Thread: As Promised, here is a multi-timeframe positional strategy based on CCI.

CCI Basics: A CCI reading above 100 is considered Bullish and overbought and a reading below -100 is considered Bearish and oversold. 1/n

CCI Basics: A CCI reading above 100 is considered Bullish and overbought and a reading below -100 is considered Bearish and oversold. 1/n

I believe in buying overbought and selling oversold and this strategy is based on this assumption.

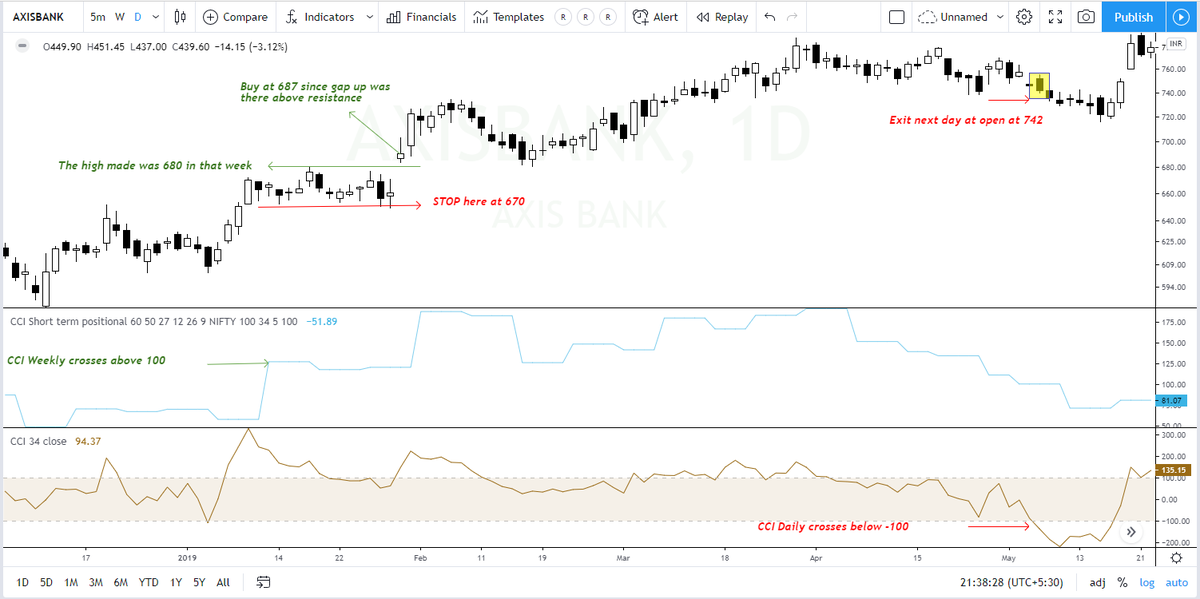

Entry criteria: CCI(34) on Weekly crossed above 100 and CCI(34) on Daily >100. Enter only above weekly high

Stoploss criteria: Recent swing low on the daily chart 2/n

Entry criteria: CCI(34) on Weekly crossed above 100 and CCI(34) on Daily >100. Enter only above weekly high

Stoploss criteria: Recent swing low on the daily chart 2/n

Exit criteria: CCI(34) on Daily<-100

Holding period: Few days to many months

Pyramiding your winners should be considered to make your winners big. I'll write a post on this topic in the future. 3/n

Holding period: Few days to many months

Pyramiding your winners should be considered to make your winners big. I'll write a post on this topic in the future. 3/n

Why trade on a multi-timeframe? This is a top-down approach where we observe the larger trend of the stock before we take entries on the smaller or medium trend of the stock. This concept can be compared to tides in the sea. 4/n

A larger wave in the sea will overpower the smaller waves, no matter what, simply because the larger waves have more velocity and force. In a similar way, a stock trending in the larger TF will overpower the smaller TF trend and will finally take the stock price higher. 5/n

While trading this strategy we presume this will work & buy stock in the shorter TF just when the larger TF is showing bullishness. This ensures we are in the right direction. In case the stock reverses, we exit based on the stop loss or based on the exit criteria. 6/n

Not to mention, this is NOT a holy grail strategy but helps one catch the shorter TF trend very well. You WILL have losing trades. So, it is important to consider proper position sizing and assess your risk before entry. Let's look at examples now. 7/n

Do run this strategy over many stocks to understand it better before you take any trades. #CCI #Tradingideas #shortterm #Positional #Multitimeframe #Tradingstrategy @pachisia_sourav here you go!

جاري تحميل الاقتراحات...