NEW FROM US: Clover Health: How the “King of SPACs” Lured Retail Investors Into a Broken Business Facing an Active, Undisclosed DOJ Investigation

cc @chamath

hindenburgresearch.com $CLOV

(1/x)

cc @chamath

hindenburgresearch.com $CLOV

(1/x)

Our investigation into $CLOV has spanned 4 months & more than a dozen interviews with former employees, competitors & experts, dozens of calls to doctor’s offices & a review of thousands of pages of government reports, insurance filings, regulatory filings & marketing materials.

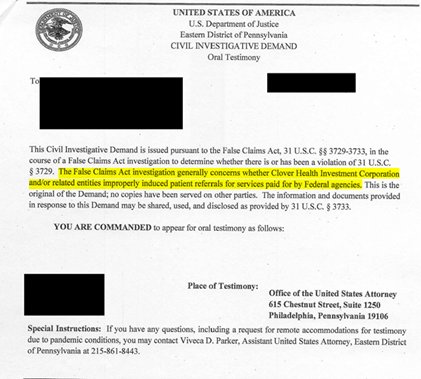

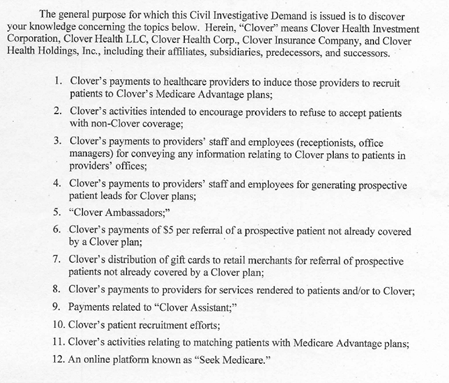

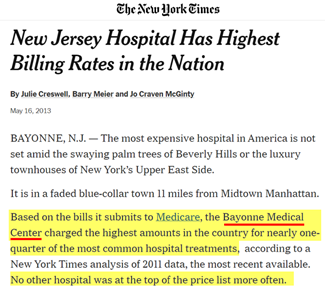

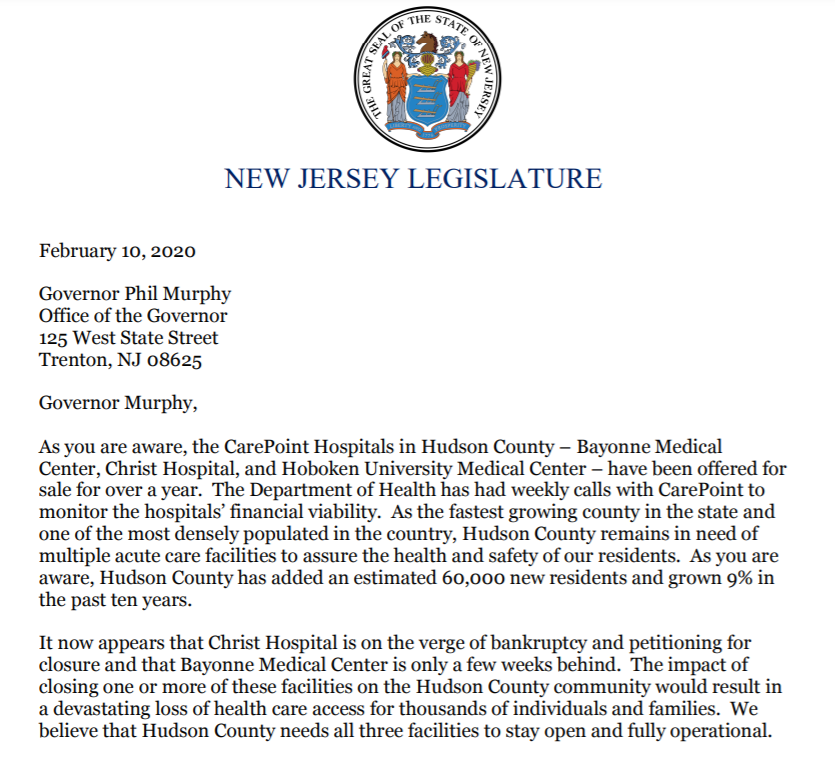

