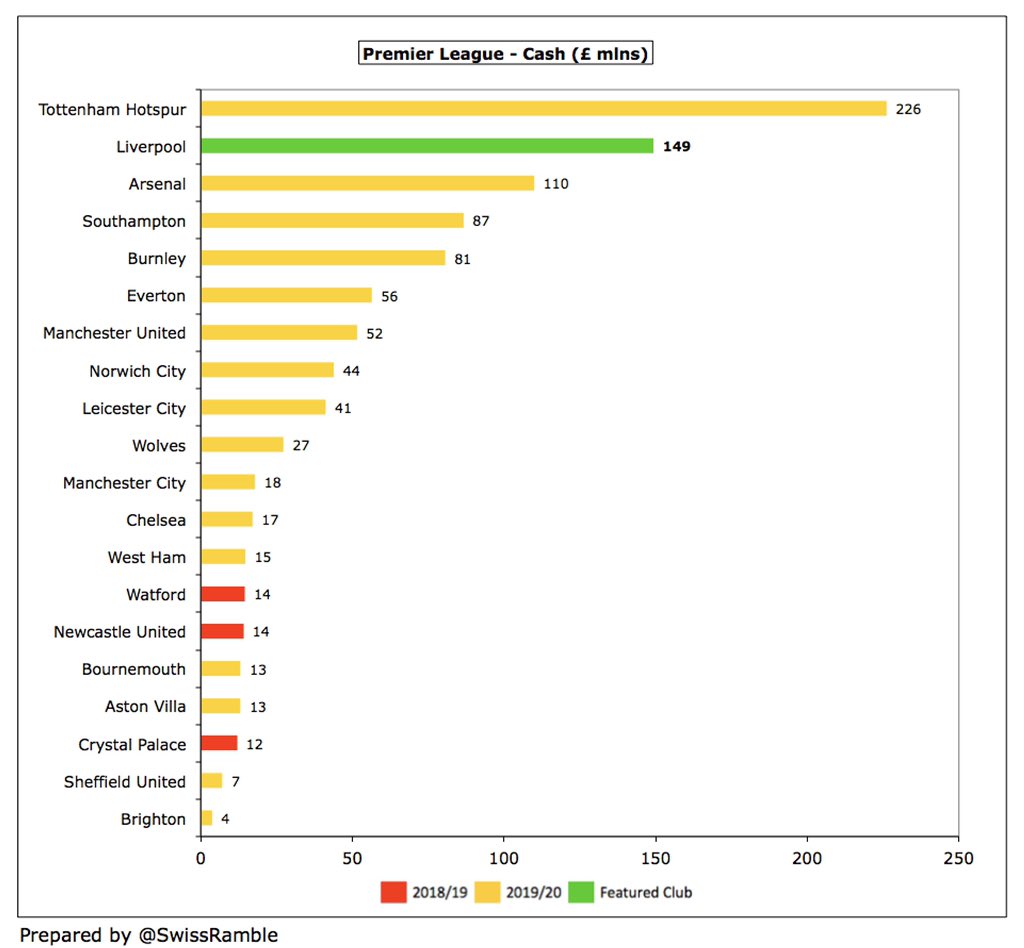

#LFC gross debt more than doubled from £129m to £268m, mainly due to the secured bank loan increasing by £147m from £49m to £197m, while the owner’s loan (to fund stadium expansion) was reduced by £8m from £79m to £71m.

