#Heatmaps thread

In this thread I will explain what are heatmaps, how do they work, how I use them to have edge and what is the current market situation based on this.

Many people ask me when I post a heatmap, so this should be useful for many.

Let's start 👊

1/n

In this thread I will explain what are heatmaps, how do they work, how I use them to have edge and what is the current market situation based on this.

Many people ask me when I post a heatmap, so this should be useful for many.

Let's start 👊

1/n

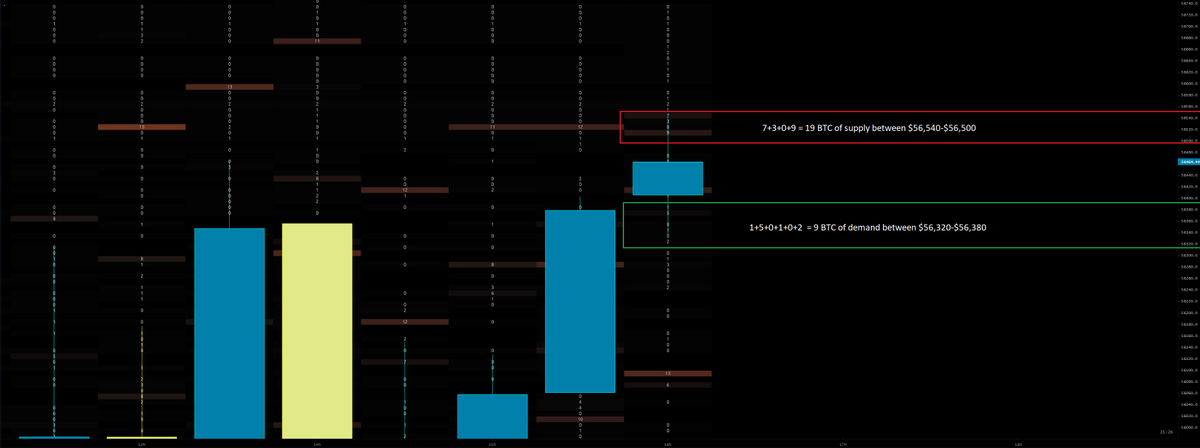

What is a #heatmap?

A heatmap shows the historical liquidity.

Blocks below current price are limit buy orders.

Blocks above current price are limit sell orders.

When the color is more intense, the order is bigger.

tradinglite.com

2/n

A heatmap shows the historical liquidity.

Blocks below current price are limit buy orders.

Blocks above current price are limit sell orders.

When the color is more intense, the order is bigger.

tradinglite.com

2/n

How I use heatmaps?

First, I try to look for situations where one side is much stronger than the other (demand > supply or supply < demand)

For this I check several of the important exchanges to have a general view.

4/n

First, I try to look for situations where one side is much stronger than the other (demand > supply or supply < demand)

For this I check several of the important exchanges to have a general view.

4/n

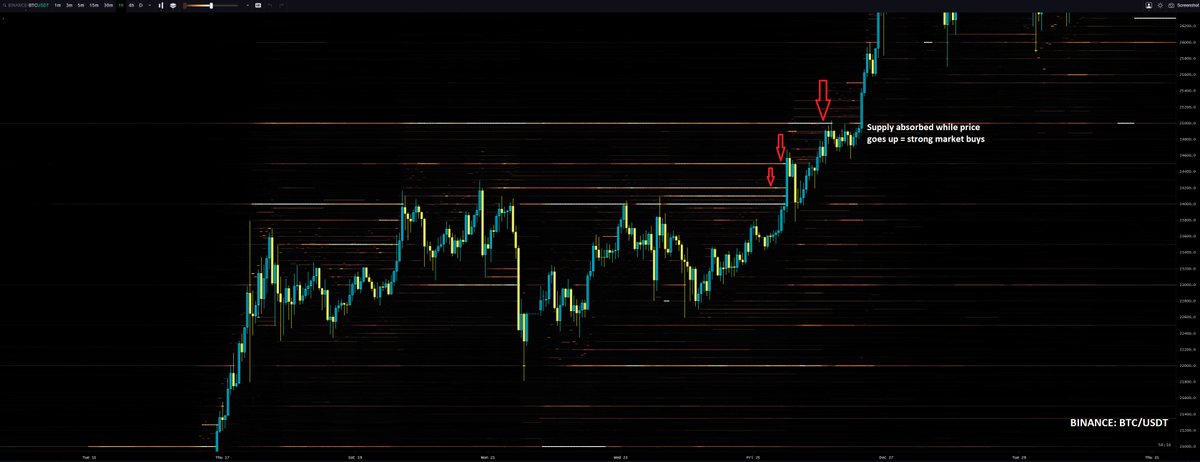

Why does it work like this? Simple

Imagine that you have limit buy orders at 10k. Price starts going up. What do many people do? They move up those orders, or they just market buy, creating buying pressure.

So we can say that heatmaps have a ''delayed'' effect

7/n

Imagine that you have limit buy orders at 10k. Price starts going up. What do many people do? They move up those orders, or they just market buy, creating buying pressure.