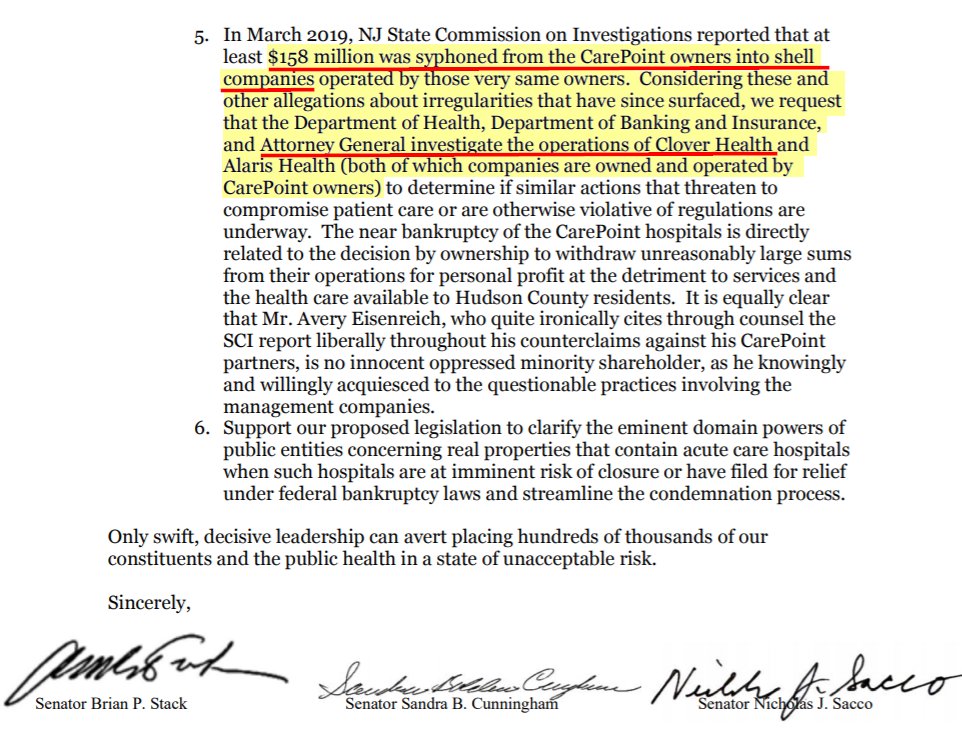

This Civil Investigative Demand and the corresponding investigation present a potential existential risk for a company that derives almost all of its revenue from Medicare, a government payor. Our research indicates that the investigation has merit. $CLOV

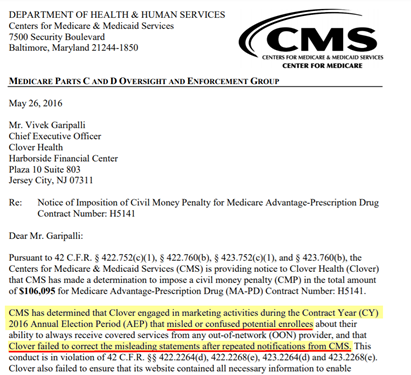

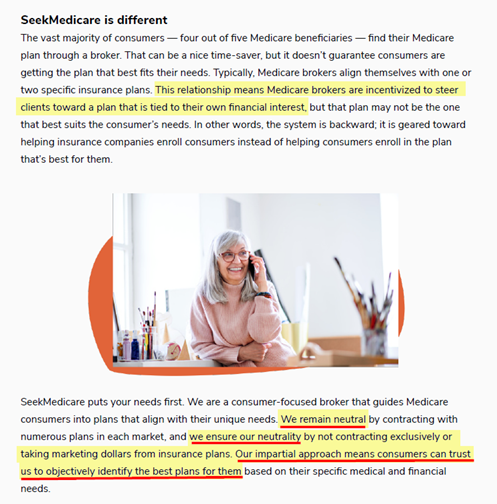

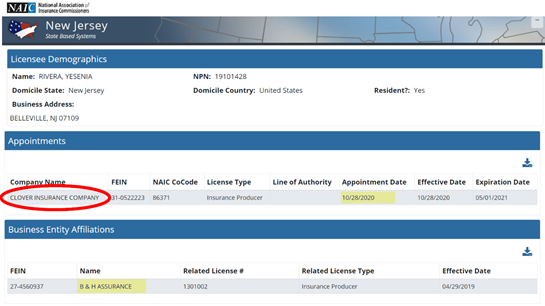

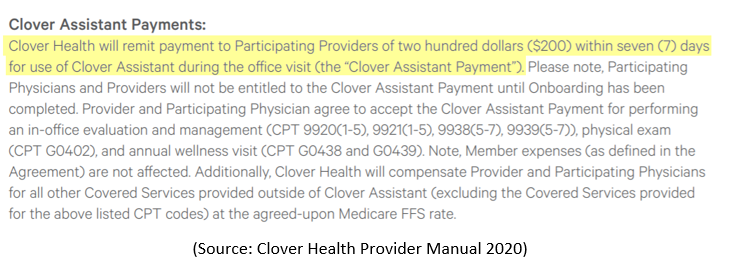

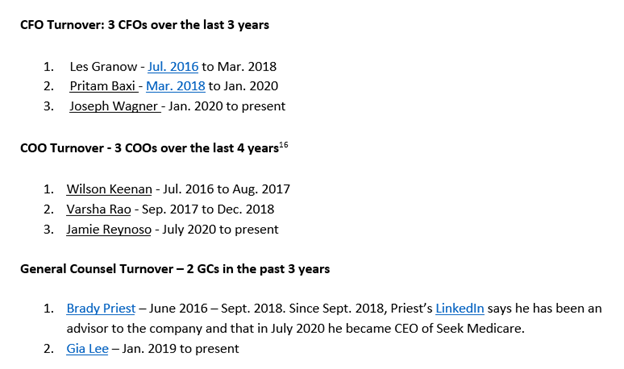

$CLOV claims that its best-in-class technology fuels its sales growth. We found that much of Clover's sales are driven by a major undisclosed related party deal and misleading marketing targeting the elderly.