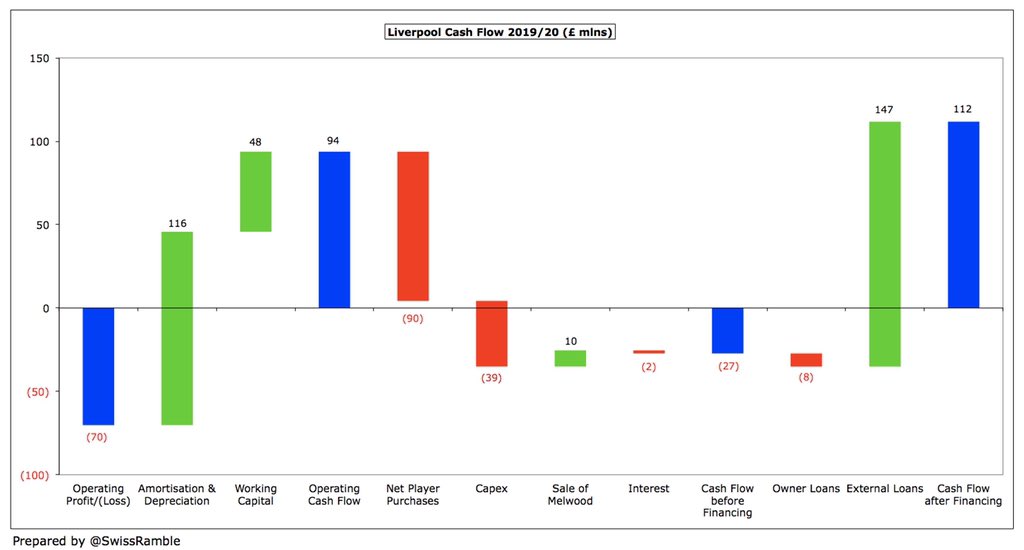

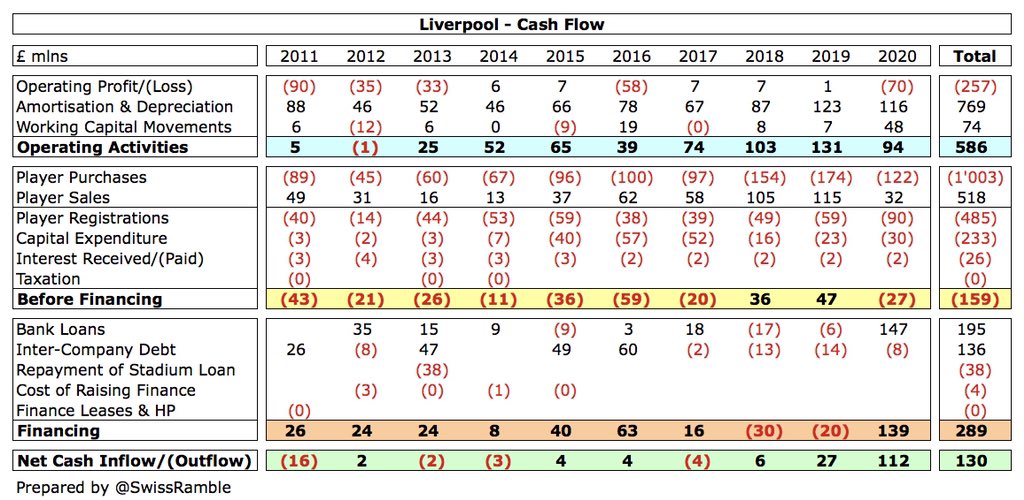

#LFC £70m operating loss became £94m cash flow after adding back £116m amortisation/depreciation and £48m working capital movements. Spent £90m on players (purchases £122m, sales £32m), £39m on new training centre and £8m FSG loan repayment. Funded by £147m external loans.

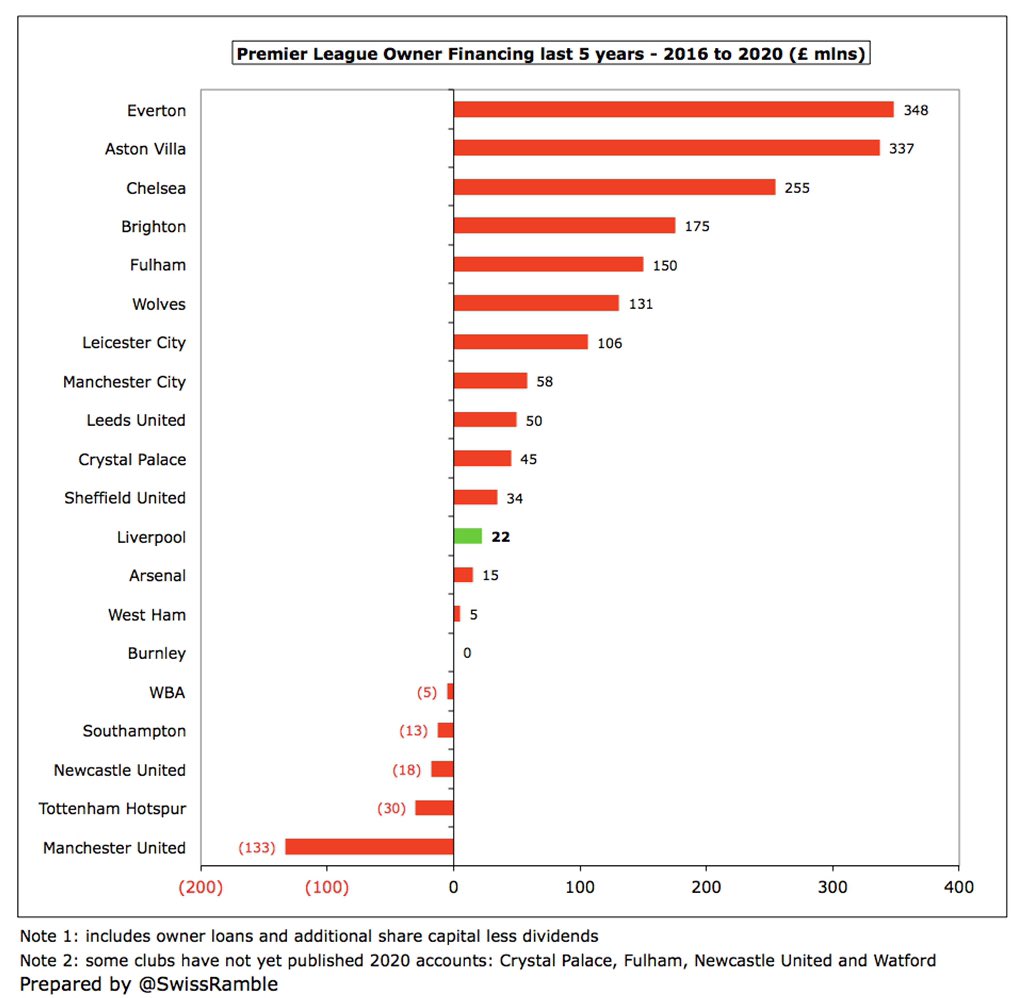

Since FSG acquired the club, #LFC have had £913m available cash: £586m from operations, £191m from bank loans and £136m from owner loans. £485m went on players (net), £233m capital expenditure, £38m stadium loan repayment and £26m interest payments.

FSG have sold 10% of their company to Red Bird Capital, which should help strengthen the #LFC balance sheet, cover COVID losses (estimated at £120m) and fund Anfield expansion. This might facilitate some transfer spending, but is unlikely to go towards a massive “war chest”.

#LFC success on the pitch, both domestically and in the Champions League, has driven significant revenue growth and profitability, but they have been adversely impacted by the pandemic (like all other clubs). Champions League qualification is important to future prospects.

جاري تحميل الاقتراحات...