So we can say that heatmaps have a ''delayed'' effect

7/n

Combining these two heatmap strategies and other ones that I will explain in the near future, you can greatly improve your reading of the market. This added to other methods gives you a pretty good edge.

10/n

10/n

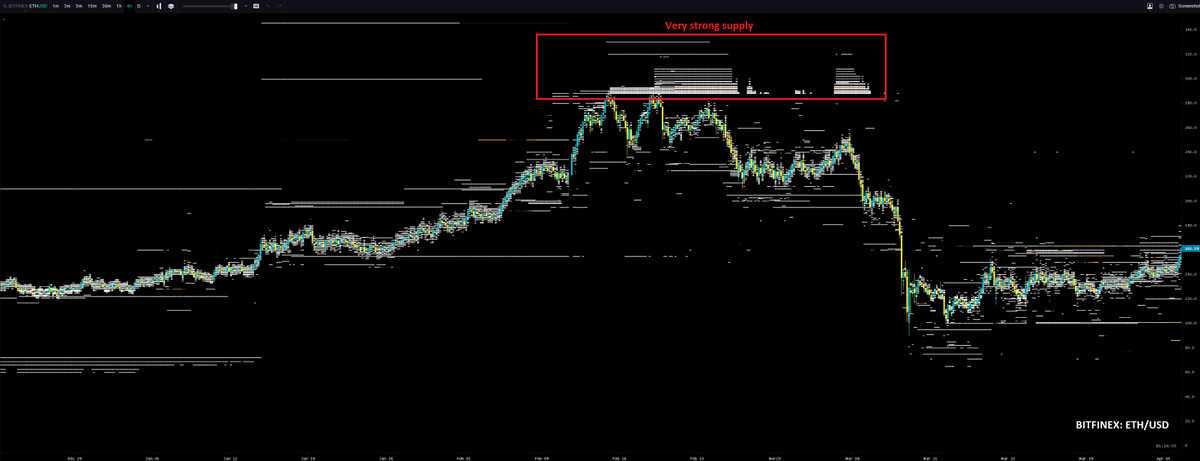

What is the current market situation based on heatmaps?

I have to say it's bullish for #Bitcoin Many exchanges are showing strong demand, while supply is weak.

11/n

I have to say it's bullish for #Bitcoin Many exchanges are showing strong demand, while supply is weak.

11/n

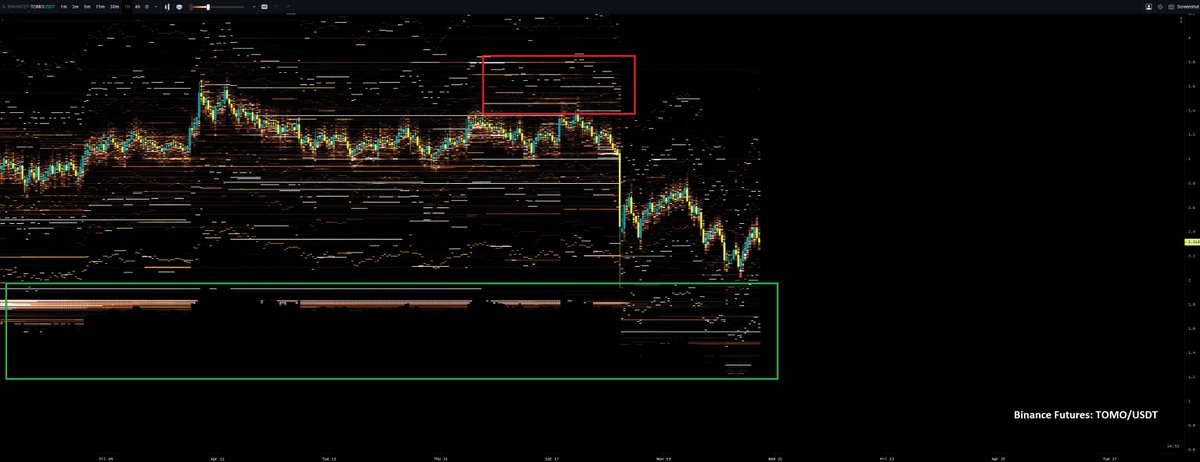

This also happens with the #altcoins, where many of them have very strong demand accompanied by a strong trend, which is usually an even more bullish sign.

12/n

12/n

Some misconceptions:

-A large block doesn't mean that price has to go there.

-A large selling block doesn't mean it will be resistance.

-Heatmaps are very useful but it's better to combine them with other indicators/methods

13/n

-A large block doesn't mean that price has to go there.

-A large selling block doesn't mean it will be resistance.

-Heatmaps are very useful but it's better to combine them with other indicators/methods

13/n

Personally I use @tradinglite. They offer many exchanges to check and many pairs, UI is cool and they also have other useful indicators like funding and OI.

They will include an aggregated heatmap soon.

tradinglite.com

END

They will include an aggregated heatmap soon.

tradinglite.com

END

Loading suggestions...