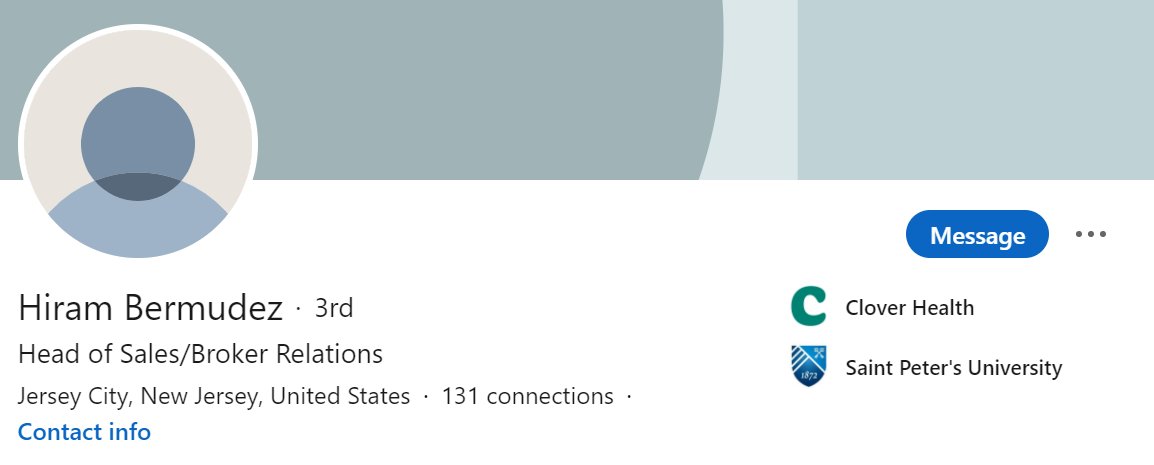

In case there is any doubt that Seek is an extension of $CLOV's sales operation, Florida corporate records show that Seek’s Chief Sales Officer is Hiram Bermudez, who concurrently serves as Clover’s Head of Sales.

search.sunbiz.org

search.sunbiz.org

Multiple former employees explained $CLOV's software is primarily a tool to help the company increase coding reimbursement.

We provide detail on how the software captures & retains irrelevant diagnoses, which we believe deceives the healthcare system & poses a regulatory risk.

We provide detail on how the software captures & retains irrelevant diagnoses, which we believe deceives the healthcare system & poses a regulatory risk.

Doctors at key Clover providers described the software as "embarrassingly rudimentary", “a waste of my time” and as just another administrative hassle to deal with.

Meanwhile, @chamath has described Garipalli as "an absolute proven moneymaker".

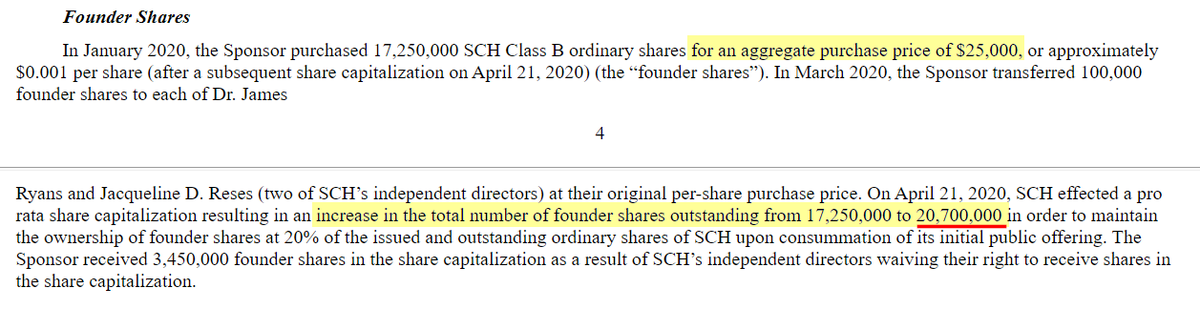

That could be because Chamath’s firm received over 20 million “founders shares” (worth ~$290 million at current prices) in exchange for $25,000 and for promoting the $CLOV SPAC.

That could be because Chamath’s firm received over 20 million “founders shares” (worth ~$290 million at current prices) in exchange for $25,000 and for promoting the $CLOV SPAC.

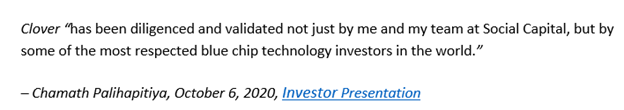

Given that investors are paying over a quarter billion dollars for @chamath's due diligence, we think they deserve to know whether Chamath knew of these issues at $CLOV and concealed them, or whether he simply failed to notice them at all.

hindenburgresearch.com

hindenburgresearch.com

Short sellers have exposed almost every major market fraud in the past several decades, yet there have been recent questions about whether they play an important role in a healthy, functioning market.

We hope our research today serves as a timely reminder that they do.

We hope our research today serves as a timely reminder that they do.

Loading suggestions...